Ero Copper Announces 31% Increase in Mineral Reserves of the Caraíba Operations and Extension of Mine Life to 20 Years

VANCOUVER, British Columbia, Nov. 07, 2022 (GLOBE NEWSWIRE) -- Ero Copper Corp. (TSX: ERO, NYSE: ERO) ("Ero" or the “Company”) is pleased to announce an update of its National Instrument 43-101 (“NI 43-101”) compliant mineral reserves and resources along with a life-of-mine ("LOM") production plan for its Caraíba Operations, located in Bahia State, Brazil. The updated mineral reserve and mineral resource estimates incorporate drilling activities through June 30, 2022 while mining depletion has been updated through the effective date of the estimate, September 30, 2022.

HIGHLIGHTS

- The addition of Project Honeypot contributes measured and indicated mineral resources, inclusive of reserves, of 9.7 Mt grading 1.87% copper containing 181.3 kt of copper;

- Increase of 31% in the Caraíba Operations proven and probable mineral reserves as compared to the 2021 estimate, including a 43% increase within the Pilar Mine, driven by the Project Honeypot maiden mineral reserve of approximately 129.7 kt of contained copper (8.1 Mt grading 1.59% copper);

- An additional 49.1 kt of contained copper (4.6 Mt grading 1.08% copper) was added to proven and probable mineral reserves from other areas within the upper levels of the Pilar Mine, resulting in a net increase of 150.5 kt of contained copper after mine depletion;

- The mineral reserve estimate for Project Honeypot currently reflects more conservative assumptions for dilution and mine recovery than what is being achieved in the Pilar Mine - see notes on mineral resources and reserves for additional details;

- The inclusion of Project Honeypot into Caraíba's 2022 Strategic LOM Plan provides operational flexibility and improvements over prior production guidance and the LOM plan included in the 2020 Technical Report (as defined below):

- A 5% increase in projected mill head grades when compared to same-year projections outlined in the Company's 5-Year Guidance (please refer to press release dated January 11, 2022);

- Vermelhos District open pits re-sequenced from 2026 / 2027 to beyond 2030, deferring capital related to pre-stripping and ore sorting as well as simplifying the Company's development initiatives over the medium-term; and,

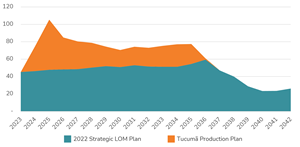

- Steady growth in copper production from 45.3kt (2023) to 59.4 kt of copper by 2036 and current mine life of 20 years

"Caraíba's 2022 updated mineral reserves, mineral resources and life-of-mine production plan reflect years of planning and investment to significantly extend the scale and life of our operations in the Curaçá Valley." stated David Strang, Chief Executive Officer. "One of our core objectives for the Company this year was to focus on the inclusion of Project Honeypot in the Pilar Mine production plan - with nearly 10 million tonnes of higher grade measured and indicated resources added to our mineral inventory within the upper levels of the Pilar Mine, we have achieved this objective.

"Time has shown that one of the many benefits of Caraíba's hub-and-spoke operating model has and will continue to be flexibility. The sheer number of operating levers and opportunities available provides us with the capability to adjust our production plans to market conditions while continuing to demonstrate consistent year-on-year growth. The results of Project Honeypot, which has now been incorporated into our strategic planning, has afforded our team the ability to evaluate short-term and long-term production plans with various grade, cost and capital profiles. We believe these plans will support attractive and resilient operating margins in the future and create shareholder value through a wide variety of macroeconomic conditions."

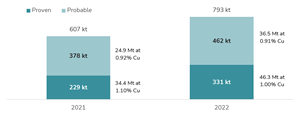

Caraíba Operations Proven & Probable Mineral Reserves in 2021 vs. 2022

(contained copper)

Note: Mineral reserve estimates were prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council on May 10, 2014 (the “CIM Standards”), and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines, adopted by CIM Council on November 29, 2019 (the “CIM Guidelines”), using geostatistical and/or classical methods, plus economic and mining parameters appropriate for the deposit. Please refer to the Company's press release dated January 6, 2022 or the forthcoming 2022 Technical Report, as applicable and as defined below, for a discussion on the assumptions, parameters and methods used to estimate the mineral reserves. 2022 mineral reserve estimate effective date of September 30, 2022. All figures have been rounded to the relative accuracy of the estimates.

Ero Copper's Consolidated Copper Production Profile

(recovered copper in kt)

Note: Tucumã Production Plan sourced from the 2021 Tucumã Technical Report (as defined below). Please refer to notes on mineral reserves and resources in this press release for additional information on the 2022 Strategic LOM Plan. The Company's 2022 Strategic LOM Plan is preliminary in nature and includes inferred mineral resources which are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. As such, there is no certainty that the 2022 Strategic LOM Plan will be realized.

