Key Brokerage Houses competing to become 1 stop solution to Institutional & Non Institutional Investors in Saudi Arabia

The Saudi Arabia Capital Market Trading Industry, Business Model & revenue streams adopted by key players, Investor’s Overview and Industry’s Future Potential.

SAUDI ARABIA, October 21, 2020 /EINPresswire.com/ -- Saudi Arabia economy has been relying heavily on hydrocarbons industry; contributing > 40% of GDP (2015). As oil market experienced boom during 2003-2014, the country’s overall GDP grew by ~5% (annualized). Being one of the largest oil producers in the Middle Eastern region, KSA jumped from position of 27th largest economy in world in 2003 to 19th in 2014.However, as oil prices plummeted across the world, KSA economy experienced shrinkage in GDP for the first time post financial crisis. But, during such tough times, its non-oil private sector grew by 0.9% for the first time since 2015. It was only after this event that the government of Saudi Arabia decided to shift its heavy reliance on oil for its overall economic development. On lines of development of non-oil sector, the government introduced Vision 2030 in year 2016 with a part being accredited to increased role of private & public investments.

In 2019, Saudi Arabia state controlled oil firm “Aramco” launched its IPO of USD 25.6 Bn surpassing amount raised by Chinese firm Alibaba. The trust on state owned firm attracted large number of individual investors however failed at attracting expected international investments owing to concerns related to transparency, government practices, security and other related factors. In 2019, number of non-institutional investors grew at a rate of ~15% reaching 5.47 Mn investors as of December 2019, while institutional investors still dominate >90% of value traded in the financial markets.

For More Information on the research report, refer to below link: -

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/ksa-financial-brokerage-industry-outlook-to-2024/366820-93.html

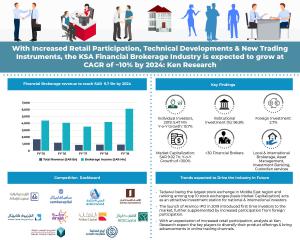

With majority of brokerage houses being bank based, the financial brokerage industry in Saudi Arabia is considered to be highly fragmented in nature with ~70% of market share (basis Revenue) being occupied by top 25 players with Al Rajhi Capital dominating the market. Following a uniform pricing of 0.15%, majority of players in the market compete on the basis of parameters such as trading platforms provided, investment instruments, international investment opportunities and others. Some of the players cater majorly to institutional clients by offering PMS, DPM and Investment Banking services.

Till 2019, investors had the option of investing only in Equity and Debt markets. Therefore, brokerage housed were providing an option to diversify their portfolios, most of the players in the industry provide opportunity of investing in international markets like US, Europe, GCC & some of Asia Pacific countries. In July 2020, Tadawul and Capital Market Authority introduced derivatives trading in the markets.

With launch of Derivative products in 2020 (starting off with Futures), the market is expected to soon start trading in Options & Commodities as well thereby completing its investment opportunities ecosystem.

Tadawul has also been witnessing several regulatory & infrastructural reforms in order to attract more FDIs to the country. As Tadawul becomes the second exchange in GCC region to provide Derivatives trading, it will act as a huge opportunity for GCC. Already started with part privatization of Armaco, the country is expected to witness higher number of IPO deals and increased participation of retail investors as well by 2030. With such driving factors already set in pace the analysts at Ken Research expect the Financial Brokerage industry to grow at a CAGR of ~10% by 2024.

Companies Covered

Al Rajhi Capital

NCB Capital

Aljazira Capital

Samba Capital

Saudi Fransi Capital

Derayah Capital

Riyad Capital

HSBC Saudi Arabia

Alistithmar Capital

ANB Invest

Albilad Investment

Alinma Investment

EFG Herms Saudi Arabia

Merrill Lynch KSA Co.

Falcom Financial Services

Morgan Stanley

Alawwal Invest

Deutsche Securities Saudi Arabia

Al Khair Capital

Jadwa Investment

Arbah Capital

Emirates NBD Capital

Audi Capital

GIB Capital

Citigroup Saudi Arabia

Time Period Captured in the Report:-

Historical Period: 2015–2019

Forecast Period: 2020-2024

Key Topics Covered in the Report:-

Industry Overview- Key Trading Statistics for Equity, Sukuk & Bonds, ETFs and Mutual Funds

Investor’s Overview

Trading Summary-Value, Volume & Number of transactions, Online Trading and Sukuk & Bonds Trading statistics across top 25 players

Operational Indicators- Number of Individual Clients & portfolios, Online traders, AUM, Customer Acquisition Cost, Net Adjusted Working Capital and Number of Investment Centres for top 25 players

Pricing parameters for local & International Stock Exchanges

Financial Indicators covering Total Revenue, segmental Revenue, Operating Expenses, Operating Profit, Net Profit across top 25 players

For More Information on the research report, refer to below link: -

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/ksa-financial-brokerage-industry-outlook-to-2024/366820-93.html

Related Reports by Ken Research: -

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/india-financial-brokerage-industry-outlook/335268-93.html

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ankur Gupta

Ken Research Private limited

+91-9015378249

ankur@kenresearch.com

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.