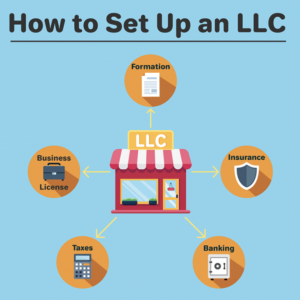

The 5 Minute LLC in American Samoa

Start your own business in American Samoa, you may want to consider filing as an LLC online

Making an LLC online in American Samoa is a relatively straightforward process that requires just a few simple steps at HTTPS://LLC.AS.GOV. I have set up my LLC in American Samoa but live in Florida”

ORLANDO, FLORIDA, UNITED STATES, August 1, 2022 /EINPresswire.com/ -- Start a business in American Samoa, consider filing as an LLC online. LLCs offer a number of benefits, including reduced taxes and increased business flexibility. LLCs are a popular choice for businesses in American Samoa because they offer a number of benefits, including reduced taxes and increased business flexibility. For example, an LLC can operate as a separate legal entity from its members, which can help protect the business from personal liability. By filing an LLC online, take advantage of these benefits without leaving home or facing long paperwork delays.— Lem Guerro

Anonymous LLC In America Samoa:

LLCs are popular in the United States because they offer a number of benefits, such as tax efficiency and flexibility. However, there are some important considerations to take into account when forming an LLC in America Samoa. First and foremost, LLCs in America Samoa is considered to be confidential entities, meaning that the details of their operations – including the ownership structure and financial information – are strictly confidential.

No State Taxes In America Samoa:

There are No state taxes in America Samoa. This is because America Samoa is not a state; it is an unincorporated territory of the United States. As such, it does not have its own government and is subject to the laws of the United States. This means that all income earned in America Samoa is exempt from taxation by the US government.

Personal Asset Protection:

There is no one-size-fits-all answer to this question, as the best way to protect personal assets may vary depending on circumstances. However, some common measures individuals can take to protect personal assets include forming an LLC online in American Samoa. This type of entity offers a number of advantages, including the ability to shield assets from creditors and potential lawsuits. Also, LLCs are tax-advantaged entities, meaning that profits earned from their operations are taxed at a lower rate than those earned by a regular corporation. By taking these steps, one can ensure that personal assets are protected and preserved for future use.

One Stop Application Process:

When starting a business in American Samoa, individuals will need to file an LLC with the appropriate government office. Then follow no specific process, as each jurisdiction has different requirements. However, the One Stop Application Process can help streamline the process. This website provides detailed instructions on creating and registering an LLC in each US state and numerous foreign jurisdictions. Once an LLC is registered, submit various documents, such as articles of incorporation and a formation agreement. However, this website provides comprehensive information on all of the required filing requirements for starting a business in American Samoa.

No US Citizenship Required:

American Samoa is a great option if those that are looking to form an LLC in the United States without having to obtain US citizenship. This territory is part of the US but not a state, so LLC formation and business operation are simplified. American Samoa has no income or franchise taxes, and the corporate registry is straightforward and efficient. In addition, the territory has close links with Hawaii and provides easy access to major US markets.

No Third-Party Required:

Form an LLC in American Samoa for many reasons. For example, if a business owner wants to protect personal assets from any potential legal issues that could arise, an LLC can provide the necessary protection. Additionally, because there is no requirement for a third party to be involved in the formation of an LLC in American Samoa, this type of business structure is perfect for start-ups. Finally, because American Samoa has a small population and limited resources, setting up an LLC can help on legal fees.

How To Apply For LLC:

To apply for an LLC in American Samoa, first fill out an application with the secretary of state's office. The application process is relatively straightforward, and once filed, the LLC will be registered with the state. Once registered, Business dealings will need to be conducted through the LLC instead of as an individual. Get professional services to apply for LLC as well as protect business from various legal issues.

Final Thoughts:

Making an LLC online in American Samoa can be a great way to start a business. There are a few things to keep in mind when setting up an LLC, though, so make sure to do research before proceeding. In short, making an LLC online in American Samoa is a relatively straightforward process that requires just a few simple steps at HTTPS://LLC.AS.GOV

Staff

Florida LLC

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.