PolicyX.com Releases Insurance Price Index for Q1, 2022

PolicyX.com’s Term Price index continues its upward march witnessing an increase in the prices by 5.9% in Q1, 2022 whereas the health index increased by 2%

GURGAON, HARYANA, INDIA, April 4, 2022 /EINPresswire.com/ -- PolicyX.com, a leading web insurance aggregator, announces the data of Insurance Price Index- Term Insurance & Health Insurance for Quarter 1, 2022 highlighting the changes that occurred in the insurance prices.In Quarter 1, 2022, the Term Insurance Price Index Value has gone up by 5.9%, reaching the new figure of INR 25,340. PolicyX.com’s Insurance Price Index has increased from 21,802 in Q1, 2021 to 25, 340 in Q1, 2022 marking an increase of 16.2% in the last 1 year.

Amongst the 5 life insurance companies forming the part of the index, 2 have revised their premiums upwards by 21% and 11% respectively. The remaining 3 companies have kept their premiums constant in the last quarter.

Evidently, all 5 companies have increased their premiums in the last 12 months from Q1, 2021 to Q1, 2022. However, surprisingly, the rate of increase has varied significantly across companies. While 1 company has increased the prices by a whopping 52.7%, others have been fairly considerate and have increased their prices by 12.4%, 13.4%, 4.9%, and 3.7%.

When analyzed on the basis of age, delaying the purchase of a term policy by 10 years can cost approximately 48.6% more for a 25-year-old, 77.9% more for a 35-year-old, and 81.1% higher for a 45-year-old.

In terms of habits, a smoker pays 50.53% higher premium when covered for 1cr as compared to a non smoking person.

The above-mentioned premium prices are averaged from 5 leading insurance companies for various age groups i.e. 25 years, 35 years, 45 years and 55 years for both smokers & non-smokers, males and females category and for a sum assured of INR 50 lakh and INR 1 crore.

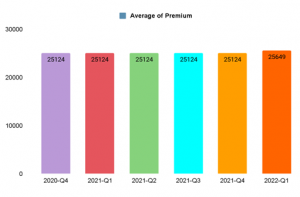

The Health Insurance Price Index in Q1, 2022 has increased by 2% as opposed to the trend of the previous 5 quarters wherein the value had remained constant from Q4,2020 to Q4,2021. The value of the Health Insurance Price Index has been constant at INR 25,124 for the last 5 quarters. It is in Quarter 1, 2022 it has displayed a tenuous spike in the premium prices of health insurance.

In the first quarter of 2022, an average 26-year-old paid the premium of INR 8,563 when covered for 5 lakhs and paid a premium of INR 10,581 when covered for 10 lakhs for 1 adult category, on a yearly basis.

The health insurance premium does not increase proportionately with the sum insured amount. Quarter 1, 2022 showcases that a 36-years-old male paid INR 9,833 for the sum insured of INR 5 lakh and the same person paid INR 12,377 for the sum insured of INR 10 lakh on average. In this case, the premium increased only 26% in spite of a 100% increase in the sum insured.

Since it has been established by the recent times that it is quintessential to secure the entire family irrespective of the age of each family member, buying a family floater plan stands out as a cost-effective option. A family floater plan provides the leverage of adding another member of the family without an extensive increase in the premium price. According to the Quarter 1, 2022 report, a premium paid for 2 Adults of 36-years old was INR 14,394 and the premium paid for 2 Adults and 1 Child of the same age category was INR 17,146 against the sum insured of 5 lakhs.

Of the 5 companies, forming the index, the variance observed in premiums among the health companies is very high as compared to the variance observed in term insurance companies. This is primarily because of the fact that coverage, features, and benefits differ significantly for health insurance whereas term insurance is usually simple with similar benefits in case of death. For example for a 26-year old, the minimum premium plan available in the market costs 7,119 per annum and the average for the same age group was 15314 while the maximum premium was 24,686.

The premium prices for Health Insurance are average prices taken from the leading 5 health insurance companies for all age groups i.e, 26 years, 36 years, 46 years, and 56 years & all coverage types i.e, 1 adult, 2 adults, 2 adults + 1 child, and 2 adults + 2 children.

Commenting on the latest report, Mr. Naval Goel, Founder & CEO, PolicyX.com stated, “Finally we see an increase in health premium for the first time since this index was launched 5 quarters back. Term insurance price continues its uptrend rising by 16% in last 1 year. I think the price increase has been reasonable given the fact that insurance companies have been under immense pressure due to covid and upward revision of prices by re-inurers. My suggestion to the customers will be to buy insurance sooner than later without trying to predict the price movement ”

About Insurance Price Index

This is the sixth ‘Insurance Price Index’ report launched by the leading insurance web aggregator company, PolicyX.com. The index tracks prices of Term insurance and Health insurance from the leading Indian Insurance Companies, offering analysis and trends through data analytics.

PolicyX.com is the foremost company to introduce the ‘Insurance Price Index’ that allows users to have a transparent & enhanced view of insurance prices by observing the shifts & trends in the premium price.

About PolicyX.com

PolicyX.com is an IRDA approved and one of the leading insurance comparison portals helping consumers compare, choose, and buy policies online. The company was founded in 2013 to provide consumers with expert guidance in selecting health, term and investment insurance plans from some of the top insurance providers in the country. It runs complex algorithms to find plans that fit customer requirements, complete with live quotes, dynamic cash flow charts, videos, and infographics within seconds, thereby helping them make an informed choice.

Naval Goel

PolicyX.com Insurance Web Aggregator

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.