Life Insurance Market Size Set to Skyrocket with Projected CAGR of 16.3% from 2022 to 2032

The global life insurance market is expected to grow from USD 3348.8 bn in 2022 to USD 15159.4 bn in 2032 at a compound annual growth rate (CAGR) of 16.3%.

NEW YORK CITY, NEW YORK, UNITED STATES, April 10, 2023 /EINPresswire.com/ -- Market.us is a market intelligence company that has recently released a new report “ Global Life Insurance Market 2023” which covers a comprehensive study offering concise and comprehensive information on the market segments. Emerging in Life Insurance and market-driving factors will propel the decision-making process In addition, market statistics information from 2015 to 2023, major market players, their company profiles Geographical overview, market share, and segmentation of the Life Insurance industry will help readers plan their business strategies.

At the initial level, the report offers a fundamental overview of the Life Insurance market on the basis of definition, market concentration, classification, and revenue statistics of Life Insurance market. Furthermore, the report lists various important factors such as drivers, restraints, industry policies, technological innovation, M& A; activities going forward, vendor landscape, and the industry supply/demand pattern Life Insurance. The report provides a geographic analysis of more than 5 regions across the globe.

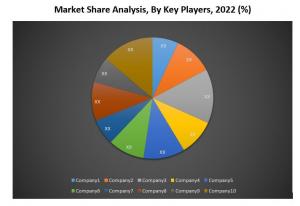

The TOP key market players listed in the report with their sales, revenues, and strategies are

ACE Insurance, Achmea, AEGON, AIA Group, AlfaStrakhovanie, Allianz, Anadolu Hayat Emeklilik, Assicurazioni Generali, Assurant, Aviva, AXA, Banamex, Banco Bilbao Vizcaya Argentaria, Banco Bradesco, BNP Paribas Cardif, China Life Insurance Company, China Pacific Insurance

Segment by Type

Term Insurance

Permanent Insurance

Segment by Application

Children

Adults

Senior Citizens

To get a detailed analysis of other segments, Request For Free Sample Report: https://market.us/report/life-insurance-market/request-sample

The Scope of the Report

The global Life Insurance Market is further segmented in terms of applications, end-user, end-use, geographic presence, by-products, and services. In addition, the situation depends on the specialists evaluating the company providing an all-inclusive category-specific business perspective. A comprehensive collection of facts about key organizations with a strong foothold within the industry provides immense value to general research.

Evaluating the winning strategies followed by these companies can help business owners not only create strategies but also execute business operations by looking at the statistics on competitor analysis. Careful analysis of the industry in different regions along with vital information on market size, share, and growth rate makes this report a wonderful resource for business evangelists. This study analyzes key regional trends contributing to the growth of the global Life Insurance Market internationally, as well as discusses the degree to which global drivers are influencing global Life Insurance in each region.

Notable Features of the Global Life Insurance Market Report

1. The current size of the global Life Insurance market, both on the regional and country levels.

2. In-depth knowledge of the factors triggering the growth of the global Life Insurance market.

3. Isolation of the market with respect to distinctive portions such as Life Insurance product type, end-use applications, and region.

4. The development of the Global Life Insurance Market with projections for individual fragments.

5. The futuristic outlook of the Global Life Insurance Market with standard patterns and leading opportunities.

6. The study of the attractive region of the market with respect to the sales of Life Insurance.

Complete the Report to read the analyzed strategies adopted by the top vendors either to retain or gain market share: https://market.us/purchase-report/?report_id=65602

Why choose this report

- These reports provide extensive information regarding which emerging markets, technologies, and factors will affect the Life Insurance industry in the future.

- The report analyzes sales, revenue (USD million), and market share from 2013 to 2023.

- The objective of the Life Insurance report is to identify new business opportunities using quantitative market forecasts.

- The report comprises the actual effects of global Life Insurance market drivers on your business.

- The report depicts the competitive situation among the leading manufacturers and the strategies employed by the leading players of the global Life Insurance market.

- The report describes the emerging market segments and their contribution to the global market share.

- The report identifies the latest market developments, opportunities, market driving forces, and market risks in the Life Insurance industry.

Key questions answered in the Life Insurance sector

1. Who are the traders, distributors, and dealers in the Life Insurance market?

2. What are sales and price analyses of top manufacturers in the Life Insurance market?

3. What are the Life Insurance Market Opportunities?

4. What are the key factors driving the global Life Insurance industry?

5. Who are the top players in the Life Insurance Industry?

6. What are the sales, revenues, and prices of each type?

About Us

Market.US (Powered by Prudour Private Limited) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as requested. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Contact our Market Specialist Team:

Global Business Development Teams - Market.us

Market.us (Powered By Prudour Pvt. Ltd.)

Send Email: inquiry@market.us

Address: 420 Lexington Avenue, Suite 300 New York City, NY 10170, United States

Tel: +1 718 618 4351

Website: https://market.us

Stefen Marwa

Prudour Pvt Ltd

+1 718-618-4351

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.