Andrew Q. Barrett Adapted His Experience in Asia to LatAm

Could a Return to Asia Be His Next Big Move?

The similarities between Asia and LatAm are striking - ”

MIAMI, FL, USA, July 11, 2023/EINPresswire.com/ -- Andrew Q. Barrett works with several Singapore and HK based property developers to develop real estate funds that he offers to his offshore-LatAm client base. Real estate makes up roughly the same percentage in UHNW client segments in both regions (30-40%). Barrett offers several thematic funds to clients in Asia that are similar to LatAm; rising middle class, consumer, travel and ESG. His company is one of the largest asset managers globally, distributing HSBC mutual funds throughout Latin America to banks and other financial institutions.— Andrew Q. Barrett

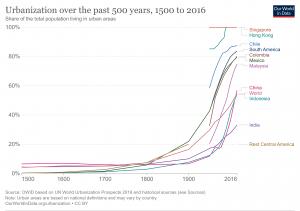

Barrett states, “The similarities between Asia and LatAm are striking - similar demographic and economic changes are taking place leading to more affluent clients, a desire to contemplate ESG, and relatively political stability. Singapore as the financial center for SE Asia - Miami is the financial center for LatAm. I really can't distinguish between my office view when I was in Singapore from my office view in Miami - both are with architecturally stunning high rises that look eerily similar.”

The current company that he heads, Bci Financial Group, one of few LatAm banks that have an office in Asia, (Shanghai Est. 2016) reflects the strong trading ties between Chile, Peru, and China. As for Barrett, the transition from Asia to LatAm began as a challenge until he used the valuable lessons learned in Asia were also effective in LatAm.

To understand family dynamics and family businesses, Barrett traveled 3 miles under the earth’s surface to visit a client’s gold mine. He trekked 18 miles in the Malaysian jungle to see a bird’s nest harvest site, and endless factories to see family businesses from the client’s point of view. In LatAm, Barrett visited a large poultry operation in Guatemala and turned a two-hour tour into a two-day visit. He visited a garment manufacturer in Haiti and advised him on practices he observed in Vietnam and India – to create a partnership between two clients on opposite ends of the world.

Asia is not one merely one culture. Neither is LatAm. Japan is as far away culturally from Thailand as Brazil is from Chile. But there are some common themes according to Barrett:

“No business gets done over the phone. It’s face to face where relationships and trust are built. It may take several meetings before funding accounts or moving assets. In America or Europe, it is common to meet in an office setting. In Asia and LatAm, business is transacted while eating. Yes, it is true. Eat everything put in front of you. I have had the Ecuadorian specialty cuy (guinea pig) on numerous occasions, in the Philippines I have tried to enjoy bulot which is a duck egg that has not fully matured yet. Neither on the top of my favorites list – but it is important to acknowledge the culture you are in.

The highest honor you can receive is to be invited into someone's home. Americans are quick to say 'swing by' but in LatAm and Asia is it a formal occasion so treat it as such. Family and business are commonly intertwined. The need for succession and wealth transfer planning is even more needed in these regions. True 'family businesses' are more common than in the US or Europe.

On the product offering side, we are working with a number of Singapore and HK based property developers to develop real estate funds that we can offer our offshore-LatAm client base. Real estate makes up about the same percentage in our UHNW client segments in both of those regions (30-40%). We have a number of thematic funds that we offer our clients that participate in some of the biggest trends in Asia - rising middle class and the consumer, travel and ESG. These are becoming similar themes in LatAm as well” says, Barrett.

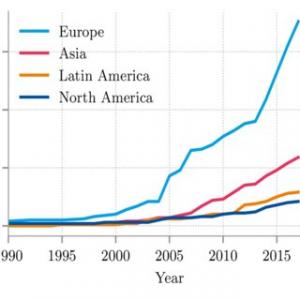

Barrett and Bci currently cover the US, with about 30% of its client base in the States. Barrett sums it up this way, “U.S. clients, like most clients, have a ‘home bias’ when it comes to investing. COVID, Ukraine War, and the US economy have emphasized this. Why take the risk abroad when we have so much to worry about at home? That is a reasonable view. However, these trends are undeniable, and investors are starting to take notice. The U.S. markets have had a very strong first half of 2023 and which makes valuations here more challenging. That is not the case in Emerging Market economies where valuations look more attractive. We are seeing increasing interest in global asset allocations and more assets moving over to participate in this theme.”

About Robert J. Smith Productions:

Smith Profits has been produced game-changing marketing campaigns since the day its founder Robert J. Smith, began with and advertisement that produced dramatic results while at John Hancock in 1993. Smith Profits

Today, Smith is an award-winning writer and international bestselling author who has set worldwide production records for Fortune Global 500 companies as well as small and medium-sized businesses. Smith is a member of the Forbes Business Council. Featured Forbes Articles.

Robert J. Smith Productions is located in Winter Garden, Florida. The company’s core businesses include Advertising, Branding, and Content; Public Relations and Influence; Books and Comic Books That Sell Your Company’s Products and Services; Television, Commercials and Film. Robert J. Smith Productions

For more information, visit Robert J. Smith, and follow us on YouTube, Twitter, LinkedIn and IMDb.

Media Contacts: Robert J. Smith, MFA, Forbes Business Council (407) 508-0200.

Robert@RobertJSmith.com and Britt Reid Press@RobertJSmith.com.

SOURCE – Andrew Q. Barrett, CEO Bci Securities at Banco Bci

Britt Reid

Robert J. Smith Productions

+1 407-508-0200

email us here

Visit us on social media:

Twitter

LinkedIn

YouTube

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.