The Company's 2022 LOM planning process considers recently completed and ongoing investments in mining and milling infrastructure under the Company's Pilar 3.0 initiative. As a result of the integration of Project Honeypot and the nature of the mineralization remaining in the upper levels of the Pilar Mine, and more broadly within the Company's underground operations, effective extraction of the mineral reserve necessitated the consideration of inferred mineral resources in the Company's long-term strategic planning efforts, particularly in the design of stopes that include measured, indicated and some inferred mineral resources

- a process that has been utilized at the Pilar Mine since underground operations commenced in 1986. Inferred mineral resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral resources which are not mineral reserves do not have demonstrated economic viability. Please refer to the notes on mineral reserves and resources in this press release for additional detail on the 2022 Strategic LOM Plan.

2022 Strategic LOM Plan, Milling Operations

| Unit | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | |

| Milling Operations (incl. stockpile + ore sorting adjustments) | |||||||||||

| Tonnes Processed | kt | 3,467 | 3,900 | 4,197 | 4,080 | 4,200 | 4,213 | 4,200 | 4,200 | 4,200 | 4,200 |

| Grade Processed | % Cu | 1.43 | 1.29 | 1.24 | 1.28 | 1.25 | 1.29 | 1.34 | 1.31 | 1.36 | 1.33 |

| Recovery | % | 91.6 | 92.3 | 92.1 | 92.3 | 92.1 | 92.3 | 92.5 | 92.4 | 92.6 | 92.4 |

| Copper in Concentrate | kt | 45.3 | 46.3 | 47.8 | 48.3 | 48.5 | 50.3 | 52.0 | 50.9 | 53.1 | 51.5 |

| Unit | 2033 | 2034 | 2035 | 2036 | 2037 | 2038 | 2039 | 2040 | 2041 | 2042 | |

| Milling Operations (incl. stockpile + ore sorting adjustments) | |||||||||||

| Tonnes Processed | kt | 4,200 | 4,200 | 4,200 | 4,200 | 4,200 | 4,200 | 4,200 | 4,080 | 3,375 | 2,997 |

| Grade Processed | % Cu | 1.32 | 1.32 | 1.40 | 1.52 | 1.22 | 1.05 | 0.77 | 0.65 | 0.78 | 0.96 |

| Recovery | % | 92.4 | 92.4 | 92.7 | 93.1 | 92.0 | 91.2 | 89.7 | 88.7 | 89.7 | 90.8 |

| Copper in Concentrate | kt | 51.2 | 51.2 | 54.6 | 59.4 | 47.1 | 40.0 | 28.8 | 23.4 | 23.6 | 26.2 |

Note: The Company's 2022 Strategic LOM Plan is preliminary in nature and includes inferred mineral resources which are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. As such, there is no certainty that the 2022 Strategic LOM Plan will be realized. The Company has an active drill program in place to continuously infill and upgrade inferred mineral resources once underground drill stations have been developed. However, until this work is completed and the inferred resources have been upgraded to mineral reserves, there is no certainty this material will be converted into mineral reserves. Modified inferred mineral resources are not mineral reserves. Mineral resources that are not mineral reserves do not have a demonstrated economic viability.

2022 MINERAL RESERVE AND RESOURCE ESTIMATE

|

2022 Mineral Reserves & Resources |

2021 Mineral Reserves & Resources |

Change |

||||||

| Tonnes (kt) |

Grade (Cu %) |

Contained Cu (kt) |

Tonnes (kt) |

Grade (Cu %) |

Contained Cu (kt) |

Contained Cu (kt) |

% | |

| Project Honeypot Areas, Pilar Mine | ||||||||

| Proven Reserves | 2,595 | 1.66 | 43.1 | — | — | — | 43.1 | NA |

| Probable Reserves | 5,551 | 1.56 | 86.6 | — | — | — | 86.6 | NA |

| Proven & Probable Reserves1 | 8,146 | 1.59 | 129.7 | — | — | — | 129.7 | NA |

| Measured Resources | 3,229 | 1.86 | 60.0 | — | — | — | 60.0 | NA |

| Indicated Resources | 6,459 | 1.88 | 121.3 | — | — | — | 121.3 | NA |

| Measured & Indicated | 9,687 | 1.87 | 181.3 | — | — | — | 181.3 | NA |

| Inferred Resources | 896 | 1.07 | 9.6 | — | — | — | 9.6 | NA |

|

Total Pilar Mine, including Project Honeypot Areas | ||||||||

| Proven Reserves | 15,092 | 1.26 | 190.3 | 6,406 | 1.33 | 85.0 | 105.3 | 124 |

| Probable Reserves | 19,870 | 1.56 | 309.4 | 18,110 | 1.46 | 264.2 | 45.2 | 17 |

