UPDATE - Nouveau Monde Announces Phase 2 of What Is Planned to Become North America’s Largest Fully Integrated Anode Material Production Facility – Supported by Strong Economics and Carbon Neutrality

- Nouveau Monde’s mission and strategy is to become the Western World’s largest producer of high-quality anode materials to be used mainly in batteries for electrical vehicles and renewable energy storage

- Its large-scale lithium-ion active anode material facility in Bécancour, Québec (Canada) (“Bécancour VAP project”) is an integral part of its strategy

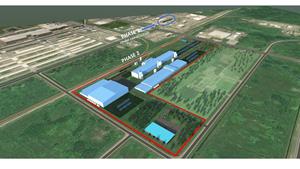

- Nouveau Monde has acquired a 200,000 m2 parcel in the industrial park of Bécancour, adjacent to its Phase 1 plant located within the facilities of Olin Corporation

- The Phase 1 plant of the Bécancour VAP project is currently under construction, with a planned nameplate capacity of 2 kilotonnes per annum (“ktpa”) of anode material and scheduled to make its first production within 12 months

- The Front-End Loading engineering analysis (“FEL-1”) for Phase 2 has now been completed and supports a strong business case to build a large-scale lithium-ion active anode material facility in Bécancour

- The Phase 2 of the Bécancour VAP project is designed to receive approximately 60 ktpa of flake graphite from Nouveau Monde’s own Matawinie mineral project, or from alternative third-party sources of supply deemed suitable, to be transformed into approximately 42 ktpa of anode material, 3 ktpa of purified flakes and 14 ktpa of micronised graphite representing a valuable process by-product

- At current market prices, and projected costs, the incremental annual operating profit potential of the Phase 2 of the Bécancour VAP project, when at full capacity, is forecasted to be up to US$200 million - depending on the retained raw material supply scenario, which will be in addition to the operating profit potential generated by the direct sales to third-party customers of flake graphite produced by the Matawinie mineral project

- Front-End Loading pre-feasibility engineering analysis (“FEL-2”) is underway with the goal to be completed within 12 months

- The current plan provides for the Phase 2 plant to commence commissioning of its first capacity in Q1 2025

- Nouveau Monde continues to progress qualification activities and commercial discussions with potential customers using material produced at its demonstration facility

- Nouveau Monde remains committed to “Best in Class Standards”, by reducing the supply chain carbon footprint and targeting carbon neutrality for its entire production value chain

MONTREAL, March 13, 2021 (GLOBE NEWSWIRE) -- Nouveau Monde Graphite Inc. (“Nouveau Monde” or the “Company”) (TSXV: NOU; OTCQX: NMGRF; Frankfurt: NM9) is pleased to announce the completion of a Front-End Loading engineering analysis (“FEL-1”) for Phase 2 of its large-scale commercial lithium-ion anode material project in Bécancour, Québec, Canada as it continues to execute its strategy of becoming the Western World’s largest producer of high-quality anode materials to be used mainly in batteries for electrical vehicles and renewable energy storage. As it expands, Nouveau Monde preserves its firm commitment to carbon neutrality.

Arne H Frandsen, Chairman of Nouveau Monde, commented: “Nouveau Monde is firmly on its way to become one of the world’s most important anode materials producers, delivering high quality anode materials from our sophisticated processing and beneficiation plants in Bécancour. Our successful upstream integration with our Matawinie mineral project is designed to ensure that we have access to the right quality feedstock for decades to come. Thanks to Nouveau Monde’s team of local and internationally acclaimed experts and professionals, we are continuing to move forward at speed!”

Eric Desaulniers, President and CEO of Nouveau Monde, added: “We founded Nouveau Monde in 2011 with the vision of developing the largest and best-in-class graphite-based anode material supplier in North America. For the past five years, we have specifically focused on developing the processing know-how and skills internally. We have hired highly qualified professionals from around the world, creating a multifaceted team of anode materials experts. This team has in turn engaged with multiple other local and international experts to establish our technologies to produce high-quality lithium-ion anode material on a large scale.

