Wasseem Dirani Explores What Can Canadian Businesses Do in the Time of Covid?

Wasseem Dirani, a business financing expert from Hamilton, Ontario, shares several ways Canadian small businesses can find funding set themselves up after Covid

HAMILTON, ONTARIO, CANADA, November 5, 2021 /EINPresswire.com/ -- Wasseem Dirani Explores What Can Canadian Businesses Do in the Time of Covid?

Now that the Delta variant is starting to lose its grip on the world, Canadian businesses are starting to ask, what can be done to best move forward. Wasseem Dirani, a business financing expert from Hamilton, Ontario, shares several ways Canadian small businesses can find funding and set themselves up for a prosperous future

Like it or not, our history is now split between pre-and post-Covid times, with definite differences between the two. In Covid's aftermath, the return strategies that Canadian companies adopt will not only see them through the end of the pandemic but also set them up for success in a world that prioritizes health and safety measures.

The New Normal

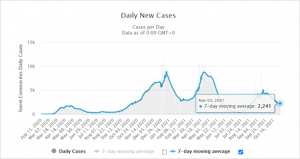

Through the summer and fall of 2021, there were intermittent reopenings with a sustained focus on the economy.

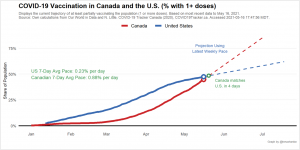

The continued vaccine rollout has seen success against the rate of infections and deaths. Canada does not suffer from the same bipartisan push against science that our neighbors to the south have dealt with, allowing us to surpass their rollout percentages this past May.

Though effective, vaccines can not eradicate the virus outright; and while 82% of Canadians are willing to get the jab, 12% remain averse while 7% are unsure. With a lingering uncertainty around child vaccinations, combined with the emergence of the more transmissible Delta plus variant, businesses can be sure of new or continued public health containment measures for the time being.

The opening of borders with the U.S. does not help this situation and has the potential to bring with it a new wave of infections from abroad which must be monitored closely.

First, Business Flexibility is Key

Because the chance of a variant can lead to new shutdowns, a transition to sustained but still intermittent reopenings of the economy can be expected. Facing this transition, businesses need flexible return-to-work strategies to accommodate employees with options matching their comfort levels, returning to the office, continued remote work, or a hybrid approach.

Subsidies are Coming to an End

The government put into place several plans to aid businesses hurt by the pandemic; however, these are coming to an end. Already, pandemic-driven emergency wage and rent subsidies fell to 60% of eligible expenses in July and further declined to 20% in September. The business loan program ceased accepting new applications at the end of June and is not expected to reopen the program for additional applicants.

This elimination of programs is unfortunate for those businesses most affected. Surveys conducted by the Coalition of Hardest Hit Business (CHHB) indicated that nearly 60% of the most affected companies will not survive if the subsidies are not extended through 2021. These are mainly businesses in the restaurant travel and tourism sectors. The question still remains, was it the right move to invest in companies to save them but let them fail in the third period?

How has the Economy Been Affected?

The economy reopening has seen numbers that are mostly positive on the macro level. Ending the summer, the economy expanded by 0.4% in August, but missed estimates. There are some interesting findings, and an economic slowing in the fall has resulted.

Jobs

By October 2021, Canadian employment levels have recovered to the levels last seen in February 2020 (pre-pandemic). However, job growth was primarily seen in part-time positions typically filled by women. 100,000 fewer men held full-time positions relative to their pre-pandemic levels, and overall, 400,000 fewer jobs were held relative to the pre-pandemic trend line.

Global supply chain shortage

The rebound in global demand for goods as restrictions are lifted exposed supply chain shortages, with companies scrambling for workers, ships, and even fuel to power their factories. These issues have threatened the fledgling bounce back, and Canada has also seen repercussions, with more recent economic data showing a negative outlook.

In mid-October, Finance Minister Chrystia Freeland stated the government had concerns about the challenges facing many global supply chains and she is "watching the country's ports very closely."

Inflation

Canadian inflation fears are mixed. While there has been inflation seen in 2021, continued fears are not yet warranted with the mixed predictions of even the largest firms. Some say the government's measures over the past 18 months are sufficient, while others see a continued negative trend to follow.

Sectors most likely to prosper post-Coivd

CPA Canada has identified eight sectors that are in a solid position to prosper in post-Covid times. They are the following:

1) Online education

2) Healthcare

3) Public service

4) E-commerce

5) Delivery and transportation

6) Cyber security

7) Remote work and digital platforms

8) Drone technology

With the exceptions of healthcare and public service, all of these sectors are the direct beneficiaries of our new normal. We are self separating and have come to rely on the web for an online life of touchless work, play, and purchasing. Even the two exceptions will likely require the six other services to build back post-pandemic.

Summary

While Canada does not have any immediate red economic flags, there remains a yellow warning for businesses. A close eye should be kept on three things.

1. Virus numbers

2. Supply chain issues

3. Inflation

All three things can turn red quickly; the second two are interrelated and can both result from changes to the first. Companies that have seen problems during the pandemic will likely not receive any further assistance, and several sectors will probably be the beneficiaries of our new normal. Like it or not, Covid has brought us a new historical phase; how we deal with it is up to us.

Wasseem Dirani

Taxes to Save

+1 905-979-7109

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.