| Proven & Probable Reserves1 | 34,962 | 1.43 | 499.7 | 24,515 | 1.42 | 349.2 | 150.5 | 43 |

| Measured Resources | 29,806 | 1.38 | 412.4 | 23,683 | 1.60 | 378.3 | 34.2 | 9 |

| Indicated Resources | 23,947 | 1.73 | 413.3 | 23,656 | 1.56 | 368.0 | 45.4 | 12 |

| Measured & Indicated Resources | 53,753 | 1.54 | 825.8 | 47,339 | 1.58 | 746.2 | 79.5 | 11 |

| Inferred Resources | 16,993 | 1.42 | 241.3 | 15,567 | 1.46 | 227.6 | 13.7 | 6 |

Note: 2022 mineral reserve and resource estimates are effective as at September 30, 2022. Presented mineral resources inclusive of mineral reserves. All figures have been rounded to reflect the relative accuracy of the estimates. Summed amounts may not add due to rounding. Mineral resources that are not mineral reserves do not have a demonstrated economic viability. See below notes on mineral reserve and resource estimates for additional technical and scientific information.

1. In the mine design of the Pilar underground mine, certain stopes include measured and indicated as well as inferred resource blocks. In these instances, inferred resource blocks within the defined mining shape were assigned zero grade. Development occurring within marginal ore, above the operational cut-off grade, has also been included in the mineral reserve estimate. Marginal grade material above the operational cut-off grade, is used for mine planning purposes in dilution and development envelopes and not for design of primary production stopes. See below notes on mineral reserve and resource estimates for additional technical and scientific information.

|

2022 Mineral Reserves & Resources |

2021 Mineral Reserves & Resources |

Change |

||||||||

| Tonnes (kt) | Grade (Cu %) | Contained Cu (kt) | Tonnes (kt) | Grade (Cu %) | Contained Cu (kt) | Contained Cu (kt) | % | |||

| Total Caraíba Operations | ||||||||||

| Underground | ||||||||||

| Proven Reserves | 17,336 | 1.30 | 225.6 | 9,177 | 1.49 | 136.8 | 88.8 | 65 | ||

| Probable Reserves | 22,125 | 1.51 | 333.1 | 20,797 | 1.42 | 295.6 | 37.5 | 13 | ||

| Proven & Probable Reserves1 | 39,461 | 1.42 | 558.7 | 29,974 | 1.44 | 432.4 | 126.3 | 29 | ||

| Measured Resources | 34,224 | 1.44 | 493.2 | 30,355 | 1.63 | 493.7 | (0.5 | ) | — | |

| Indicated Resources | 35,389 | 1.48 | 524.8 | 39,005 | 1.33 | 519.9 | 4.9 | 1 | ||

| Measured & Indicated Resources | 69,613 | 1.46 | 1,018.0 | 69,360 | 1.46 | 1,013.6 | 4.4 | — | ||

| Inferred Resources | 35,888 | 1.15 | 411.4 | 40,331 | 1.14 | 458.3 | (46.9 | ) | (10 | ) |

|

Open Pit |

||||||||||

| Proven Reserves | 19,148 | 0.55 | 105.5 | 15,680 | 0.59 | 92.0 | 13.5 | 15 | ||

| Probable Reserves | 24,158 | 0.53 | 128.4 | 13,627 | 0.61 | 82.7 | 45.7 | 55 | ||

| Proven & Probable Reserves | 43,306 | 0.54 | 233.9 | 29,306 | 0.60 | 174.7 | 59.2 | 34 | ||

| Measured Resources | 20,803 | 0.62 | 128.7 | 16,777 | 0.61 | 103.0 | 25.7 | 25 | ||

| Indicated Resources | 27,486 | 0.56 | 154.1 | 18,563 | 0.56 | 104.5 | 49.6 | 47 | ||

| Measured & Indicated Resources | 48,289 | 0.59 | 282.8 | 35,340 | 0.59 | 207.5 | 75.3 | 36 | ||

| Inferred Resources | 11,513 | 0.62 | 71.4 | 3,000 | 0.50 | 15.1 | 56.3 | 373 | ||

|

Total Underground and Open Pit |

||||||||||

| Proven Reserves | 36,484 | 0.91 | 331.1 | 24,857 | 0.92 | 228.8 | 102.3 | 45 | ||

| Probable Reserves | 46,283 | 1.00 | 461.5 | 34,423 | 1.10 | 378.3 | 83.2 | 22 | ||

| Proven & Probable Reserves1 | 82,767 | 0.96 | 792.6 | 59,280 | 1.02 | 607.1 | 185.5 | 31 | ||

| Measured Resources | 55,027 | 1.13 | 621.9 | 47,132 | 1.27 | 596.7 | 25.2 | 4 | ||

| Indicated Resources | 62,875 | 1.08 | 678.9 | 57,568 | 1.08 | 624.4 | 54.5 | 9 | ||

| Measured & Indicated Resources | 117,901 | 1.10 | 1,300.8 | 104,700 | 1.17 | 1,221.1 | 79.7 | 7 | ||

| Inferred Resources | 47,400 | 1.02 | 482.8 | 43,331 | 1.09 | 473.4 | 9.4 | 2 | ||

