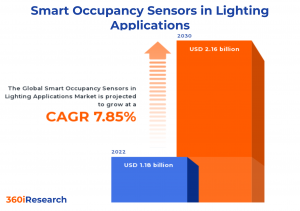

Smart Occupancy Sensors in Lighting Applications Market worth $2.16 billion by 2030 - Exclusive Report by 360iResearch

The Global Smart Occupancy Sensors in Lighting Applications Market to grow from USD 1.18 billion in 2022 to USD 2.16 billion by 2030, at a CAGR of 7.85%.

PUNE, MAHARASHTRA, INDIA , November 17, 2023 /EINPresswire.com/ -- The "Smart Occupancy Sensors in Lighting Applications Market by Sensor Type (Dual-technology Sensors, Microwave Sensors, Passive Infrared (PIR) Sensors), Operation (Indoor Operation, Outdoor Operation), Application - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Smart Occupancy Sensors in Lighting Applications Market to grow from USD 1.18 billion in 2022 to USD 2.16 billion by 2030, at a CAGR of 7.85%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/smart-occupancy-sensors-in-lighting-applications?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

An occupancy sensor is a specialized device that detects the presence of people in a specific area and automatically controls the lighting system accordingly. In lighting applications, these sensors improve energy efficiency, reduce operational costs, and enhance user comfort. A growing global emphasis on energy conservation has prompted governments worldwide to implement stringent regulations demanding energy-efficient lighting solutions. Increasing consumer awareness about sustainable living practices has accelerated the demand for smart lighting systems with integrated occupancy sensing capabilities. However, the inaccuracy of sensors and compatibility issues between different lighting control systems and legacy infrastructure impact product adoption. The development of low-cost sensing solutions that maintain high-performance standards can cater to budget-conscious clients while simultaneously expanding market reach. Researching novel techniques for accurate detection, including artificial intelligence (AI) and machine learning algorithms, can help improve occupancy sensing capabilities and mitigate false triggers. Collaborations between lighting control system providers and IoT device manufacturers could pave the way for more seamless integration across smart home ecosystems.

Application: Improved energy savings and occupant comfort observed in building lightings integrated with occupancy sensors

Occupancy sensors are in high demand in the automotive lighting industry due to their ability to enhance vehicle safety, energy efficiency, and driver comfort. They detect the presence of passengers or objects within a vehicle and automatically control the interior lighting accordingly. Automakers are increasingly focusing on equipping their vehicles with advanced safety features, such as adaptive headlights and interior occupancy sensors. The integration of occupancy sensors in building lighting applications helps achieve considerable energy savings by automating light usage based on human presence. Occupancy sensor technology is used extensively across lighting in residential, commercial, industrial, healthcare facilities, and educational institutions, among others. These sensors help maintain optimal lighting levels while conserving energy and reducing operating costs in buildings.

Sensor Type: Increased reliability and accuracy of dual technology sensors

Dual-technology sensors combine both passive infrared (PIR) and ultrasonic sensing technologies to detect occupancy more accurately. This type of sensor is highly reliable and reduces the chances of false triggers, making them suitable for spaces with intermittent or unpredictable occupant movement patterns such as restrooms, meeting rooms, and private offices. Microwave sensors utilize electromagnetic waves to detect movement within a space. These sensors can cover larger areas than other sensor types, making them ideal for open spaces such as warehouses, parking lots, and outdoor areas. However, microwave sensors are more sensitive to interference from other electronic devices in the vicinity which may lead to false activations. Passive infrared (PIR) sensors are widely used in residential and commercial environments due to their cost-effectiveness and energy efficiency. These sensors detect heat emitted by humans or animals rather than motion itself - providing accurate occupancy detection while minimizing false activations caused by drafts or mechanical movement. Ultrasonic sensors emit high-frequency sound waves to detect occupancy within a space. These sensors are highly sensitive to motion, making them ideal for applications where precision is crucial, such as hospital operating rooms or laboratories.

