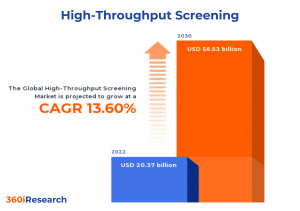

High-Throughput Screening Market worth $56.53 billion by 2030 - Exclusive Report by 360iResearch

The Global High-Throughput Screening Market to grow from USD 20.37 billion in 2022 to USD 56.53 billion by 2030, at a CAGR of 13.60%.

PUNE, MAHARASHTRA, INDIA, November 16, 2023 /EINPresswire.com/ -- The "High-Throughput Screening Market by Product & Service (Consumables, Instruments, Services), Screening Size (12-well Format, 1536-well Format, 24-well Format), Technology, Application, End User - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global High-Throughput Screening Market to grow from USD 20.37 billion in 2022 to USD 56.53 billion by 2030, at a CAGR of 13.60%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/high-throughput-screening?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

High throughput screening is a mode of scientific experimentation that comprises screening large compound libraries for activity against biological targets via automation, miniaturized assays, and large-scale data analysis. It involves the rapid testing and analysis of many samples, enabling researchers to evaluate various compounds' effectiveness, selectivity, and potential toxicity. The primary applications of HTS are drug discovery and development in pharmaceutical and biotechnology companies, along with academic research laboratories. The rise in investment by governments and private organizations globally towards research and development activities fuels the growth of this market segment. Advances in computational biology enable researchers to analyze massive amounts of data generated by HTS systems more efficiently, which has significantly driven the market growth. However, high initial setup costs related to equipment procurement and maintenance and complexities related to data interpretation may hamper the market expansion. Expanding applications of HTS in different sectors, such as agrochemicals and environmental monitoring, will create a lucrative market opportunity in the forecasted period.

End User: Penetration of HTS technology in pharmaceutical & biotechnology companies for rapid development of novel therapeutics

Academic and research institutes typically require HTS systems for applications such as target identification, primary screening, and drug discovery and development. High throughput screening provides academic and research institutes the tools to accelerate their research, enhance productivity, and contribute significantly to the discoveries. Contract research organizations (CROs) used HTS to outsource drug discovery processes for pharmaceutical and biotechnology companies. CROs predominantly use HTS platforms for hit identification, lead optimization, and assay development projects. Pharmaceutical and biotechnology use HTS to focus on the rapid identification and development of novel therapeutic agents. These companies typically utilize HTS technology for lead generation, hit-to-lead optimization, and safety assessment studies. HTS is a critical tool that helps pharmaceutical and biotechnology companies streamline their research and development efforts, reduce costs, and bring new and innovative therapies to market more efficiently.

Screening Size: Utilization of 96-well format for increase in cell based studies

In high-throughput screening (HTS), various screening formats are utilized for diverse applications, such as drug discovery, biochemical assays, and cell-based assays. The 12-well format is suitable for conducting small-scale experiments that require larger volumes and more cells per well and is often utilized in cell culture studies and migration assays. The 1536-well format allows for the highest density of wells on a standard microplate footprint, enabling ultra-high-throughput screening (uHTS). This format is favored when working with limited sample volumes and expensive reagents due to the reduced well volume compared to other formats. Further, with a moderate number of wells and larger well size than higher-density formats, the 24-well format is ideal for primary cell culture experiments, organoid cultures, and studying larger organisms such as zebrafish embryos. The 384-well format is commonly used for medium- to high-throughput screening applications, such as compound profiling and high-content imaging. Additionally, the 384-well format balances sample volume and throughput, making it suitable for various assays. The 48-well format offers researchers increased throughput compared to the standard 6- or 12-well formats without sacrificing well size. This format is ideal for experiments requiring intermediate throughput levels or when transitioning from lower-density formats to higher-density ones. The 6-well format is widely used in basic research laboratories due to its large well size, which allows for easy handling and observation of cells under a microscope during various stages of cell culture. The 96-well format is a versatile and widely recognized standard for high-throughput screening applications. Its size makes it compatible with many liquid handling systems, making it suitable for various assays, such as ELISA, qPCR, and cell-based studies.

Product & Service: Proliferating use of software in the HTS process to manage vast amounts of raw data

Consumables are indispensable components of the HTS process, used in sample preparation and analysis to identify target compounds or biomolecules. Instruments used in HTS are essential for automating various aspects of the HTS workflow as they enable researchers to efficiently process large volumes of samples with minimal errors at rapid speeds. The services segment offers assay development, target validation, compound profiling, hit identification, and validation services tailored to client requirements. Softwares provide HTS workflows with robust solutions to manage vast raw data generated during experiments. Software solutions aid researchers in data acquisition, management, analysis, visualization, and reporting while ensuring compliance with regulatory guidelines.

Application: Extensive utilization of the HTS process in drug discovery to identify compounds with pharmacological or biological activity

Biochemical screening uses a pure target protein of interest and estimates the binding of ligands or the inhibition of enzymatic action in vitro. These assays are typically performed in a competition structure where the compound under study must displace a known ligand or substrate. In the drug discovery process, HTS is used to identify small molecules that have the potential to modulate a target protein's function, leading to therapeutic effects on disease-relevant pathways. These are starting points for medicinal chemical optimization during pharmacological probe or drug discovery and development. HTS technologies facilitate rapid data generation and analysis in life sciences research applications to uncover fundamental biological mechanisms or contribute to advancements in personalized medicine. Researchers use HTS for high-resolution imaging studies, gene expression profiling, or protein interaction analyses.