Today, we are proud to announce Phase 2 of our effort, with a projected low operating cost profile. This next phase will continue to comply with Nouveau Monde’s high ESG standards and will benefit from Québec’s green and inexpensive hydroelectricity as our exclusive energy source. Our significant forecasted incremental annual operating profit potential is a testimony that it is possible to embrace sustainable development and profitability to the benefit of all stakeholders.

It is essential for North America to develop a fully integrated supply chain of high-quality battery materials that are produced at meaningful scale, with the lowest carbon footprint, with strict traceability compliance while maintaining cost competitiveness at all times.”

Figure 1: 3D rendering of Nouveau Monde's Bécancour VAP project

https://www.globenewswire.com/NewsRoom/AttachmentNg/1dc39b48-7fc6-4501-b867-8875b397a849

Projected Capital and Operating Costs for Phase 2

The FEL-1 concludes that a production of 42,000 tpa of anode material and 3,000 tpa of purified flakes can be achieved with the construction of a brand-new state-of-the-art facility on Nouveau Monde’s industrial site of 200,000 m2 and supported by its existing Phase 1 plant infrastructure. The FEL-1 includes a review of all environmental regulations and permits, the project schedule, product specifications definition, stakeholders’ analysis, the capital expenditure budget and projected operating costs. Nouveau Monde’s site in Bécancour is strategically situated for large-scale anode material production, with proximity to potential customers, access to key utilities (e.g., water, hydropower, gas), adjacent to a chlor-alkali producer which provides access to key consumables, a skilled workforce and an adjacent deep-water international port on the St. Lawrence River.

| ANNUAL OPERATING METRICS | 45 ktpa FACILITY |

| ktpa | |

| Processed natural graphite | 60 |

| Anode material (CSPG) production | 42 |

| Purified jumbo flakes production | 3 |

| Micronised graphite by-product | 14 |

| Chloride by-product | 1 |

Table 1: Annual operating metrics

| CAPEX FINANCIAL METRICS | 45 ktpa FACILITY | |

| In M US$ | IN US$ / tonne | |

| Direct cost | 359 | 7,988 |

| Indirect cost | 103 | 2,280 |

| Contingency | 83 | 1,848 |

| Total CAPEX | 545 | 12,116 |

Table 2: Initial capital expenditure estimate (excluding Owner's cost, provision for escalation and taxes & duties)

| OPEX FINANCIAL METRICS | 45 ktpa FACILITY | ||||

| In M US$ | IN US$ / tonnes | ||||

| Anode | Revenue | 300 | 7,152 | ||

| Material | All-in cost excluding | 91 | 2,167 | ||

| (CSPG) | raw material | ||||

| 42 kt production | Raw material | 23(1) | 77(2) | 544(1) | 1,841(2) |

| Operating Margin | 186 | 132 | 4,440 | 3,144 | |

| Purified | Revenue | 18 | 6,000 | ||

| Jumbo | All-in cost excluding | 3 | 1,069 | ||

| Flakes | raw material | ||||

| 3 kt production | Raw material | 1(1) | 8(2) | 414(1) | 2,631(2) |

| Operating Margin | 14 | 7 | 4,517 | 2,300 | |

| Total Operating Margin – 45 ktpa facility | 200 | 139 | 4,445 | 3,088 | |

Table 3 :Projected operational expenditures

(1) Assumes a transfer pricing at Matawinie mineral project FS 43-101 operating cost plus transportation cost to Bécancour

(2) Assumes a transfer pricing at Matawinie mineral project FS 43-101 sales price plus transportation cost to Bécancour

The Capex and Opex prepared for this FEL-1 are based on a Class 4 type estimate as per the American Association of Cost Engineers (“AACE”) International Practice 18R-97 with a target accuracy between -30% to +40%. The Capex is estimated at US$545 million including the material, equipment, labour and freight required for the plant, as well as all infrastructure and services necessary to support the operation. The estimate excludes the owner’s cost, provision for escalation and all duties and taxes.

