Experior Financial responds to article on Ontario regulators' findings, seeking to clarify the record of Oct 3, 2023

Response to “Insurance Agents Facing Penalties and Discipline after Ontario Regulators Uncover ‘Harmful’ Sales Practices,” on October 3, 2023

GUELPH, ONTARIO, CANADA, October 19, 2023 /EINPresswire.com/ -- Experior expressed concerns during the initial release of the thematic review in 2022, as it was then that it learned which companies were included in the review and which companies were not.Additionally, the FSRAO's request for non-disclosure agreements raised concerns as it was violated multiple times, prompting Experior to address this at the next CAILBA meeting. Experior emphasized its transparency but expected the regulator to uphold its contractual obligations.

Furthermore, Experior believed that Canada's MGA principals would share their concerns regarding the regulator's release of report findings to the media before informing the involved parties, an unjust practice. As of now, Experior still lacks information about the audited parties, making it challenging to confirm or refute the report's findings.

Experior is exceptionally proud of the fact that it has always made a concerted effort to act in the best interests of the consumer as well as our agents. The company promotes transparency, education, and the empowerment of clients and agents alike as the foundation of our value proposition.

In its 10-year history, there has never been an E&O claim against Experior or any of its agents.

Until September 2022, most insurers, including Canada's largest, were willing to grant contracts without expressing concerns about Experior's compliance department. Among the 15+ insurers Experior collaborates with, none have raised issues regarding its compliance practices. However, following the initial report, three carriers terminated contracts without cause. Two of these insurers also denied Experior agents access to service their clients, impacting clients' best interests.

Experior annually serves tens of thousands of clients and has received fewer than five client complaints to a regulatory body in nearly a decade—an achievement any MGA serving independent agents would be proud of.

During the review, Experior's compliance team, President Lee-Ann Prickett and Director of Operations Nathania Millette sought recommendations and changes to their processes. The regulator never expressed satisfaction or concern about any of its processes, even though the President repeatedly asked for feedback. The processes that were recommended during the CAILBA conference by the regulators were, in fact, processes Experior Financial Group already had in place for several years before the conference, which the regulator had reviewed and had full access to during the thematic review. Due to this announcement, Experior Financial Group expressed full confidence that what it has in place works well.

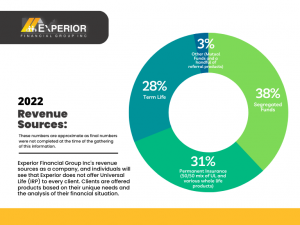

Despite Mark White's statement, ”This was an egregious instance of consumer harm by the managing general agents in question," regarding enforcement actions, only Experior among the three MGAs reviewed faced no enforcement actions. The assertion that the organizations in the review disproportionately sell universal life insurance as a retirement savings strategy, including Experior, was unequivocally false. Experior's proprietary "Expert Financial Analysis" tool guides clients through a comprehensive discussion. 31% of its revenue comes from permanent products. Universal life and whole life are evenly split.

No evidence warranted Experior’s inclusion over other MGAs that make training and recruiting a part of their business model. Experior has been given no opportunity to review or make fulsome comments on the findings. Nor was Experior given the opportunity to assist those audited unless they came forward. Experior has acted in good faith and with complete transparency. If the company is guilty of anything, it is only that of an unfair association with the other two MGAs.

Experior takes pride in the fact that it is not only different from the other two MGAs in the review but from all MGAs in Canada. An MGA built by agents, owned by agents, for the benefit of all those it serves. Experior believes there is a lot more that can be done to ensure the fair treatment of clients across the industry, and it continues to strive to be a leader in this regard—an organization building financial foundations for families to empower them today and leave a legacy for tomorrow.

Joanna St Jacques

Experior Financial Group Inc.

+1 888-909-0696

info@experiorheadoffice.ca

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.