Rong360 Jianpu Technology Survey Finds 1/3 of the Chinese Population Experienced Unlawful Check of Their Credit Records

Jianpu Technology (NYSE:JT)

BEIJING, CHINA, September 1, 2020 /EINPresswire.com/ --Despite the wide uses of credit reports in different scenarios, there are still many people who have never inquired about or used their credit reports. According to Rong 360 Jianpu Technology (NYSE: JT)’s survey data, 25.24% of the respondents claimed that they had never inquired about their personal credit records.

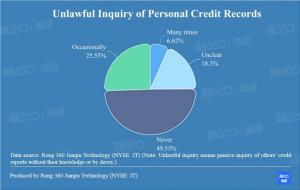

While there are people who have never inquired about their credit records, others experienced passive inquiries without their knowledge. According to the survey by Rong 360 Jianpu Technology (NYSE: JT), more than 30% of the respondents said they had such experiences.

According to the Regulations on the Administration of Credit Reporting Industry, one who inquires personal data of credit information institutions shall obtain the written consent from the data owner and agree on the uses of the data with the owner. However, some institutions, for business reasons, attempt to obtain the consent of credit inquiries from users by fraud or decoy.

For example, there was a consumer complaint against a takeaway platform that bundled its takeaway coupons together with the consent of credit inquiries, thus misleading consumers into taking coupons without noticing the line written in a small font underneath: “Authorization is hereby granted for inquiry of the user’s Personal Credit Report”. As a result, the user’s credit information was “inquired of”.

It is worth noting that, in a certain period of time, the more frequently the credit record is inquired of, the greater the negative impact will be. This is commonly known as “excessive credit” and may cause trouble in applying for bank credit.

Inadvertently giving third parties the right to access your credit record is no less than giving up on your privacy and exposing your important personal information in sunlight. Zhao Xiao, who works in Guangzhou, often receives loan-touting calls, just because of a leakage of personal information in a credit record inquiry.

“A while back, I borrowed some money online to pay the rent. Later on, I learned that online borrowing might affect my credit record, and then I checked it”, said Zhao. But instead of inquiring through the official channel of the PBOC, Zhao just used some credit inquiry APP downloaded from the APP store.

Such kind of APPs require the users to provide access to their private information including location, telephone number, camera, and even SMS and call history. The so-called “direct connection to the Credit Reporting System of the People’s Bank of China” is nothing but an intermediary that first collects the user’s personal data and then makes the inquiry.

Generally speaking, the credit reports provided by the PBOC contains detailed information including phone numbers, addresses, marital status, career information, bank credit records, and records of overdraft of credit cards. All these private data, which requires the highest level of protection, can be easily recorded and used by such APPs.

“I knew it’s risky to borrow money that way, but had no idea about the consequence of frequent credit inquiry. Nuisance calls are no big deal. What concerns me most now is that my data would be abused by others to take out loans in my name,” said Zhao Xiao regretfully. “That’d cause tremendous loss to me.”

Di Wang

Jianpu Technology

+86 10 8262 5755

email us here

Visit us on social media:

LinkedIn

Twitter

Facebook

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.