Bécancour VAP Project Financing Strategy

The Company’s strategy is to finance the Bécancour VAP project with a structure involving approximately two thirds comprised of non-dilutive financial instruments and the remaining one third of equity financing. The non-dilutive financial instruments that are contemplated by the Company are a combination of bank loans, structured debt, forward payments on production and royalty streams. The Company’s largest shareholder, The Pallinghurst Group, is fully supportive of the Bécancour VAP project. No assurance can be given that any such additional financing will be available or that, if available, it can be obtained on terms favourable to the Company. The failure to obtain additional financing on favourable terms, or at all, could have a material adverse effect on the ability of the Company to complete the construction of the Bécancour VAP project.

Project Timeline

Given the strong economics revealed in the FEL-1, Nouveau Monde has commenced a FEL-2 pre-feasibility study, based on the results from the demonstration modules, which is expected to be completed in the first half of 2022. The FEL-1 evaluated various strategies to optimise the deployment of the project, including advancing directly to an enhanced FEL-2 program that includes detailed engineering of certain portions of the project and a modular construction and commissioning sequence enabling an initial production capacity to be available earlier, while construction activities are being completed. The project development pathway beyond detailed design and initiation of the construction phase will be determined by financial partnerships and end-customer commitments. It is currently anticipated by management that the first production lines of the Phase 2 Bécancour VAP project will commence their commissioning in Q1 2025.

Figure 2: Bécancour VAP Project prospective timetable

https://www.globenewswire.com/NewsRoom/AttachmentNg/0bcd81c4-ffa4-48dc-bdaa-7933b1e614a7

De-Risking by Building Significant Phase 1 Plant and Strategic R&D

The production of purified, coated spherical graphite used as anode material in lithium-ion battery involves three major process steps, namely: shaping, purification and coating. Since 2016, the Company has committed approximately US$27 million in process development and de-risking by running large-scale bench test and building demonstration units. Since early 2020, Nouveau Monde has been operating two commercial scale shaping units in which it processed nearly 1,000 batches to confirm the optimised process parameters and equipment performance profile to be implemented to produce systematically within customers’ specifications. Significant equipment improvements and modifications were implemented on-site to achieve an optimum operating throughput and overall yield while maintaining constant in-specs quality material. Ongoing internal R&D programs on the shaping process are targeting manufacturing excellence by the enhancement of fundamental understanding of fluid dynamics and air flows by using as-built scan, numerical modelling and adoption of advanced automation and artificial intelligence technologies.

As for the Phase 1 purification sector of the facility, Nouveau Monde developed its proprietary thermochemical process that is currently being deployed at a 1,500 tpa nameplate capacity in Olin’s facility adjacent to the Company’s industrial site, with a commissioning scheduled to start in the first half of 2021 (Construction Commenced of Phase 1 Purification Facility for Lithium-Ion Battery Material in Bécancour and the Land for Phase 2 Expansion Is Now Successfully Acquired).

The final process step to produce anode material consists of coating the purified spherical graphite with a carbon-based material to minimise the surface area and enhance the stability of the solid electrolyte interface. Nouveau Monde is currently in the detailed engineering phase and has initiated the procurement to build the first module of the Phase 1 2,000 tpa capacity plant that is scheduled to be commissioned early in 2022 (Nouveau Monde Advances its 2,000-Tonne Coated Spherical Graphite Production Facility – Commissioning Set for Q1 Next Year). Nouveau Monde is of the view that its strategy of de-risking the process by investing in a rapid deployment of a first scalable-complete module will allow a faster product qualification with lithium-ion battery cell makers and more efficient and reliable engineering development.

Product Offering and Marketing

The anode material flowsheet developed by Nouveau Monde is designed to produce anode material of various particle sizes varying between 8 and 20 µm with flexibility to serve various lithium-ion battery applications. Roskill’s Fall 2020 issue reported 2019 average Chinese sales prices of US$ 7,157/tonne for CSPG with specifications similar to the anode material that is expected to be produced by Nouveau Monde. The Company is of the view that this is a fair and prudent estimate of the projected sales price for the Bécancour VAP project. Moreover, the Company and its experienced graphite marketing team is actively developing value-added opportunities for the 1 and 8 µm micronised graphite representing a valuable anode material process by-product potentially serving multiple niche applications.

