Advanced Biofuels Canada announces release of Navius Research’s ‘Biofuels in Canada 2023’ report

New report assesses Clean Fuel Regulations impact, shows significant ramp up in adoption of low carbon fuels

The report profiles a surge in biofuels use in Canada, leading to expanded climate benefits. In the debate about how Canada will meet its climate goals, advanced biofuels are delivering results today.”

VANCOUVER, CANADA, October 31, 2023 /EINPresswire.com/ -- Advanced Biofuels Canada (ABFC) announced the release of the eighth annual Navius Research Biofuels in Canada (BIC) report, accompanied by detailed and comprehensive data on Canadian renewable and low-carbon fuel markets. — Ian Thomson, ABFC President

The report’s highlights for 2022 (estimates), and the previous twelve years (2010-2021, actual), include:

- Overall, biofuel consumption has reduced Canadians’ wholesale fuel costs by $3.7 billion between 2010 and 2022.

- Over 2010-2022, biofuels have saved the typical gasoline light-duty car and truck owner about 0.3% in annual fuel costs, whereas the typical medium- and heavy-duty diesel truck owner has seen costs increase by 1% from biofuels use in the period.

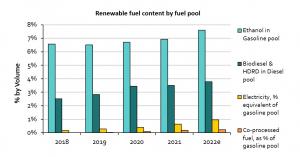

- Ethanol blending grew in 2022 at a faster pace than any period in the past decade, continuing an upward trend in utilization from 6.7% in 2020, 6.9% in 2021, and reaching 7.6% in 2022.

- Biodiesel and HDRD blends in diesel fuels totaled 3.8% in 2022, up from 3.4% in 2020 and 3.5% in 2021.

- Biofuel use in Alberta and Manitoba surged, with more greenhouse gas (GHG) emissions avoided - 45% and 24%, respectively - than were avoided in 2021, compared with the Canadian average increase in avoided GHG emissions of 13%.

- Electrification contributed 13% of GHG reductions in transportation across Canada in 2022, up from 4% five years earlier (2018).

- The weighted average carbon intensity of biofuels used in Canada has decreased 11% from 2018 to 2022.

- Volumetric taxation of biofuels and the improper application of carbon taxes on biofuels have generated surplus tax revenues for governments of $3.9 billion (2010-2022). Fair taxation of biofuels would have reduced consumer fuel costs by $423 million in 2022.

The report is commissioned annually by Advanced Biofuels Canada and independently authored by Navius Research, a leading energy and environment quantitative market analysis firm. It evaluates Canadian renewable and low carbon fuel policies and their impact on provincial fuel consumption, GHG emissions reduction, and consumer costs.

In this year's report, several key updates have been introduced. A new methodology for calculating the carbon intensity of co-processed fuels provides insights into their emissions impacts. The report sheds light on credit generation under British Columbia’s Low Carbon Fuel Standard (LCFS) Part 3 Agreements program and provides a projection of the near-term federal Clean Fuel Regulations credit/debit balance. The new data also includes an updated tax cost analysis, including E15 and B20/R80 biofuel blends.

“The report profiles a surge in biofuels use in Canada, leading to expanded climate benefits. Biofuels use in 2022 reduced greenhouse gas emissions by over 7 Mt for the first time. While early credit generation under Canada’s new Clean Fuel Regulations impacted biofuels use in the last half of 2022, the data demonstrates that provincial fuel regulations continue to provide an effective market signal to decarbonize non-ZEV transport,” stated ABFC President Ian Thomson. “In the debate about how Canada will meet its climate goals, advanced biofuels are delivering results today and showing a lot of room for growth.”

“New world-scale advanced biofuel production facilities are already creating thousands of well-paying jobs in every region across the country. They are also improving our energy security by reducing reliance on imported gasoline, diesel, and jet fuel. These advanced fuels – which add value to the energy, agriculture, forestry, and waste management sectors – are compatible with existing vehicles and utilize existing infrastructure for rapid adoption and cost-effective distribution.”

The annual report calculates the volumes of renewable and petroleum transportation fuels consumed in each Canadian province, and characterizes these by fuel type, feedstock, and carbon intensity (CI). Clean fuels profiled include ethanol, biodiesel, and hydrogenation-derived renewable diesel (HDRD); fuels from bio-based feedstocks that are co-processed with crude oil in a conventional refinery are also analyzed. Data on the impact of electric vehicles on Canadian fuel markets is also included.

“The report highlights the dysfunction of federal and provincial carbon tax regimes. When very low carbon biofuels in BC are charged a higher carbon tax than gasoline and diesel (energy adjusted), that sends exactly the wrong signal to fuel users. Navius estimates that by 2030, the tax penalty on biofuels would cost Canadian fuel consumers $1.5 billion per year, with absolutely no benefit to climate action. There is no technical obstacle to correcting the carbon tax on biofuels; political will is needed.”

“Because biofuels are generally less energy-dense than petroleum fuels, consumers are paying more tax on every kilometer driven using renewable fuels, in addition to improper application of the carbon tax. Navius concludes: ‘Without these additional tax costs, renewable fuel consumption during the study period [2010-2021] would have saved consumers about $3.5 billion rather than costing them $60 million’.”

This year’s analysis studies the extent to which current renewable fuel consumption would satisfy the requirements of the new Clean Fuel Regulations which came into effect July 1, 2023, following early credit generation periods from June 21, 2022, to June 30, 2023. Amongst improvements to this edition, the volumes and GHG impact of co-processed renewable fuels are included, with data based on reporting from the British Columbia Low Carbon Fuel Standard. Tax rates used in the cost impact calculations now change by fiscal year rather than the calendar year, and the cost benefit of ethanol has updated the octane valuation.

ABFC also updated the Clean Fuels Report Card, which profiles Canada’s provincial leaders and laggards, based on key fuel market metrics from the Navius BIC report. The ABFC report card highlights emissions reductions in transportation, emphasizing the importance of biofuels and non-fossil clean fuels in meeting Canada’s climate targets. The visualization tool allows fuel users to analyze the impact of poorly designed fuel taxation systems on their sector’s clean fuel choices. A broader set of data visualizations and insights from the latest BIC report are contained in ABFC’s Canadian Transportation Fuels Dashboard.

Advanced Biofuels Canada/ Biocarburants avancés Canada is the national voice for producers, distributors, and technology developers of advanced biofuels and renewable synthetic fuels. For more information, visit www.advancedbiofuels.ca.

Ian Thomson

Advanced Biofuels Canada

+1 604-947-0040

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.