Unemployment and Inflation - How they affect housing prices in two unique markets

Newport Beach Real Estate Market

NEWPORT BEACH, CA, USA, December 3, 2020 /EINPresswire.com/ -- Let’s begin with the obvious. Higher unemployment (usually above 13%) leads to lower home prices. It makes sense because we see more people unable to afford homes, higher foreclosures, and less people able to purchase new homes. Inflation is defined as a general increase in prices and fall in the purchasing power of money.Known Factors:

• Inflation is fairly homogeneous across the United States.

• The Fed focuses more on unemployment then inflation.

• The Fed increased money supply 20% in 2020.

• Unemployment affects home values above 13%.

• 2020 May be considered a recession year (-5.91% GDP Rate).

• Areas which currently have “relatively low unemployment” see smaller upticks in unemployment during a recession.

• Areas which currently have “relatively high unemployment” see larger increases in unemployment during a recession.

• In stable unemployment, inflation naturally affects home prices more than small changes in unemployment.

Let’s examine two different home markets.

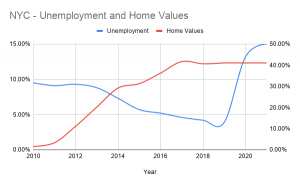

• New York City, NY Unemployment Rate (October, 2020) = 13.2%

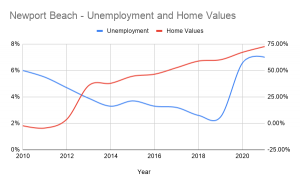

• Newport Beach, CA Unemployment Rate (October, 2020) = 6.6%

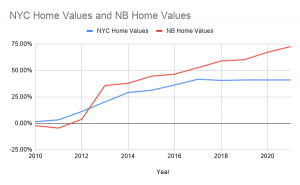

As unemployment rises across the country, we see unemployment rise by more percentage points in New York City compared to Newport Beach. We also see home prices have flattened (some may even suggest depreciated) in New York City, while Newport Beach continues to see price appreciation.

There is a strong correlation between inflation and house prices (typically, housing prices trail inflation). In particular, you will see periods of inflation are followed by increasing periods of price appreciation especially for homes in Newport Beach (this is clear from the 2011-2012 inflationary period).

Data:

• New York City unemployment rates from 2019 to 2020 have moved from 3.9% to 13.2%.

• Newport Beach unemployment rates from 2019 to 2020 have moved from 2.5% to 6.6%.

• New York City is in a buyer’s market with 7+ months of inventory.

• Newport Beach is in a seller’s market with 2 months of inventory.

Our estimations:

• Inflation (nationally) should move back above 3%, maybe to 5% (based on money supply increases).

• Unemployment for both cities should remain steady at the current levels.

• New York City home prices will remain flat through 2021 and may oscillate +/-2% from 0% price appreciation.

• Newport Beach home prices will remain strong and may oscillate +/-2% from +6% price appreciation.

• The Fed will be forced to keep interest rates low in 2020.

The real losers here will be banks who finance loans at 2-3% if inflation pushes higher than 4%, so expect to see their lending rates creep up to combat inflationary pressures.

Homes for sale Newport Beach

Homes for sale Newport Coast

Homes for sale Corona Del Mar

For the charts, Home Values are year over year change in percentage, based on data from Zillow. Unemployment numbers are from the Bureau of Labor and Statistics. GDP Rate is from IMF.

https://trivistarealestate.com

Steven Lockhart

TriVistaMedia.com

+1 949-903-2242

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Newport Beach Real Estate, Orange County, Newport Coast, Corona Del Mar, Best Realtor Near Me

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.