Innovative Roof Shingles Qualify for Homeowners Energy Tax Credit and Deduction in 2023, 2024

The U.S. Government has recently highlighted a list of advanced roof shingles that qualify homeowners for an energy tax credit or deduction in 2023 and 2024.

TRAVERSE CITY, MI, US, August 5, 2023/EINPresswire.com/ -- The U.S. Federal Government has recently highlighted a list of advanced roof shingles that qualify homeowners for an energy tax credit or deduction in 2023 and 2024.

This move is part of a broader initiative to promote energy efficiency in homes and reduce the nation's carbon footprint.

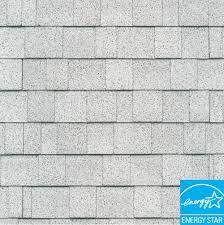

The new roof shingles, crafted with advanced technology, meet or exceed Energy Star standards.

They are specifically designed to increase energy efficiency, reduce heat absorption, and lower utility bills.

Key highlights of the new roof shingles that qualify for an energy tax credit or deduction in 2023, or 2024: They include a 30% tax credit on expenses up to $5000, providing homeowners with up to $1500 in savings.

"This initiative incentivizes homeowners to invest in energy-efficient improvements, which is a win-win for both the homeowner and the environment," stated a Government Spokesperson.

"With these new roof shingles, homeowners can reap significant savings while contributing to a more sustainable future."

The tax credit applies to primary residences and second homes but does not include rental properties. The program runs from January 1, 2023, to December 31, 2032.

To be eligible for the tax credit, homeowners need to ensure that the roofing materials used are on the approved list of energy-efficient products.

As with all tax incentives, homeowners should keep all receipts and documentation related to their roofing expenses for their tax records.

This new tax credit provides new homeowners and existing homeowners an opportunity to improve their homes while taking advantage of government incentives.

Furthermore, by promoting energy-efficient choices, it supports the country's broader sustainability goals.

For more information on the new roof shingles that qualify for an energy tax credit or deduction in 2023, or 2024, visit https://nationaltaxreports.com/energy-star-roof-tax-credit/

Frank Ellis

American Tax Service

+1 231-313-6079

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.