Note: 2022 mineral reserve and resource estimates are effective as at September 30, 2022. Presented mineral resources inclusive of mineral reserves. All figures have been rounded to reflect the relative accuracy of the estimates. Summed amounts may not add due to rounding. Mineral resources that are not mineral reserves do not have a demonstrated economic viability. See below notes on mineral reserve and resource estimates for additional technical and scientific information.

1. In the mine design of the Pilar, Vermelhos and Surubim underground mines, certain stopes include measured and indicated as well as inferred resource blocks. In these instances, inferred resource blocks within the defined mining shape were assigned zero grade. Development occurring within marginal ore, above the operational cut-off grade, has also been included in the mineral reserve estimate. Marginal grade material above the operational cut-off grade, is used for mine planning purposes in dilution and development envelopes and not for design of primary production stopes. See below notes on mineral reserve and resource estimates for additional technical and scientific information.

MINING OPERATIONS, LOM PRODUCTION PLANS

The Company's 2022 updated LOM production plans reflect recent and ongoing investments in mining and milling infrastructure that continues to support significant operating flexibility - further enhanced by the Company's Pilar 3.0 initiative. A key component of Pilar 3.0 is Project Honeypot, an engineering initiative focused on recovering high-grade stopes, rib and sill pillars in the upper levels of the Pilar Mine left behind by previous operators during the late 1990s primarily due to the under-capitalized nature of operations at the time.

Due to the nature of the mineralization remaining in the upper levels of the Pilar Mine, and elsewhere within the underground operations of the Company, effective extraction of the mineral reserve necessitated the consideration of inferred mineral resources in long-term strategic planning efforts - a process that has been utilized at the Pilar Mine since underground operations commenced in 1986. As a result, the Company has defined two production plans:

- The 2022 Reserve LOM Plan, which is based only on the Caraíba Operation's proven and probable mineral reserves as of September 30, 2022 with inferred mineral resources, where unavoidably mined, assigned zero grade thus reducing stope sizing and production volumes relative to the Company's strategic plan; and,

- The 2022 Strategic LOM Plan, which considers inferred mineral resources for which modifying factors have been applied (see notes on mineral reserves and resources of this press release).

The Company's 2022 Strategic LOM Plan is preliminary in nature and includes inferred mineral resources from the Company's mining operations that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. As such, there is no certainty that the 2022 Strategic LOM Plan will be realized. The Company has an active drill program in place to continuously infill and upgrade inferred mineral resources once underground drill stations have been developed. However, until this work is completed and the inferred resources have been upgraded to mineral reserves, there is no certainty this material will be converted into mineral reserves.

The 2022 Strategic LOM Plan applies the same mining and recovery methods as the 2022 Reserve LOM Plan within each mining area. Specifically, the same mining, recovery and dilution modifying factors have been applied to inferred resources included in the 2022 Strategic LOM Plan. More information on these modifying factors will be included in the forthcoming 2022 Technical Report (as defined below). Modified inferred mineral resources are not mineral reserves. Mineral resources that are not mineral reserves do not have a demonstrated economic viability.

2022 Reserve LOM Plan, Mining Operations, Mineral Reserves

| Unit | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | |

| Underground Operations | |||||||||||

| Tonnes Mined | kt | 2,445 | 2,774 | 2,941 | 3,249 | 3,422 | 3,304 | 2,996 | 2,458 | 2,131 | 2,010 |

| Grade Mined |

% Cu | 1.54 | 1.30 | 1.36 | 1.34 | 1.27 | 1.38 | 1.46 | 1.41 | 1.40 | 1.43 |

| Open Pit Operations | |||||||||||

| Tonnes Mined | kt | 541 | 488 | 514 | 558 | 1,024 | — | 68 | 287 | 950 | 1,061 |

| Grade Mined |

% Cu | 0.68 | 0.55 | 0.52 | 0.73 | 1.07 | — | 0.80 | 0.74 | 0.57 | 0.68 |

| Total Mining Operations | |||||||||||

| Tonnes Mined | kt | 2,986 | 3,262 | 3,455 | 3,807 | 4,446 | 3,304 | 3,065 | 2,745 | 3,082 | 3,072 |