Operation: Affordability and easy installation capabilities of indoor occupancy sensors

Indoor occupancy sensors are designed to detect human presence within closed spaces, such as residential buildings, offices, hospitals, and educational institutions. The use of occupancy sensors in indoor operation is to optimize energy consumption by controlling lighting based on the presence or absence of occupants. Outdoor occupancy sensors are employed in numerous applications, such as streetlights, parking lots, and security systems for commercial buildings and public areas. It can enhance safety by providing adequate illumination when human activity is detected while minimizing energy consumption at other times.

Regional Insights:

The Americas region is a significant player in the occupancy sensors market due to its robust infrastructure development and increasing awareness regarding energy conservation. Numerous incentives provided for green building technologies and growing construction activities in the U.S. and Canada have accelerated the demand for an occupancy sensor for lighting in the region. Asia's occupancy sensor for lighting market showcases an impressive growth trajectory due to rapid urbanization and industrial expansion. Countries such as China and India are witnessing an ever-growing demand for energy-efficient solutions and a rise in smart city projects. Asia serves as a hub for manufacturing capabilities for international players while having an established portfolio from regional companies. Europe's strong focus on reducing energy consumption has accelerated the growth of occupancy sensors for lighting applications within its boundaries. The European Union's strict energy efficiency targets encourage member countries to incorporate smarter technologies in their lighting applications, resulting in a higher demand for occupancy sensors. The region also witnesses an increasing trend of retrofitting existing buildings with smart lighting systems that include occupancy sensing capabilities. European companies contribute significantly to the production and innovation of occupancy sensors within Europe.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Smart Occupancy Sensors in Lighting Applications Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Smart Occupancy Sensors in Lighting Applications Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Smart Occupancy Sensors in Lighting Applications Market, highlighting leading vendors and their innovative profiles. These include A.P. Associates, Accu-Tech Lighting Solutions, Acuity Brands, Inc., Alan Manufacturing, Inc., Analog Devices, Inc., Eaton Corporation PLC, Enlighted, Inc. by Siemens SE, General Electric Company, Honeywell International Inc., Hubbell Incorporated, Johnson Controls International PLC, Legrand SA, Leviton Manufacturing Co., Inc., Lutron Electronics Co., Inc., Novelda AS, Paamvi Group, Panasonic Corporation, PointGrab Inc., Schneider Electric SE, Signify N.V. by Koninklijke Philips N.V., Starrbot Automations Pvt. Ltd., TE Connectivity Ltd., and Telkonet, Inc..

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/smart-occupancy-sensors-in-lighting-applications?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Smart Occupancy Sensors in Lighting Applications Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Sensor Type, market is studied across Dual-technology Sensors, Microwave Sensors, Passive Infrared (PIR) Sensors, and Ultrasonic Sensors. The Microwave Sensors is projected to witness significant market share during forecast period.

Based on Operation, market is studied across Indoor Operation and Outdoor Operation. The Indoor Operation is projected to witness significant market share during forecast period.

Based on Application, market is studied across Automotive Lightings and Building Lightings. The Building Lightings is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 38.43% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Smart Occupancy Sensors in Lighting Applications Market, by Sensor Type

7. Smart Occupancy Sensors in Lighting Applications Market, by Operation

8. Smart Occupancy Sensors in Lighting Applications Market, by Application

9. Americas Smart Occupancy Sensors in Lighting Applications Market

10. Asia-Pacific Smart Occupancy Sensors in Lighting Applications Market

11. Europe, Middle East & Africa Smart Occupancy Sensors in Lighting Applications Market

12. Competitive Landscape

13. Competitive Portfolio

14. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Smart Occupancy Sensors in Lighting Applications Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Smart Occupancy Sensors in Lighting Applications Market?

3. What is the competitive strategic window for opportunities in the Smart Occupancy Sensors in Lighting Applications Market?

4. What are the technology trends and regulatory frameworks in the Smart Occupancy Sensors in Lighting Applications Market?

5. What is the market share of the leading vendors in the Smart Occupancy Sensors in Lighting Applications Market?

6. What modes and strategic moves are considered suitable for entering the Smart Occupancy Sensors in Lighting Applications Market?

Read More @ https://www.360iresearch.com/library/intelligence/smart-occupancy-sensors-in-lighting-applications?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+ 1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.