Trase helps investors take action on deforestation risk

This impact story is from our 2021 annual report.

How can investors identify and assess deforestation risk in their portfolios to inform their choices on engagement and divestment with companies? Through the Trase initiative, SEI and Global Canopy worked with Storebrand Asset Management to show how.

Some estimate that nearly half of all economic activity depends either “moderately” or “highly” on nature – around $44 trillion of global GDP. Yet we continue to live in a way that exceeds the limits of the Earth’s natural systems, threatening future prosperity.

Tropical deforestation carried out to clear land for agricultural production is a significant driver of biodiversity loss, altered rainfall patterns and climate change. It is estimated that up to 13% of all human greenhouse gas emissions originate from deforestation, meaning that we cannot tackle the climate emergency without tackling deforestation.

Enabling transparency for investors

Deforestation from agriculture creates risks for commodity producers and traders. These include reputational damage, constrained access to capital, loss of market access and competitive risk and operational risks from continued land clearance.

The complexity of agricultural production and supply chains creates a barrier to more effective investor action. Commodities such as cattle, soy and palm oil are sourced from land recently converted both legally and illegally, but investors are often unaware of how these commodities are ultimately sourced and how they are consequently financing climate change and biodiversity loss.

Comprehensive data

In the absence of comprehensive data on deforestation by financial data providers, Storebrand developed an approach using two monitoring and assessment tools: Trase, developed by SEI, Global Canopy and Neural Alpha, and Forest 500 by Global Canopy.

Storebrand selected companies in its portfolio for direct engagement using scores from Forest 500’s assessment to categorize companies into three groups: green, yellow and red.

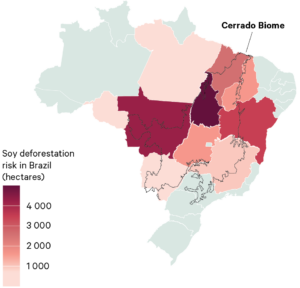

For red category companies, Trase data were used to drill down and identify deforestation risk, measured in hectares of deforestation. Storebrand then mapped the highest risk companies to their portfolios to identify companies that score well for policies and commitments, but are linked to persistent and high deforestation risks and companies that have a low score for policies and commitments alongside high deforestation risk.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.