| Grade Mined | % Cu | 1.39 | 1.19 | 1.24 | 1.25 | 1.23 | 1.38 | 1.44 | 1.34 | 1.14 | 1.17 |

| Contained Copper | kt | 41.5 | 38.9 | 42.7 | 47.5 | 54.5 | 45.7 | 44.3 | 36.9 | 35.2 | 35.9 |

|

Unit |

2033 |

2034 |

2035 |

2036 |

2037 |

2038 |

2039 |

2040 |

2041 |

2042 |

|

| Underground Operations | |||||||||||

| Tonnes Mined | kt | 2,143 | 2,532 | 2,275 | 1,534 | 1,671 | 966 | 168 | — | — | — |

| Grade Mined |

% Cu | 1.24 | 1.26 | 1.35 | 1.56 | 1.70 | 1.83 | 2.97 | — | — | — |

| Open Pit Operations | |||||||||||

| Tonnes Mined | kt | 1,302 | 963 | 2,527 | 2,030 | 3,703 | 5,007 | 5,419 | 5,945 | 5,950 | 4,797 |

| Grade Mined |

% Cu | 0.68 | 0.91 | 0.72 | 0.50 | 0.46 | 0.45 | 0.42 | 0.44 | 0.50 | 0.60 |

| Total Mining Operations | |||||||||||

| Tonnes Mined | kt | 3,445 | 3,495 | 4,802 | 3,565 | 5,374 | 5,974 | 5,586 | 5,945 | 5,950 | 4,797 |

| Grade Mined | % Cu | 1.03 | 1.16 | 1.02 | 0.95 | 0.85 | 0.68 | 0.50 | 0.44 | 0.50 | 0.60 |

| Contained Copper | kt | 35.5 | 40.7 | 49.0 | 34.0 | 45.5 | 40.4 | 27.9 | 25.9 | 29.8 | 28.6 |

2022 Strategic LOM Plan, Mining Operations, Inferred

| Unit | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | |

| Underground Operations | |||||||||||

| Tonnes Mined | kt | 507 | 560 | 634 | 516 | 523 | 665 | 877 | 1,430 | 1,518 | 1,347 |

| Grade Mined |

% Cu | 1.70 | 1.79 | 1.34 | 1.39 | 1.46 | 1.03 | 1.15 | 1.16 | 1.44 | 1.32 |

| Open Pit Operations | |||||||||||

| Tonnes Mined | kt | 68 | 135 | 20 | 41 | 12 | — | 9 | 11 | 96 | 117 |

| Grade Mined |

% Cu | 0.49 | 0.68 | 0.48 | 0.35 | 1.81 | — | 0.61 | 0.55 | 0.61 | 0.63 |

| Total Mining Operations | |||||||||||

| Tonnes Mined | kt | 575 | 696 | 653 | 557 | 536 | 665 | 886 | 1,441 | 1,614 | 1,465 |

| Grade Mined | % Cu | 1.55 | 1.57 | 1.32 | 1.31 | 1.47 | 1.03 | 1.14 | 1.15 | 1.39 | 1.26 |

| Contained Copper | kt | 8.9 | 11.0 | 8.6 | 7.3 | 7.9 | 6.8 | 10.1 | 16.6 | 22.4 | 18.5 |

|

Unit |

2033 |

2034 |

2035 |

2036 |

2037 |

2038 |

2039 |

2040 |

2041 |

2042 |

|

| Underground Operations | |||||||||||

| Tonnes Mined | kt | 1,557 | 1,099 | 1,016 | 970 | 429 | 427 | 57 | — | — | — |

| Grade Mined |

% Cu | 1.50 | 1.42 | 1.53 | 2.10 | 2.13 | 2.23 | 0.50 | — | — | — |

| Open Pit Operations | |||||||||||

| Tonnes Mined | kt | 140 | 67 | 49 | 140 | 204 | 82 | 115 | 201 | 126 | 33 |

| Grade Mined |

% Cu | 0.59 | 1.01 | 0.58 | 0.47 | 0.37 | 0.46 | 0.40 | 0.47 | 0.51 | 0.65 |

| Total Mining Operations | |||||||||||

| Tonnes Mined | kt | 1,697 | 1,166 | 1,065 | 1,110 | 633 | 510 | 172 | 201 | 126 | 33 |

| Grade Mined | % Cu | 1.42 | 1.40 | 1.48 | 1.89 | 1.57 | 1.94 | 0.44 | 0.47 | 0.51 | 0.65 |

| Contained Copper | kt | 24.1 | 16.3 | 15.8 | 21.0 | 9.9 | 9.9 | 0.8 | 0.9 | 0.6 | 0.2 |