Technology: Adoption of cell-based assay technologies to get biologically relevant data for the drug discovery process

Cell-based assays are vital for high-throughput screening that facilitates studying biological processes, drug discovery, and target identification. These assays employ living cells as test platforms to measure the efficacy or toxicity of compounds. 3D cell culture is a cost-effective screening platform for drug development and testing. The improved cell functionality and morphology of 3D cultures compared to 2D makes them a promising option for use in high throughput screening (HTS) and high content screening (HCS) applications. Scaffold-free techniques allow the cells to self-assemble to form non-adherent cell aggregates called spheroids. Spheroids mimic the solid tissues by secreting their extracellular matrix and displaying differential nutrient availability. Lab-on-a-chip technology integrates laboratory functions onto a single integrated circuit chip to enable rapid analysis with minimal sample volumes and reduced costs compared to traditional benchtop experiments. Label-free technology allows researchers to study biomolecular interactions without needing fluorescent or radioactive tags that can interfere with biological processes or produce false-positive results.

Regional Insights:

The Americas experienced significant growth in high throughput screening market due to several government initiatives, patents for innovative technologies, and collaborative activities with industry partners to facilitate drug discovery through HTS. Within EU countries, HTS is being supported through initiatives funded by the European Commission research program towards advancing scientific breakthroughs and rising research and development activities by the key market vendors to optimize healthcare solutions. The Middle East and African region represents a growing market for HTS, driven mainly by investments in infrastructure development by governments seeking to improve local biotechnology capabilities. The Asia-Pacific region has observed a developing landscape due to government support by investing heavily in life sciences and pharmaceutical research and government-supported HTS advancement through funding programs such as the Japan Agency for Medical Research and Development (AMED). The rapidly growing pharmaceutical industry, fueled by strong government support in healthcare initiatives and innovation in drug discovery by providing access to HTS facilities at academic institutions, contributed to the market growth in the APAC region.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the High-Throughput Screening Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the High-Throughput Screening Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the High-Throughput Screening Market, highlighting leading vendors and their innovative profiles. These include Agilent Technologies, Inc., Aurora Biomed Inc., AXXAM S.p.A., Beckman Coulter, Inc., Bio-Rad Laboratories, Inc., BMG LABTECH GmbH, Charles River Laboratories International, Inc., Corning Incorporated, Danaher Corporation, DIANA Biotechnologies, a.s., Eurofins Scientific SE, F. Hoffmann-La Roche AG, Hamilton Company, IRBM S.p.A., Lonza Group AG, Luminex Corporation, Merck KGaA, Molecular Devices, LLC, NanoTemper Technologies GmbH, PerkinElmer, Inc., Promega Corporation, Reprocell Inc., SYGNATURE DISCOVERY LIMITED, Tecan Trading AG, and Thermo Fisher Scientific Inc..

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/high-throughput-screening?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the High-Throughput Screening Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Product & Service, market is studied across Consumables, Instruments, Services, and Software. The Consumables is further studied across Laboratory Equipment and Reagents & Assay Kits. The Instruments is further studied across Detection Systems and Liquid Handling Systems. The Software is projected to witness significant market share during forecast period.

Based on Screening Size, market is studied across 12-well Format, 1536-well Format, 24-well Format, 384-well Format, 48-well Format, 6-well Format, and 96-well Format. The 1536-well Format is projected to witness significant market share during forecast period.

Based on Technology, market is studied across Cell-Based Assays, Lab-on-a-Chip Technology, and Label-Free Technology. The Cell-Based Assays is further studied across 2D Cell Culture, 3D Cell Culture, Perfusion Cell Culture, and Reporter-Based Assays. The 3D Cell Culture is further studied across Scaffold-Based Technology and Scaffold-Free Technology. The Scaffold-Based Technology is further studied across Hydrogels, Inert Matrix & Solid Scaffolds, and Micropatterned Surfaces. The Hydrogels is further studied across Alginate & Agarose, Animal-Derived Hydrogels, and Synthetic Hydrogels. The Animal-Derived Hydrogels is further studied across Collagen and Matrigel. The Scaffold-Free Technology is further studied across Hanging-Drop Plates and Ultra-Low Binding Plates. The Lab-on-a-Chip Technology is projected to witness significant market share during forecast period.

Based on Application, market is studied across Biochemical Screening, Drug Discovery, and Life Sciences Research. The Life Sciences Research is projected to witness significant market share during forecast period.

Based on End User, market is studied across Academic & Research Institutes, Contract Research Organizations, and Pharmaceutical & Biotechnology Companies. The Contract Research Organizations is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 38.75% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. High-Throughput Screening Market, by Product & Service

7. High-Throughput Screening Market, by Screening Size

8. High-Throughput Screening Market, by Technology

9. High-Throughput Screening Market, by Application

10. High-Throughput Screening Market, by End User

11. Americas High-Throughput Screening Market

12. Asia-Pacific High-Throughput Screening Market

13. Europe, Middle East & Africa High-Throughput Screening Market

14. Competitive Landscape

15. Competitive Portfolio

16. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the High-Throughput Screening Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the High-Throughput Screening Market?

3. What is the competitive strategic window for opportunities in the High-Throughput Screening Market?

4. What are the technology trends and regulatory frameworks in the High-Throughput Screening Market?

5. What is the market share of the leading vendors in the High-Throughput Screening Market?

6. What modes and strategic moves are considered suitable for entering the High-Throughput Screening Market?

Read More @ https://www.360iresearch.com/library/intelligence/high-throughput-screening?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.