Buying a property in the US on a work visa (H1B) By Your home sold guaranteed realty

One of the most crucial factors to consider while making a purchase decision of a house is the availability of financing. The US government has enabled H1B Visa holders (and some other visa classes) to obtain a mortgage and other forms of financing for buying properties. Apart from Mortgages, H1B visa holders can also obtain Federal Housing Administration (FHA) Loans. These funding options are available on the same terms and conditions as US citizens. This is a tremendous advantage and facility for the H1B visa holders provided by the US government to secure financing for owning their own house or investing in a property.

It is important to note that obtaining these forms of financing may be slightly difficult for non-US citizens. According to ANMTG (a mortgage platform), it is important to build a credit history before applying for a mortgage. The applicant will need to obtain a Social Security Number to initiate their credit history, and two years of credit history is recommended before applying for the mortgage. This is necessary for the lenders to gauge the payment capacity and credit security of the borrowers. That being said, it is worthwhile on account of the reasons that are discussed below.

Us real estate market is profitable and booming

The US real estate market is booming and is expected to grow in the future. According to The New York Times, the prices last year increased by a double-digit of 12.7% last year. The graph summarizes the spiraling prices across the nation. The trend is expected to grow given the low mortgage and interest rates and the recently passed infrastructure bill.

Perhaps, the most important factor to consider is the recently passed bill in the US for a 3.5 trillion US Dollar Infrastructure. According to Reuters, this bill is expected to provide a great stimulus for the real estate sector especially pertaining to the smaller cities. The bill marks the initiation of the biggest infrastructure spending package in decades. Therefore, this is the ideal time for investing in a property.

Buying vs. Renting a home

According to USA Today, buying a house is cheaper than renting a house in many cities across the United States. The mortgage payments of a house may save up to USD 500 per month compared to renting in different cities across the United States. The popular cities with such a scenario include San Jose, Atlanta, Dallas, and Virginia. However, it is important to note that in large metropolitans like Brooklyn and Boston, the houses are very expensive. Therefore, it will be much more expensive to buy than to opt for rent.

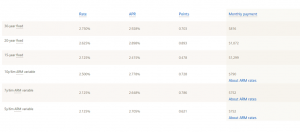

The United States is currently offering historically low mortgage rates, which means that it is the perfect time to secure financing for a house, especially for an H1B Via holder. According to the Bank of America, the mortgage rate offered for 30 years is 2.75%, and 20 and 15 years it is 2.625% and 2.125%, respectively. Moreover, the interest rate in the US is also very low, which makes it easier to obtain financing at a very low rate. Hence, the mortgage payments will impose lower stress on a person's finances.

Moreover, mortgage payments are more stable and certain than rental payments. The rental agreements are usually set to be revised yearly. A landlord may increase the rent to higher levels due to variations in the market. This may put pressure on a person's finances. Furthermore, a landlord may call for eviction for certain reasons, and the tenant will have to spend energy and time looking for a new place, thereby reducing productivity. On the other hand, the mortgage payments are usually the same for the period of the loan. The lender usually shares a schedule of payments in advance.

Owning an asset

Owning a house which means converting equity into an asset. That asset is expected to bring economic benefits in terms of capital gain and riddance from rental payments. As mentioned earlier, the United States market is booming and expected to grow on account of the infrastructure bill; investing in a real estate asset will provide capital gain in the future. Hence investing in a house today is highly recommended for an H1B visa holder.

In a rented property, the tenant is subject to following some rules and regulations of the landlord. Certain changes cannot be made to the house without the approval of the landlord. The landlord may also apply some restrictions like owning pets. Hence, owning a house gives autonomy to the homeowner in making major changes to the house and adopting a certain lifestyle.

Moreover, owning a home will also be beneficial for old age and retirement benefits. Owning a house after retirement can reduce the burden on pensions and increase spending power in old age.

Tax benefits

The mortgage payments carry a lot of tax benefits as compared to rental payments. The interest charged on the mortgage payments is deductible from the taxable income. Moreover, deduct the local taxes and other charges from the income when calculating tax liability. This gives quite a big advantage to H1B visa holders by increasing their spending power. It is especially beneficial for visa holders looking to send money back home.

Conclusion

Although, the optimal decision to buy a house depends upon the nature and circumstances of every person. However, generally speaking, it is highly recommended to purchase a property, especially on an H1B visa. Given the correct cost-benefit analysis for most of the H1B visa holders, owning a house will give more autonomy, tax benefits, and greater economic gain in the future.

Gupta Group

Your Home Sold Guaranteed Realty

+1 408-763-8131

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.