Note: The 2022 Strategic LOM Plan applies the same mining and recovery methods as the 2022 Reserve LOM Plan. Accordingly, the same mining, recovery and dilution modifying factors have been applied to inferred resources included in the 2022 Strategic LOM Plan. More information on these modifying factors will be included in the forthcoming 2022 Technical Report (as defined below). Modified inferred mineral resources are not mineral

NOTES ON MINERAL RESERVES AND RESOURCES

Mineral reserve and mineral resource estimates are effective as at September 30, 2022. Mineral resources are presented inclusive of mineral reserves. All figures have been rounded to the relative accuracy of the estimates. Summed amounts may not add due to rounding. Mineral resources that are not mineral reserves do not have a demonstrated economic viability.

Mineral reserve estimates are prepared by or under the supervision of and verified by Dr. Beck (Alizeibek) Nader, FAIG of BNA Mining Solutions and Mr. Alejandro Sepulveda, Register Member (No. 0293) (Chilean Mining Commission) of NCL Ingeniería y Construcción SpA, who are independent qualified persons under NI 43-101.

Mineral resource estimates are prepared by or under the supervision of and verified by Sr. Porfirio Cabaleiro Rodriguez, FAIG, who is an independent qualified persons under NI 43-101.

Reference herein of $ or USD is to United States dollars and BRL is to Brazilian reais. Mineral Reserves for the Caraíba Operations have been estimated using a copper price of $3.30/lb, and the exchange rate used for mineral reserve and resource estimates was USD/BRL 5.29.

Underground mineral resource estimates have been constrained within newly developed 3D lithology models applying a 0.45% and 0.20% copper grade envelope for high and marginal grade, respectively. Within these envelopes, mineral resources for underground deposits were constrained using varying stope dimensions of up to 20m by 10m by 35m applying a 0.51% copper cut-off grade, as well as a 0.34% copper marginal (or operational) cut-off grade. Mineral resources have been estimated using ordinary kriging inside 5m by 5m by 5m block sizes. The mineral resource estimates were prepared in accordance with the CIM Standards, and the CIM Guidelines, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit.

A low-grade envelope using a cut-off grade of 0.20% copper for underground deposits was used to develop a dilution and development block model that was included to define the grade of blocks within the dilution envelope in planning and design of stopes within the mineral resource and mineral reserve estimate.

Open pit mineral resource estimates have been constrained within newly developed 3D lithology models using a 0.16% copper cut-off grade for open pit deposits. Mineral resources have been estimated using ordinary kriging inside 5m by 5m by 5m block sizes. The mineral resource estimates were prepared in accordance with the CIM Standards, and the CIM Guidelines, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit.

Mineral reserves are the economic portion of the measured and indicated mineral resources. Mining dilution and recovery factors vary for specific mineral reserve sources and are influenced by factors such as deposit type, deposit shape, stope orientation and selected mining method. In the mine design of the Pilar and Vermelhos underground mines, certain stopes include measured and indicated as well as inferred resource blocks. In these instances, inferred resource blocks within the defined mining shape were assigned zero grade. In 2022, inferred blocks assigned zero grade totaled approximately 188,000 tonnes for the Deepening Extension Zone, 234,000 tonnes for the Pilar Underground Mine and approximately 27,000 tonnes for the Vermelhos Underground Mine. Development occurring within marginal ore, above the operational cut-off grade, has also been included in the mineral reserve estimate. Dilution occurring from measured and indicated resource blocks was assigned grade based upon the mineral resource grade of the blocks included in the dilution envelope. Planned and operational mining dilution and mine recovery for the Company's underground operations vary by deposit:

- Within the upper levels of the Pilar Mine, including Project Honeypot, dilution and mine recovery average 32% and 90%, respectively;

- Elsewhere in the Pilar Mine, including the Deepening Extension, dilution and mine recovery average 23% and 96%, respectively;

- Within the Vermelhos Mine and the Surubim Mine, dilution and mine recovery average 10% and 95%, respectively.

QUALIFIED PERSONS AND THE NI 43-101 TECHNICAL REPORT

Sr. Porfirio Cabaleiro Rodriguez, FAIG, has reviewed and approved the scientific and technical information contained in this press release. Mr. Rodriguez is independent of the Company and a qualified person as defined by NI 43-101.

