ALT 5 SIGMA – DIGITAL ASSETS WEEKLY

Higher US yields and Fed policy expectations limit crypto upside

NEW YORK, NEW YORK, US, April 22, 2022 /EINPresswire.com/ -- ALT 5 Sigma Inc. a global fintech that provides next generation blockchain powered technologies for tokenization, trading, clearing, settlement, payment, and insured custodianship of digital instruments releases its digital assets morning call.• Crypto prices pull back again after Fed officials suggest even more aggressive tightening

• Bitcoin’s trading in the last Fed tightening cycle offers some clues to the present

• China developments may be out of the headlines but still has implications for crypto prices

Major crypto assets continue their recent consolidation and while there were signs that prices could begin to rise more substantially, that opportunity diminished by week’s end as renewed gains in US and global yields pressured crypto currencies and risk assets more broadly.

Yields and crypto prices

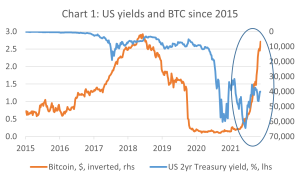

Market expectations on monetary policy from the Federal Reserve and the world’s other major central banks remains a primary focus and driver for financial markets, including crypto assets. It is no accident that the November peak in bitcoin’s price (and other crypto currencies) coincided with the “about face” in Fed guidance, when the central bank began to signal that the period of easy monetary policy was coming to an end (see Chart 1).

Since then, shorter term US yields have surged, with the 2-year Treasury note rising from near 0,25% to 2.78% this week, a dramatic move in speed and scale by almost any historical comparison, as it continues to price in the anticipated move higher in the Fed’s policy interest rate in the coming two years.

History doesn’t always repeat, but it sometimes rhymes

The relationship between interest rates and crypto prices is not straight froward or consistent and a comparison is complicated by the relatively short price history of crypto assets. That said, it is worth looking at the last Fed tightening cycle and in particular the notable rise in 2yr yields during the 2017-18 period. Over that time, 2-year yields rose from about 1.15% to 2.90%, a move that eventually coincided with bitcoin’s selloff from what had been its all-time peak of $19,500 reached in December 2017 (see Chart 2). Although there were other factors also impacting bitcoin’s price during that period, Fed tightening also played a role.

A lot of Fed tightening is now priced in, which could offer crypto prices some relief

In current circumstances, it is arguable that much of the rise in market yields—i.e., much of the anticipated Fed tightening—is already priced into the market. If so, that may leave allow some relief and further near-term consolidation in crypto prices.

But with some Fed officials this past week suggesting they could raise rates by up to 75bp at their next meeting May 3-4 (even more aggressive than the 50bp rate hike expected), we would not be complacent about the risk of further yield gains and some accompanying pressure on crypto prices. Moreover, the interest rate backdrop could be further complicated by the Fed’s balance sheet reduction, the pace of which is also likely to be detailed at the May FOMC meeting.

China stresses present headwinds to crypto while they persist

Despite optimism earlier this week that the current covid wave in China could be receding, concerns about the economic impact of covid-related lockdowns persists. And lacking more substantial policy measures by the government/central bank, financial markets have come under renewed pressure, with China’s benchmark Shanghai SE Composite Index down nearly 4% on the week.

Importantly, China’s central bank governor Yi Gang this week downplayed the prospects for further easing of monetary policy in comments this week. We have highlighted the potential boost to the economic outlook—and to shorter term financial market sentiment—that could come from a policy easing in China. As such, reduced easing expectations also weighed on financial asset prices.

The performance and developments in the world’s second largest economy have material implications for global growth and, by extension, for financial markets including crypto assets. Hence, crypto investors should continue to monitor upcoming data/events, including scheduled data (the purchasing managers index is due next week), developments with the current covid wave and lockdowns, and potential unscheduled policy initiatives.

Robert Lynch

Head of Research and Strategy

ALT 5 Sigma Inc.

bob@alt5sigma.com

Source for all charts: Federal Reserve Bank of St. Louis, FRED database

ABOUT ALT 5 Sigma

ALT 5 Sigma is a global fintech that provides next generation blockchain powered technologies for the trading, clearing, settlement, payment, and insured custodianship of digital instruments. ALT 5 was founded by financial industry specialists out of the necessity to provide the digital asset economy with security, accessibility, transparency, and compliance. ALT 5 provides its clients the ability to buy, sell and hold digital assets in a safe and secure environment deployed with the best practices of the financial industry. ALT 5 Sigma's products and services are available to Banks, Broker Dealers, Funds, Family Offices, Professional Traders, Retail Traders, Digital Asset Exchanges, Digital Asset Brokers, Blockchain Developers, and Financial Information Providers. ALT 5's digital asset custodian services are secured by Fireblocks.

DISCLAIMER:

Digital Assets Weekly is for informational purposes only and does not constitute, either explicitly or implicitly, any provision of services or products by ALT 5 Sigma ("ALT 5"). Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. ALT 5 Sigma. makes no representation or warranty to any investor regarding the legality of any investment, the income or tax consequences, or the suitability of an investment for such investor. ALT 5 Sigma does not solicit or provide any financial advice. This is at the sole discretion of the individual.

ALT 5 Sigma Canada Inc

ALT 5

+1 888-778-7091

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.