In their latest February 2021 Lithium-ion Battery Megafactory assessment report, Benchmark Mineral Intelligence forecasts 562 GWh in 2025 and 937 GWh in 2030 of battery capacity in North America and Europe combined with associated graphite anode demand of 674,000 tpa and 1,124,000 tpa, respectively.

Best in Class in Reducing Supply Chain Carbon Footprint; Fully Committed to Carbon Neutrality

Nouveau Monde seeks to contribute to the decarbonisation of the economy by producing graphite materials, a required input for the production of low-carbon products, with the smallest greenhouse gas (“GHG”) footprint possible. In addition to pushing the science and technology development in order to mine and transform graphite in a sustainable and low GHG-emitting manner, the Company has pledged to offset all GHG emissions from sources it either has direct control over or may significantly influence (i.e., the Company’s Scope 1, Scope 2 and portion of Scope 3 emissions). Based on the FEL-1, the Bécancour VAP projected GHG emissions are detailed in table 4.

| EMISSIONS IN METRIC TONNES CO2 EQUIVALENT (T CO2 EQ) | |||

| Source | Total GHG | ||

| Scope 1 |

Stationary combustion | N/A | - |

| Mobile combustion | N/A | - | |

| Fugitive emissions | N/A | - | |

| Process emissions |

partial oxidation of carbon from the furnace packing material (calcined petroleum coke) | 5,760 | |

| partial oxidation of carbon from petroleum pitch in the coating process | 1,975 | ||

| Total Scope 1 | 7,735 | ||

| Scope 2 |

Stationary combustion | electricity production | 300 |

| Total Scope 2 | 300 | ||

| Scope 3 |

Stationary combustion | combustion of pitch-derived residual (condensed) material | 4,608 |

| Mobile combustion |

transport of calcined petroleum coke | 260 | |

| transport of petroleum pitch | 255 | ||

| Process emissions | production of calcined petroleum coke | 3,842 | |

| Total Scope 3 | 8,965 | ||

| GRAND TOTAL | 17,000 | ||

Table 4: Projected carbon footprint of the Bécancour VAP project

The offsetting costs are estimated at US$ 11.86/ t CO2 eq per tonne of CSPG produced and represent approximately US$ 202,000 annually. On a per product basis, this represents approximately US$ 3.83 per tonne of CSPG product and US$ 2.01 per tonne of by-product.

The forecasted GHG footprint for the Bécancour VAP project is derived from the FEL-1, its associated energy and mass balances, and the most likely procurement scenario for process inputs such as calcined petroleum coke and petroleum pitch. Nouveau Monde envisions developing and producing the cleanest anode-grade graphite material possible and is continuously striving for excellence in minimising GHG emissions and climate impact.

Nouveau Monde has ongoing R&D programs in place with professor Philippe Ouzilleau, PhD, from McGill University in Montréal to find alternate carbon sources to the petroleum-based product currently being used in the coating process with the objective of significantly reducing its carbon emissions.

Nouveau Monde also remains fully committed to achieving carbon neutrality at the Company’s level, including the Matawinie mine and concentrator in Saint-Michel-des-Saints and the Bécancour VAP project.

Co-Existence of the Matawinie Mineral Project and the Bécancour VAP Project

The FEL-1 does not impact nor alter the National Instrument 43-101 (“NI 43-101”) feasibility study filed on December 10, 2018 with regards to the Matawinie mineral project. While Nouveau Monde is of the view that there are obvious operational and financial benefits to developing a fully controlled and integrated business model, both the Matawinie mineral project and Bécancour VAP project should be considered independently from each other with regards to their economic viability. To this end, it is the intention of the Company to sell opportunistically the high-purity jumbo and large flakes produced at the Matawinie mineral project directly into third party traditional and speciality graphite markets, while the Bécancour VAP project intends to source its products, comprised of intermediate and fine flakes, from multiple sources. As a reference, the FEL-1 is based on a graphite concentrate feedstock pricing identical to a weighted average between the intermediate and fine flakes expected sales price shown at table 19.3 of the Matawinie NI 43-101 feasibility study. It is Nouveau Monde’s intention to prioritise the use of the feedstock produced at the Matawinie mineral project; however, the Company intends to source raw material from other graphite suppliers from time to time should market, or operational, conditions so justify.

