IRS Publishes Official Tax Form 1040 and Instructions

The (IRS) recently published the official Form 1040 and the accompanying instructions, giving taxpayers their first look at the forms they will need

TRAVERSE CITY, MI, US, May 11, 2023/EINPresswire.com/ -- The Internal Revenue Service (IRS) recently published the official Form 1040 and the accompanying instructions, giving taxpayers their first look at the forms they will need to use when filing their tax returns.

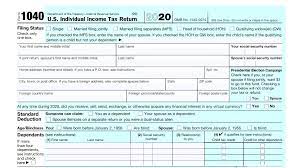

The updated version of this important form includes changes due to legislation passed in December 2021, as well as other updates.

The new Form 1040 has a simpler design than previous years, with just 23 lines for taxpayers to fill out.

The most notable change is that taxpayers who are claiming the earned income tax credit (EITC) or additional child tax credit (ACTC) must provide more information in order to qualify for these credits.

In addition, some changes have been made to the instructions that accompany the form. For example, there is now a section discussing how alimony payments are reported on a federal tax return.

These updated 1040 instructions provide taxpayers with comprehensive guidance to help them understand and complete their tax forms correctly.

The instructions provide detailed information about how to complete different types of tax forms such as 1040, 1040-SR, 1040-NR, and 1040-PR.

They also include helpful tips for calculating income and deductions so that taxpayers can be sure to get the most out of their returns.

The 1040A tax form provides a streamlined approach to filing taxes, allowing taxpayers to complete the form in fewer than 15 minutes.

This is especially useful for those who have straightforward financial situations, such as those who are students, retired, or do not have investment income or self-employment income.

In addition to simplifying the filing process, the 1040A tax form also allows taxpayers to more easily claim certain deductions and credits – such as the Child Tax Credit or Earned Income Tax Credit – that can significantly reduce their tax bill.

To help taxpayers save time and ensure accuracy in filing their taxes this year, the IRS has also provided additional resources such as an interactive tax assistant tool and a frequently asked questions page.

For more information about IRS 1040 tax forms and instructions visit https://filemytaxesonline.org/

Frank Ellis

Harbor Financial

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.