Rong360 Jianpu Technology (NYSE:JT) Survey Finds Only 1/10 of the Respondents Say They Know about Their Credit Records

Jianpu Technology (NYSE:JT)

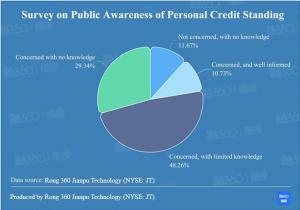

BEIJING, CHINA, September 8, 2020 /EINPresswire.com/ -- Earlier before, the hashtag “some users’ Ant Check Later (ACL) accounts have been connected to the credit reporting system of the People’s Bank of China” hit the headline, triggering heated discussions among netizens on such topics as “What is the point of ACL data being connected to PBOC’s credit reporting system?” “How would this affect the users?” and “Is it time to cancel your ACL account?”Such heated discussions mirrored a harsh fact that the general public are lacking credit knowledge and many have no idea about the practical uses of their credit records. According to the survey by Rong 360 Jianpu Technology (NYSE: JT), nearly 90% of the respondents said they paid certain attention to their credit records, but only 10.73% responded that they were well informed of their credit standing.

Such ignorance can be reflected not only in the uncertainties about “the real impacts of ACL data being included in PBOC’s credit reporting”, and also users’ lack of basic credit knowledge. For example, nearly 20% of the respondents did not know which authority can issue personal credit reports (Credit Information Center of the People’s Bank of China), a half had no idea of free inquiry times (twice per person), and only 31.86% knew about how long the personal overdue records will be kept (5 years).

Among these respondents was Miao Miao, who used to be a drifter in Beijing and now decided to settle down in Nanjing. However, he landed in trouble when applying for mortgage for his carefully selected apartment.

“I was told by a bank staff member that my loan application would not be approved because of my negative credit record”, said Miao Miao, “I was astonished when hearing of this because I had never taken out any loan before.” After checking his credit record, Miao Miao found he opened a credit card a long time ago. The card has been invalidated, but his default on the payment of the annual fee over the years has tainted his credit record.

Knowing the reason, Miao Miao rushed to pay all the overdue fees but still failed in his next attempt of loan application. “I was then informed that the credit record would be kept for 5 years. How ignorant I was!”

Should behaviors such as violation of anti-pandemic policies be noted in credit records?

While the topic “ACL data included in PBOC’s credit records” triggers waves of discussion, another piece of news did not receive much attention. On July 17, 2020, the Credit Information Center of the People’s Bank of China and Baihang Credit Co., Ltd. entered into a strategic cooperation agreement. As announced by Baihang Credit, the two sides will carry out cooperative research on strategy, business, and technology according to laws and regulations on the premise of information security.

The quickened pace of credit market construction has also exposed many loopholes and problems in the personal credit reporting system. For example, driven by the fast development of financial technology in China, the consumer finance market is growing exponentially, which then drives up the demand of the personal credit market. However, the present credit products and services fail to meet such a demand.

As revealed by data from Rong360 Jianpu Technology (NYSE: JT), the public calls for abundant contents and high accuracy in personal credit reports. 53.31% of the respondents showed their full support for extending report coverage, 38.8% were conditionally supportive, and only 2.21% were against further expansion of the report.

But respondents hold different views on a few more debatable topics. For example, the hearsay that the billing information for utilities is to be collected as part of personal credit information has received 30.6% full support and 53.63% conditional support, provided that pre-authorization is granted. This is well grounded as PBOC had explicitly stated while launching the second-generation credit reporting system that authorization of the data owner is required for such collection.

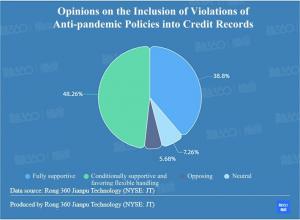

Since the beginning of 2020, the Covid-19 pandemic has ravaged the world. In response, some local governments in China released measures to include violators of anti-pandemic policies into the credit blacklist. For example, the Shanghai government issued a policy that explicitly states that those who purposely cover up their medical history shall be included in the credit blacklist.

According to the survey by Rong360 Jianpu Technology (NYSE: JT), this practice received 38.8% full support, 48.26% conditional support, and 5.68% objection, reflecting a greater public willingness to include deeds that harm public interests into personal credit reports.

Miao Miao showed his support: “There is no difference between such kind of things and credit card repayment. Everyone can do it well if they want. Violation means they have an attitude problem.” Zhao Xiao held the same opinion: “Those who violate such rules should be disciplined.”

Di Wang

Jianpu Technology

+86 10 8262 5755

email us here

Visit us on social media:

LinkedIn

Twitter

Facebook

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.