AutoPacific Forecasts Around 700,000 U.S. EV Sales Amidst Increasing Consumer Demand

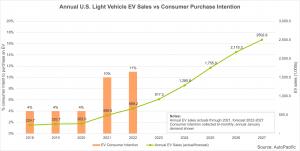

AutoPacific forecasts U.S. EV sales of nearly 700,000 units with strong growth throughout the 6-year forecast period as consumer demand rises.

The market is seeing exponential growth in the number of EV nameplates available to consumers, making EVs more visible to vehicle shoppers and in turn increasing their consideration for them.”

LONG BEACH, CA, UNITED STATES, February 24, 2022 /EINPresswire.com/ -- Noted automotive consulting firm AutoPacific just issued its forecast of fully electric light vehicle sales in the U.S. of around 700,000 units in 2022 with strong annual increases throughout the 6-year forecast period. The forecast comes as consumer demand for EVs is also at its highest yet, having spiked significantly in the past two years. AutoPacific recently asked vehicle owners what powertrain they intend to purchase when replacing their current vehicle. The question is part of a series of questions asked in AutoPacific’s Fuel Price Impact Study (FPIS), a bi-monthly study of over 500 vehicle owners in the U.S. While hybrid (HEV), plug-in hybrid (PHEV) and electric (EV) vehicles have all been trending upward, it is EV intention that has increased the most in recent years. “The market is seeing exponential growth in the number of EV nameplates available to consumers, making EVs more visible to vehicle shoppers and in turn increasing their consideration for them,” says AutoPacific president and chief analyst Ed Kim. “Growth in EV demand is a combination of several factors including increased awareness of EVs, increased variety of vehicle brands and nameplates, types and price ranges available, improved charging infrastructure, increased range, and environmental-friendliness,” continues Kim.— Ed Kim, AutoPacific president and chief analyst

New Product Plays a Greater Role in Growing EV Demand Than Fuel Prices

From 2010 through 2014, when the average fuel price paid was highest since AutoPacific began tracking it, consumer demand for EV powertrains was stuck between 2% to 4% - more a function of a lack of product availability and consumer awareness than high fuel prices. As Tesla started introducing additional models in the mid-2010s, consumer demand increased slightly, yet remained stagnant throughout the decade. It wasn’t until 2020 that consumers began to show significantly greater intent for purchasing an EV, perfectly aligned with the growth in nameplate count starting with Tesla’s Model Y (now the top selling EV) and quickly followed by new entries like the Ford Mustang Mach-E and the Volkswagen ID.4.

In fact, steadily rising fuel prices since early last year seem to have impacted demand less than the influx of new product, as evidenced by periodic drops in demand despite rising fuel prices. Over the same time period, demand for hybrids remains higher than that of EVs, as they enable much better fuel economy than gasoline-only powertrains while allowing owners to fill up at the gas pump as they always have.

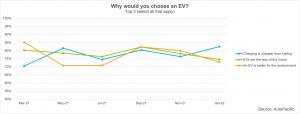

“Still, we can’t deny that fuel prices play a role in EV demand,” explains Kim. “In fact, 83% of EV intenders say they would choose an EV because “charging is cheaper than fueling.”

75% of Consumers See EVs as the “Way of the Future”, But the Road to the Future Will be a Challenging One

Since March of 2021, when AutoPacific began asking EV intenders why they would choose an EV, the top three reasons have consistently been “charging is cheaper than fueling,” “an EV is better for the environment,” and “EVs are the way of the future.” Consumers also like the convenience of charging and the quietness of an EV. “EVs are establishing their place in the market by providing consumers with more than just efficiency compared to traditional internal combustion vehicles,” says Kim.

While EV demand is growing, there remains much work to be done as about 89% of AutoPacific’s respondents still indicate they intend to buy something other than an EV for their next vehicle. Conquesting consumers out of gasoline, diesel, and hybrid vehicles – none of which require changes in daily routine to accommodate charging – will continue to be an uphill challenge for years to come.

About AutoPacific

AutoPacific is a future-oriented automotive marketing research and product-consulting firm providing clients with industry intelligence and sales forecasting. The firm, founded in 1986, also conducts extensive proprietary research and consulting for auto manufacturers, distributors, marketers, and suppliers worldwide. The company is headquartered in Long Beach, California with affiliate offices in Michigan, Wisconsin, and North Carolina. Additional information can be found at http://www.autopacific.com.

Ed Kim

AutoPacific, Inc.

+1 714-838-4234

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.