Due to its modular structure, upon Phase 2 of the Bécancour VAP project successfully reaching name plate capacity, we believe it will likely be possible for Nouveau Monde to expand its capacity further. Such Phase 3 expansion is currently being analysed by management, but its implementation has not been agreed to and is entirely speculative at this point in time.

The Company will inform its stakeholders of material developments with regards to the Bécancour VAP project as required by its continuous disclosure obligations set out in Regulation 51-102.

About Nouveau Monde

Nouveau Monde is striving to become a key element in the sustainable energy revolution. The Company is working towards developing a fully-integrated source of green battery anode material in Québec, Canada. Targeting full-scale commercial operations by 2023, the Company is developing advanced carbon-neutral graphite-based material solutions for the growing lithium-ion and fuel cell markets. With low-cost operations and high ESG standards, Nouveau Monde aspires to become a strategic supplier to the world’s leading battery and auto manufacturers, ensuring robust and reliable advanced material, while guaranteeing supply chain traceability.

| Media | Investors |

| Julie Paquet Director, Communications +1-450-757-8905 #140 jpaquet@nouveaumonde.ca |

Christina Lalli Director, Investor Relations +1-438-399-8665 clalli@nouveaumonde.ca |

Subscribe to our news feed: https://nouveaumonde.group/investors/#news

Cautionary Note Regarding Forward-Looking Information

All statements, other than statements of historical fact, contained in this press release including, but not limited to (i) the timetable and the operating metrics of the Bécancour VAP project, (ii) the financial metrics of the Bécancour VAP project, including capital and operating costs, (iii) the financing strategy of the Bécancour VAP project, (iv) the benefits of the Company’s de-risking strategy, (v) the results of the carbon neutrality initiatives, (vi) the positive impact of the foregoing on project economics, (vii) the intended results of the initiatives described above, (viii) the intended project output capacity, (ix) future market supply and demand, (x) future mineral prices and (xi) Nouveau Monde’s mission and strategy and the “About Nouveau Monde” paragraph which essentially describe the Company’s outlook and objectives, constitute “forward-looking information” or “forward-looking statements” within the meaning of certain securities laws, and are based on expectations, estimates and projections as of the time of this press release. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company as of the time of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates and assumptions may prove to be incorrect. Moreover, these forward-looking statements were based upon various underlying factors and assumptions, including the timely delivery and installation of the equipment supporting the production, the Company’s business prospects and opportunities and estimates of the operational performance of the equipment, and are not guarantees of future performance.

Forward-looking information and statements are subject to known or unknown risks and uncertainties that may cause actual results to differ materially from those anticipated or implied in the forward-looking information and statements. Risk factors that could cause actual results or events to differ materially from current expectations include, among others, delays in the scheduled delivery times of the equipment, the ability of the Company to successfully implement its strategic initiatives and whether such strategic initiatives will yield the expected benefits, the availability of financing or financing on favourable terms for the Company, the dependence on commodity prices, the impact of inflation on costs, the risks of obtaining the necessary permits, the operating performance of the Company’s assets and businesses, competitive factors in the graphite mining and production industry, changes in laws and regulations affecting the Company’s businesses, political and social acceptability risk, environmental regulation risk, currency and exchange rate risk, technological developments, the impacts of the global COVID-19 pandemic and the governments’ responses thereto, and general economic conditions, as well as earnings, capital expenditure, cash flow and capital structure risks and general business risks. Unpredictable or unknown factors not discussed in this Cautionary Note could also have material adverse effects on forward-looking statements.

Many of these uncertainties and contingencies can directly or indirectly affect, and could cause, actual results to differ materially from those expressed or implied in any forward-looking statements. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are provided for the purpose of providing information about management’s expectations and plans relating to the future. The Company disclaims any intention or obligation to update or revise any forward-looking statements or to explain any material difference between subsequent actual events and such forward-looking statements, except to the extent required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Further information regarding Company is available in the SEDAR database (www.sedar.com) and on the Company’s website at: www.NouveauMonde.group

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.