FUELARTS released a new Art+Tech & NFT Startups Report 2023

Recognized for its analytical and educational excellence in the Art+Tech & NFT industries, FUELARTS is releasing a new specialized Report.

It is the only niche analytical research on investments in infrastructure Art+Tech & NFT startups. It is designed to make investments and fundraising in Art+Tech more transparent and accessible”

NEW YORK, NEW YORK, THE USA , March 28, 2023/EINPresswire.com/ -- The main focus of the Fuelarts Report is cumulative investments in Art+Tech & NFT Startups in 2022. It gives the market overview, investment numbers and portraits of investors. The Report presents the Top investors with geographic spread and investment analysis by stages and segments. Fuelarts Report overviews trends and opportunities in both the Physical Art+Tech market and the Digital & NFT space, revealing growing points of these fast-changing markets. The Tezos Art Ecosystem is covered in a separate chapter, providing the first complex overview of the Tezos' art vertical and its recent developments. — Denis Belkevich, General Partner, Fuelarts

The authors of the research also acknowledged the increasing interest in artificial intelligence (AI). As such, the survey conducted for the report involved Art+Tech startups and strategists, who provided their perspectives on the potential impact of AI on art as well as their opinions on the efficacy of existing AI tools provided by art platforms.

The Report includes case studies and interviews with leaders in Art Market and Web3 space including Anders Petterson (ArtTactic), Mason Edwards (The Tezos Foundation), Bernadine Bröcker Wieder (Arcual), Vitomir Jevremovic (ALL.ART), Paul Viktor Schmidt (fx(hash), Valérie C. Whitacre (TriliTech), and Sandy Carter (Unstoppable Domains). The insights shared by the aforementioned market practitioners offer valuable insights into the Art+Tech ecosystem. By considering their challenges and solutions, we can gain a deeper understanding of this industry and anticipate future developments. The Report provides an outlook on investment trends in the Art+Tech sector for 2023, drawing from the perspectives of startups, strategists, and the Fuelarts platform itself.

As an added benefit to professionals in the market who rely on retrospective analyses, the Report provides an analysis of the Art+Tech ecosystem from 2018 to 2022. This analysis includes a comparison chart of industry investments over the past 5 years, which is presented for the first time in the Report.

Furthermore, the Report contains a variety of informative infographics, including timelines, market shares, ecosystems, investment data, value chains, reviews, and survey results. These infographics allow readers to visually perceive numerical data and analytics, enabling them to identify trends and derive practical insights. This feature is especially valuable for professionals operating in the Art-Tech sector who seek to gain maximum practical benefit from the data presented in the Report.

Key Findings*

A complete Fuelarts Art+Tech & NFT Startups Report 2023 can be downloaded here

● In 2022, 249 Art+Tech startups received funding: 14 startups in the "physical" Art Market and 235 companies in Digital Art & NFT Market.

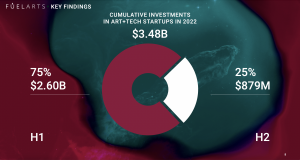

● The total funding for 249 Art+Tech startups amounted to $3.480 billion in 2022, which compounds to 70.8% of the total funding received by these startups since their launch, and 49.3% of the cumulative investments in the Art+Tech industry since 2000.

● Startups in the "physical" Art Market received $104.6 million (3.0% of the total funding), while startups developing the Digital Art & NFT Market — $3.375 billion (97.0%).

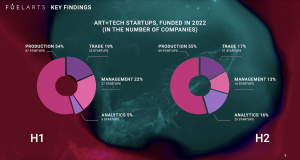

● In the Digital Art Market segment, R&D (content production) startups received the highest number of investments in 2022, which amounted to $1.647 billion for 81 companies. Startups in GameFi received $790.4 million for 37 companies. Fewer investments received Trade ($565.7 million, 41 companies), asset management ($212.8 million, 39 companies) and data analytics startups ($141.7 million, 25 companies).

● In the ‘Physical’ Art Market segment, R&D startups (content production, social networking) received the highest number of investments in 2022, which amounted to $54.4 million for 6 companies. Fewer investments received asset management tools ($38.2 million, 4 companies), online marketplaces ($11.5 million, 3 companies) and data analytics startups ($0.5 million, 1 company).

● In H2 2022 20 analytic Art+Tech startups were funded, compared to 6 in H1 2022. Overall, 38% of the 53 analytic startups that have ever existed in the public space have received investments in 2022.

● Among the countries with the incorporation of Art+Tech & NFT startups (that received investments in 2022), the United States leads with 92 companies. Second place takes Decentral startups (46 companies), while Singapore takes third place (16 companies).

● Art+Tech & NFT startups, founded in 2022, received a total funding of $167.8 million, which amounted to 4.8% of the 2022 funding of all companies in this sector created in different years. All of them represented the Digital & NFT Market.

● Art+Tech & NFT startups that received the highest investments in 2022 are in Seed Stage (142 companies, $1.289 billion), followed by 4 companies in Series C ($893.9 million) and 31 companies in Series A ($689.6 million).

● In 2022 249 Art+Tech & NFT startups had 262 funding rounds or 1.05 rounds per startup.

● The total number of investors participating in all rounds amounted to 854, 18.1% of them have made more than one investment in various Art+Tech & NFT startups in 2022. Three or more investments were made only by 6.2% of investors.

● 81.9% of investors deployed their money only in one Art+Tech & NFT startup.

● Only 84 investors of 854 were active in both H1 and H2 (9.8%). 556 investors (65.1%) who had previously deployed their money in H1, refrained from making further investments during the second half of the year.

● Venture capitalists and individuals were most active in funding Art+Tech and NFT startups, with 34.5% and 22.4% of investments made, respectively.

● In 2022, the primary means of finding new investors for startups was through recommendations from friends (47%). Word of mouth (40%) and networking at conferences (33%) also played important roles. During the crisis, professional tools such as LinkedIn and Crunchbase / Pitchbook (‘cold contacts’) were ineffective. In the second half of 2022, startups returned to trusted tools with minimal checks, such as grant programs (21%) and accelerators (8%).

● Crypto investors, both individuals (60%) and crypto VCs, were the most responsive in terms of making contact with a subsequent pitch. Crypto strategists and fiat individuals were slightly less responsive at 47% each. Traditional (fiat) investors (27%) and strategists (20%) were the least active.

DOWNLOAD THE REPORT - https://fuelarts.com/report

Anna Shvets

TAtchers' Art Management

email us here

Fuelarts Art+Tech & NFT Startups Report 2023 online release

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.