Torino - LatAm Flash Report - Venezuela: Foreign exchange market: has the fragile stability been broken?

NEW YORK, NEW YORK, UNITED STATES, September 7, 2022 /EINPresswire.com/ -- Torino Economics, the economic research unit of Torino Capital, has published this week its latest report on the possible causes that contributed to this recent exchange rate depreciation in Venezuela, which has once again generated anxiety among the population, affecting expectations about the sustainability of the strategy implemented by the Central Bank to sustain the country's exchange rate and price stability.

Venezuela LatAm Flash Report highlights:

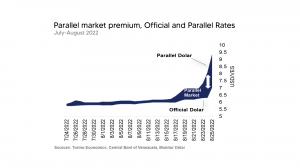

As part of its anti-inflationary strategy, the Central Bank implemented an exchange rate anchor strategy through which the monetary authority maintained the exchange rate parity with an aggressive decrease in real spending in local currency, the restriction of credit in local currency, and a sustained supply of foreign currency in the exchange market, which ranged between USD 100 and 200 million every week.

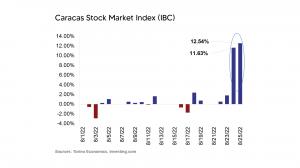

During August, the exchange rate volatility in Venezuela increased to levels not seen since January 2021 due to several seasonal payments in local currency by the government and the acceleration of inflation since June 2022, which has put pressure on the exchange rate. Thus, the bolivar has accumulated a significant appreciation.

Link access to the Report

At Torino Economics, we believe that the exchange rate anchor policy implemented by the Central Bank looks unsustainable if there it does not implement a comprehensive macroeconomic policy that seeks to balance the fundamental aspects of the economy and encourage economic growth based on productivity by stimulating key sectors such as exports.

Torino Economics is the Economic Research Unit of Torino Capital, a certified minority-owned firm. Our work consists of rigorous and in-depth monitoring of the evolution of the macroeconomic environment of several countries in Latin America and the Caribbean.

At Torino Economics, we encourage diversity of ideas and an approach that fosters innovative thinking, broadening current perspectives, and constantly seeking to find new research areas.

We are also a training platform for professionals in their early careers in an environment that promotes gender equality and the inclusion of minorities, providing the necessary tools to our team members to strengthen their professional and personal skills.

At Torino Economics, we provide our clients and end-consumers with periodic monitoring reports on Latin American economies and daily bulletins on the main economic and financial news taking place in the region.

Learn more about the periodic reports provided by Torino Economics here: http://reports-subscription.torinocap.com/

Venezuela LatAm Flash Report highlights:

As part of its anti-inflationary strategy, the Central Bank implemented an exchange rate anchor strategy through which the monetary authority maintained the exchange rate parity with an aggressive decrease in real spending in local currency, the restriction of credit in local currency, and a sustained supply of foreign currency in the exchange market, which ranged between USD 100 and 200 million every week.

During August, the exchange rate volatility in Venezuela increased to levels not seen since January 2021 due to several seasonal payments in local currency by the government and the acceleration of inflation since June 2022, which has put pressure on the exchange rate. Thus, the bolivar has accumulated a significant appreciation.

Link access to the Report

At Torino Economics, we believe that the exchange rate anchor policy implemented by the Central Bank looks unsustainable if there it does not implement a comprehensive macroeconomic policy that seeks to balance the fundamental aspects of the economy and encourage economic growth based on productivity by stimulating key sectors such as exports.

Torino Economics is the Economic Research Unit of Torino Capital, a certified minority-owned firm. Our work consists of rigorous and in-depth monitoring of the evolution of the macroeconomic environment of several countries in Latin America and the Caribbean.

At Torino Economics, we encourage diversity of ideas and an approach that fosters innovative thinking, broadening current perspectives, and constantly seeking to find new research areas.

We are also a training platform for professionals in their early careers in an environment that promotes gender equality and the inclusion of minorities, providing the necessary tools to our team members to strengthen their professional and personal skills.

At Torino Economics, we provide our clients and end-consumers with periodic monitoring reports on Latin American economies and daily bulletins on the main economic and financial news taking place in the region.

Learn more about the periodic reports provided by Torino Economics here: http://reports-subscription.torinocap.com/

Fabiano Borsato

Torino Capital LLC

+1 212-661-2400

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.