The Company will file the associated NI 43-101 compliant report (the "2022 Technical Report") on SEDAR (www.sedar.com) and EDGAR (www.sec.gov), and publish this report on the Company’s website (www.erocopper.com), within 45 days of this press release, which will serve as an update to the technical report entitled “2020 Updated Mineral Resources and Mineral Reserves Statements of Mineração Caraíba’s Vale do Curaçá Mineral Assets, Curaçá Valley”, dated January 14, 2021 with an effective date of October 1, 2020, prepared by Porfirio Cabaleiro Rodrigues, FAIG, Bernardo Horta de Cerqueira Viana, MAIG, Paulo Roberto Bergmann, FAusIMM, Fábio Valério Câmara Xavier, MAIG and Dr. Augusto Ferreira Mendonça, RM SME all of GE21 Consultoria Mineral Ltda. (“GE21”) and Dr. Beck (Alizeibek) Nader, FAIG of BNA Mining Solutions (the “2020 Technical Report”).

Please refer to the NI 43-101 compliant technical report entitled "Boa Esperança Project NI 43-101 Technical Report on Feasibility Study Update" dated November 12, 2021 with an effective date of August 31, 2021, prepared by Kevin Murray, P. Eng., Erin L. Patterson, P. Eng., and Scott C. Elfen, P.E., all of Ausenco Engineering Canada Inc., Carlos Guzmán, FAusIMM RM CMC of NCL Ingeniería y Construcción SpA, who are independent qualified persons under NI 43-101, and Emerson Ricardo Re, MSc, MBA, MAusIMM (CP) (No. 305892), Registered Member (No. 0138) (Chilean Mining Commission) Resource Manager of the Company on the date of the report (now of HCM Consultoria Geologica Eireli) (the “2021 Tucumã Technical Report”) for technical information and assumptions related to the Tucumã LOM production plan.

QUALITY ASSURANCE & QUALITY CONTROL

Current QA/QC Program

At the Caraíba Operations, the Company is currently drilling underground with core drill rigs using a combination of owned and third-party contracted drill rigs. During the period from September 2021 to June 2022, third party drill rigs were operated by Major Drilling, DrillGeo Geologia e Sondagem Ltda., and Layne Christensen Co., all of whom are independent of the Company. Drill core is logged, photographed and split in half using a diamond core saw at the Caraíba Operations’ secure core logging and storage facilities. Half of the drill core is retained on site and the other half-core is used for analysis, with samples collected on one- meter sample intervals unless an interval crosses a geological contact. Reverse circulation cuttings are split at the drill rig using one-meter sample intervals. All sample preparation is performed in the secure on-site laboratory of Mineraҫão Caraíba S.A. (“MCSA”), the Company's subsidiary that holds a 100% interest in the Caraíba Operations. Total copper is determined using a nitric-hydrochloric acid digestion and Atomic Absorption Spectrometry (“AAS”) and/or Titration. Oxide copper values are determined using sulfuric acid digestion followed by AAS. All such sample results used in the preparation of the 2022 updated mineral resource and reserve estimate have been monitored through a quality assurance and quality control (“QA/QC”) program that includes the insertion of certified standards, blanks, and pulp and reject duplicate samples. Regular check-assays are submitted to ALS Brasil LTDA’s facility located in Vespasiano, Minas Gerais, Brazil, at a rate of approximately 5%. ALS Brasil LTDA is independent of the Company.

QA/QC Validation

The QA/QC validation process undertaken for the 2022 updated mineral resource and reserve estimates for the Caraíba Operations is consistent with the process set out in the 2020 Technical Report.

ABOUT ERO COPPER CORP

Ero Copper Corp is a high-margin, high-growth, clean copper producer with operations in Brazil and corporate headquarters in Vancouver, B.C. The Company's primary asset is a 99.6% interest in the Brazilian copper mining company, MCSA, 100% owner of the Company's Caraíba Operations (formerly known as the MCSA Mining Complex), which are located in the Curaçá Valley, Bahia State, Brazil and include the Pilar and Vermelhos underground mines and the Surubim open pit mine, and the Tucumã Project (formerly known as Boa Esperança), an IOCG-type copper project located in Pará, Brazil. The Company also owns 97.6% of NX Gold S.A. which owns the Xavantina Operations (formerly known as the NX Gold Mine), namely comprised of an operating gold and silver mine located in Mato Grosso, Brazil. Additional information on the Company and its operations, including technical reports on the Caraíba Operations, Xavantina Operations and Tucumã Project, can be found on the Company's website (www.erocopper.com), on SEDAR (www.sedar.com), and on EDGAR (www.sec.gov). The Company’s shares are publicly traded on the Toronto Stock Exchange and the New York Stock Exchange under the symbol “ERO”.

ERO COPPER CORP.

