Oil and Gas Market Opportunities After COVID-19

Formaspace built this Basix™ workstation with mobile casters for a large aerospace research center located in Hampton, Virginia. It features a durable solid hardwood maple top and strong powder-coated steel frame.

The oil and gas industry is down but not out. We look at new opportunities for the energy companies in a post Covid-19 world.

We take a closer look at what the energy market may look like in the post-Covid-19 era.

Covid-19 Drives Down World-Wide Demand For Hydrocarbons

Boom and bust cycles have bedeviled the oil and gas industry since the beginning.

Seasoned workers who’ve experienced downturns before know the drill (pardon the pun) – it’s a time for belt-tightening, cost-cutting, restructuring, and industry consolidation – until the good times come back again.

But this time may be different.

Unlike the most recent oil price crash in 2014 – 2016, the Covid-19 pandemic has led to a precipitous drop in demand for hydrocarbon products that rivals the Great Depression of the 1930s.

Demand from nearly every sector that uses oil and gas is down.

Automotive Transportation Demand

The economic shutdowns in the second and third quarters of this year drove down gasoline usage dramatically, as workers stayed at home and avoided commuting trips.

Airline Transportation Demand

Airlines have been operating on skeleton schedules during much of the pandemic as demand for air travel fell off a cliff. Travel restrictions to Canada, Europe, New Zealand, and Australia have compounded the drop in demand.

Electric Generation Demand

On many days during 2020, wind and solar generation have overtaken conventional fossil fuel electricity production. Working from home has balanced out consumer demand, but slowdowns in industrial production during the height of the pandemic shutdown have curtailed energy demand.

Petrochemical Demand (Plastics, Fertilizers, Fabrics, Construction Materials, Etc.)

Demand for petrochemicals (including plastics, fertilizers, fabrics, construction materials, etc.) is down due to reduced industrial activity during the height of the economic shutdown, but compared to other sectors is showing signs of recovery.

Economists are downbeat on the prospect of a quick recovery.

For example, analysts at the World Economic Forum don’t expect demand for petroleum products to rebound until 2022 (mainly due to the aviation industry slump), while other consultants worry that 2019 may have been the peak year of oil demand for the foreseeable future.

OPEC Price War Amplifies Impact On US Oil And Gas Industry

Things were oh so different just a few years ago.

The US had finally achieved the unthinkable; we had achieved energy independence for the first time in over 50 years (thanks to growing oil and gas production from so-called unconventionals, e.g. fracking etc.). American energy companies were even beginning to increase export oil and gas to foreign markets.

But, as oil prices dip below $40, the economics of fracking become less tenable.

And this is something that rival OPEC+ oil and gas producers in Saudi Arabia and Russia know far too well.

Rather than limiting production to support oil price levels, foreign producers are continuing to work at production levels that are targeting the economic viability of US oil and gas production companies.

The results are quite sobering.

To illustrate how much the production in the oil patch has deteriorated, Baker Hughes reports in Rigzone that in 2019 it has 632 drilling units in operation, but only 254 in 2020 – this means drilling operations have dropped off by more than 70%.

In A World Of Renewables, Investors Are Worried About The Future Of Oil And Gas Production

Energy investors are non-plussed.

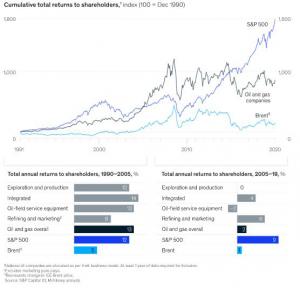

Even prior to the pandemic, the energy sector was in trouble on Wall Street. After riding high for many years, returns on energy stocks have continued to lag behind other S&P 500 sectors.

And many investors are starting to worry that a significant portion of assets held by major oil companies (e.g. proven reserves in the ground, etc.) could be “stranded” forever, e.g. never be developed. This could become a reality due to one or more factors, including demand for oil has peaked and won’t recover, newer renewable energy sources will make them uneconomic, or government bans on carbon emissions will dramatically curtail their use.

Investors have seen this movie before – with the coal industry – the once-dominant energy source for electricity production (prior to the energy industry’s widespread adoption of oil and gas). New coal-powered power plants and mining operations have been sidelined because it’s become very difficult to attract investors to finance new coal ventures.

Many investors are sensing that the same fate may await investments in oil and gas.

It may already be happening. The energy consulting firm Wood MacKenzie calculates that the oil energy sector has lost $1.6 trillion dollars in value this year alone.

A Time For Reinvention Post Covid-19?

Two of the European majors, BP and Royal Dutch Shell, have responded to the Covid-19 pandemic by rolling out plans to reinvent themselves as green energy companies, not just oil and gas companies.

BP has announced new plans to make the company a net-zero-carbon company by 2050 or sooner.

Read more...

Julia Solodovnikova

Formaspace

+1 800-251-1505

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Independent analyst Jonathon Stewart provides his insight on why the market valuation of Tesla has eclipsed that of the five leading US-based oil companies.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.