Top 10 M&A Deals in Healthcare & Life Sciences in 2022

2022 saw a slight uptick in M&A activity in the Healthcare and Life Sciences space, leading to stronger synergies in the healthcare system

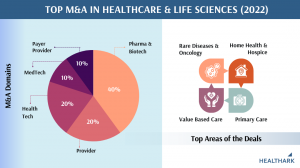

“Top 10 M&A Deals in Healthcare & Lifesciences in 2022”, a research report by Healthark Insights includes the top deals in the healthcare and life science sector during the year. The research is based on an evaluation of 200+ deals across Pharma & Biotech, MedTech, Health Technology, Providers, Primary Care and Payer sectors. Further, each deal category was assigned a weightage and a ranking metric was used basis the impact on the broader healthcare ecosystem. The top 10 transactions were determined based on factors such as deal size, region of focus, impact, and others.

Pharma & Biotech accounted for 40% of the deals, with the Amgen – Horizon Therapeutics $28.3 B mega deal topping the list, followed by two strategic acquisitions made by Pfizer i.e., of Biohaven and Global Blood Therapeutics and Bristol Myers Squibb’s acquisition of Turning Point. Oncology, Rare Disease, Hematology, Neurology and Cardiovascular were the major focus areas for Pharmaceutical M&As. The looming patent expirations and severe pressure to strengthen the R&D pipeline drove big pharma to make big strategic buyouts in this space.

Home health and hospice transactions covered a significant share in the total valuation, driven by two megadeals – CVS’ acquisition of Signify Health for $8 B and Optum’s acquisition of LHC Group for $6 B. These acquisitions were on the similar lines as initiated by Humana’s purchase of Kindred Home in 2021. These deals signify rising the interest among payers to operate healthcare provider companies, especially those that are well-positioned to participate in value-based, risk-bearing payment models.

Stakeholders across healthcare industry started expanding or penetrating primary care practices. This is evident by Walgreens backed VillageMD’s $8.9 B acquisition of Summit Health. And even Health tech giant Amazon joined this spree with the acquisition of One Medical for $3.9 B, vocalizing its ambitions of penetrating deep into the primary healthcare services.

Moving forward, 2023 is expected to be a year when significant deals are executed, despite forecasts of cautious private equity investing and a moderate recession. The increase in M&A activity will be fueled by loss of patent exclusivity, competition from generics and biosimilars, growing gene therapy pipeline, breakthroughs in digital technologies and increased patient awareness and requirements.

To get an in-depth insight on the top 10 healthcare and life science M&A deals, please visit Healthark Insights website.

About Healthark Insights Top 10 Research Report Series

Healthark Insights annually tracks the top events and trends in the healthcare and life sciences industry, and publishes five reports at the end of each year summarizing the top 10 trends in healthcare industry, life sciences industry, health tech, the top 10 innovations and top 10 mergers & acquisitions, with an objective of summarizing the key events and industry shaping forces during the previous year, and shares a view-point on how the sector will evolve in the coming year.

About Healthark Insights

Healthark Insights is a global management consulting firm developed by a team of experts from diverse fields such as consulting, pharma, medicine, medical devices, digital health, public health, and management with a common vision to cater to the healthcare and life sciences industry, along with a relentless focus on delivering executable solutions.

Healthark Insights team helps customers make critical decisions every day through expertise that combines deep domain knowledge, rigorous research, and analysis, understanding of markets, technology, and experience. With the right experience and expertise, the team not only provides insights but also works closely with clients to execute the strategy that they have helped develop.

Purav Gandhi

Healthark Wellness Solutions LLP

+91 91600 01292

email us here

Visit us on social media:

Twitter

LinkedIn

YouTube

Top 10 M&A in Healthcare & Life Sciences in 2022 - A video snapshot by Healthark Insights

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.