New Tax Rules for Home Renovations in 2023 and 2024: Tax Credits for Homeowners

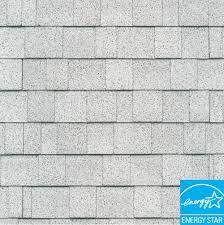

Energy Tax Credit for New Roof Shingles

The IRS has unveiled significant updates to the tax rules for home renovations for the tax years 2023 and 2024.

TRAVERSE CITY, MI, US, August 13, 2023/EINPresswire.com/ -- The IRS has unveiled significant updates to the tax rules for home renovations for the tax years 2023 and 2024.

These changes aim to support homeowners in improving their properties and to foster the development of energy-efficient and accessible homes.

Here are the key highlights of the new tax rules for home renovations in 2023 and 2024:

Energy Efficiency Incentives: Homeowners undertaking renovations that enhance energy efficiency, such as installing solar panels, energy-efficient windows, doors, insulation, or energy star roofing materials, are now eligible for tax credits or deductions.

Specific guidelines and criteria have been outlined for various improvements.

Accessibility Upgrades: Tax incentives have been introduced to support the modification of homes to accommodate disabilities. This includes installing ramps, widening doorways, and other alterations that enhance mobility within the property.

Historic Preservation Credits: For properties designated as historic landmarks, there are new tax incentives aimed at preserving and restoring these structures. Homeowners must adhere to specific preservation guidelines to qualify.

Expansion of Deductible Expenses: The IRS has expanded the list of deductible expenses related to home improvements. This includes certain costs for repairs, maintenance, and other capital improvements that add value to the property.

Green Energy Improvements: The government continues to encourage environmentally friendly building practices, with new tax provisions supporting the use of sustainable materials and technologies in home renovations.

State-Specific Incentives: Various states have also introduced or updated their own tax incentives related to home renovations. Homeowners are encouraged to consult with their state tax authority to explore additional opportunities for savings.

Documentation and Compliance: The IRS emphasizes the importance of maintaining thorough documentation of all renovation expenses and compliance with the specific requirements to claim any credits or deductions.

These new tax provisions for home renovations provide ample opportunities for homeowners to invest in their properties, promote sustainability, and increase accessibility. To learn more, homeowners can visit https://americantaxservice.org/home-improvements-are-tax-deductible/

Frank Ellis

Harbor Financial

+1 231-313-6079

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.