/s/ David Strang

David Strang, CEO

For further information contact:

Courtney Lynn, VP, Corporate Development & Investor Relations

(604) 335-7504

info@erocopper.com

CAUTION REGARDING FORWARD LOOKING INFORMATION AND STATEMENTS

This press release contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation (collectively, “forward-looking statements”). Forward-looking statements include statements that use forward-looking terminology such as “may”, “could”, “would”, “will”, “should”, “intend”, “target”, “plan”, “expect”, “budget”, “estimate”, “forecast”, “schedule”, “anticipate”, “believe”, “continue”, “potential”, “view” or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Forward-looking statements may include, but are not limited to, statements with respect to the Company's expected production at the Caraíba Operations; the realization of the 2022 Reserve LOM Plan or the 2022 Strategic LOM Plan; the estimation of mine life, mineral reserves and mineral resources; the significance of any particular exploration program or result and the Company’s expectations for current and future exploration plans including, but not limited to, planned areas of additional exploration and the potential to convert any portion of the inferred mineral resource base to economically viable mineral reserves; estimated completion dates for certain milestones; estimated commencement date for mining of certain mineralized zones; and any other statement that may predict, forecast, indicate or imply future plans, intentions, levels of activity, results, performance or achievements.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual results, actions, events, conditions, performance or achievements to materially differ from those expressed or implied by the forward-looking statements, including, without limitation, risks discussed in this press release and in the Company's Annual Information Form for the year ended December 31, 2021 and dated March 11, 2022 (the "AIF") under the heading “Risk Factors”. The risks discussed in this press release and in the AIF are not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results, actions, events, conditions, performance or achievements to differ materially from those contained in forward-looking statements, there may be other factors that cause results, actions, events, conditions, performance or achievements to differ from those anticipated, estimated or intended.

Forward-looking statements are not a guarantee of future performance. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involves statements about the future and are inherently uncertain, and the Company’s actual results, achievements or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to herein and in the AIF under the heading “Risk Factors”.

The Company’s forward-looking statements are based on the assumptions, beliefs, expectations and opinions of management on the date the statements are made, many of which may be difficult to predict and beyond the Company’s control. In connection with the forward-looking statements contained in this press release and in the AIF, the Company has made certain assumptions about, among other things: continued effectiveness of the measures taken by the Company to mitigate the possible impact of COVID-19 on its workforce and operations; favourable equity and debt capital markets; the ability to raise any necessary additional capital on reasonable terms to advance the production, development and exploration of the Company’s properties and assets; future prices of copper, gold and other metal prices; the timing and results of exploration and drilling programs; the accuracy of any mineral reserve and mineral resource estimates; the geology of the Caraíba Operations, the Xavantina Operations and the Tucumã Project being as described in the respective technical report for each property; production costs; the accuracy of budgeted exploration, development and construction costs and expenditures; the price of other commodities such as fuel; future currency exchange rates and interest rates; operating conditions being favourable such that the Company is able to operate in a safe, efficient and effective manner; work force continuing to remain healthy in the face of prevailing epidemics, pandemics or other health risks (including COVID-19), political and regulatory stability; the receipt of governmental, regulatory and third party approvals, licenses and permits on favourable terms; obtaining required renewals for existing approvals, licenses and permits on favourable terms; requirements under applicable laws; sustained labour stability; stability in financial and capital goods markets; availability of equipment; positive relations with local groups and the Company’s ability to meet its obligations under its agreements with such groups; and satisfying the terms and conditions of the Company’s current loan arrangements. Although the Company believes that the assumptions inherent in forward-looking statements are reasonable as of the date of this press release, these assumptions are subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking statements. The Company cautions that the foregoing list of assumptions is not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking statements contained in this press release.

Forward-looking statements contained herein are made as of the date of this press release and the Company disclaims any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or results or otherwise, except as and to the extent required by applicable securities laws.

CAUTIONARY NOTES REGARDING MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

In accordance with applicable Canadian securities regulatory requirements, all mineral reserve and mineral resource estimates of the Company disclosed or incorporated by reference in this press release have been prepared in accordance with NI 43-101 and are classified in accordance with CIM Standards. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 differs significantly from the disclosure requirements of the Securities and Exchange Commission (the “SEC”) generally applicable to U.S. companies. For example, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in NI 43-101. These definitions differ from the definitions in the disclosure requirements promulgated by the SEC. Accordingly, information contained in this press release may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

Mineral resources which are not mineral reserves do not have demonstrated economic viability. Pursuant to the CIM Standards, mineral resources have a higher degree of uncertainty than mineral reserves as to their existence as well as their economic and legal feasibility. Inferred mineral resources, when compared with measured or indicated mineral resources, have the least certainty as to their existence, and it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration. Pursuant to NI 43-101, inferred mineral resources may not form the basis of any economic analysis. Accordingly, readers are cautioned not to assume that all or any part of a mineral resource exists, will ever be converted into a mineral reserve, or is or will ever be economically or legally mineable or recovered.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.