India E-Pharmacy Industry Competition Benchmarking Market Report - A detailed analysis of E-Pharmacy players in India.

Innovative Online Platforms along with Intuitive Sourcing, Strong Logistic Infrastructure Facilitating Growth in India Online Pharmacy Retail Space Ken Research

GURUGRAM, HARYANA, INDIA, July 20, 2020 /EINPresswire.com/ -- Apollo Hospitals is betting big on pharmacy business amid a sharp fall in the occupancy rates at its hospitals due to Covid 19. In the March quarter, while the hospital business performance growth was subdued at 4.0% year on year, pharmacy business grew at a strong ~33.0%. Its management has given strong growth guidance for the latter.Virus boosts digital payments in India where cash ban failed. The coronavirus outbreak may finally accomplish what India’s shock demonetization four years ago failed to achieve: Use of digital payments is soaring for everything from Medicines, groceries, electricity bills and

Mukesh Ambani's Reliance Industries is in advanced discussions to acquire a majority stake in online pharmacy Netmeds as part of its broader play in e-commerce. The deal may see Reliance, through one of its subsidiaries; pay USD 130-150 million for the asset, which may also include a fresh infusion to expand the operations. The deal may happen at a slight premium to their last funding round valuation.

Value Added by e-Pharmacy to the Healthcare System in India: E-Pharmacy improves consumer convenience and access. This will most importantly benefit chronic elderly patients living in nuclear families, and patients who are not in a condition to go out to find a pharmacy. E-Pharmacy also offers competitive pricing which thereby enables less affluent people to afford medicines. There are a lot of technology advancements that are coming up in the form of applications which help in bringing price transparency, create awareness, find an appropriate healthcare service provider, medicine reminders and other alerts to the consumers.

E-Diagnostics Revenue Stream is Expected to be a Significant Contributor: Many e-pharmacy players in India are trying to integrate other healthcare services such as diagnostics, doctor consultations, doctor appointments etc. on their platforms to widen their service portfolio. E-Pharmacy players have tie-up with laboratories and offer online booking of diagnostic tests, health packages and home collection of pathology samples. Few players such as Medlife have started their own laboratories offering diagnostic services for patients on their e-pharmacy platform. Diagnostic is one of the fastest growing sectors in healthcare industry. With e-pharmacy players offering diagnostic services and opening their own diagnostic laboratories, e-diagnostics revenue stream is expected to be a significant contributor for e-pharmacy players.

Unclear Regulations on E-Pharmacies Might Hinder Future Investments: E-pharmacies in India seem to be on a roller-coaster ride. While the sector is witnessing a soaring customer base, the lack of clear regulations by the government is causing anxiety among the stakeholders. On the business front, the e-pharmacy sector is expected to grow at an exponential CAGR of 63.0% in the next 2-3 years and has currently ~30,000 skilled professionals employed in the space. The access that the e-pharmacy model is providing is something that the consumer buys and is really appreciative of. People are appreciating a better model of access, and the growth has also reached tier-II, III, IV cities. It is expected that the industry will receive defined and structured guidelines from the government which will further help the industry to innovate its offering for its consumers.

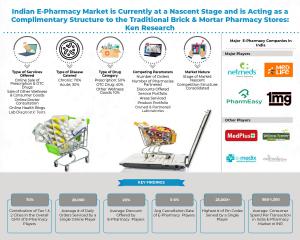

Analysts at Ken Research in their latest publication "India E-Pharmacy Competition Benchmarking – A Detailed Analysis of Major E-Pharmacy Players in India" observed that the fast-growing Indian E-Pharmacy industry needs to focus on key areas such as logistic infrastructure, lab diagnostic segment, organic growth in average daily orders and strategic partnerships with various entities to promote wellness goods & consumer goods sale with a view to create a sustainable all in one online platform catering across India, which will promote the growth of the sector in a more structural & organized way by increasing the reach of the platform. The India E-Pharmacy Industry is currently in its nascent stage & is expected to grow exponentially with an influx of investment in this space.

Key Target Audience:

Pharma/Medicine Manufacturers

Medicine Distributors

3PL Logistic Players

E-Pharmacy Players

Offline Pharmacy Players

Hospitals

Government/Regulatory Bodies

Retail Industry Associations

Time Period Captured in the Report:

FY’2015-FY’2020

Companies Mentioned:

Medlife Wellness Retail Private Limited

Netmeds Marketplace Limited

Pharmeasy (91 Street media Technologies Private Limited)

1 MG Technologies Private Limited

Key Topics Covered in the Report

Operating Analysis of Medlife, Netmeds, Pharmeasy, 1 MG (Including GMV, Number of Orders (Per day), Average Ticket Size, Month-on-Month growth Rate (On the basis of GMV), Cancellation Rate, Refund Policy, Logistic Charges, Number of Warehouses , Number of Application Downloads (As of 31st May, 2020) (Monthly Average), Partnerships, Unique Selling Proposition, Business Strategies, Strength, Weakness)

Financial Analysis of Medlife, Netmeds, Pharmeasy, 1 MG (Including Total Revenue, Growth of Revenue (%), Total Expenses, Earnings before Tax & Extraordinary Items, Earnings after Tax (Net Income), Growth of Net Income (%), EPS, Advertisement Expenses)

Heat Map Analysis of Value Added Services (Including Online Consultation, Diagnostic Labs, Appointments with Doctors, Health Blog)

Services Analysis of Players (Including Delivery Timings, Refund Status, Express delivery, Subscription model, Private Label Goods, Diagnostics Services, Live Doctor Consultation, SKU Details (Top Categories), Payment Services

Website Comparison (Including Global Website Ranking (May, 2020), Country Website Ranking (May, 2020), Category Rank (India), "Total Visit (May, 2020), (Growth rate %), Average Visit Duration, Pages per Visit, Bounce Rate, Top 3 Traffic producing Countries)

Competition Analysis (Market Share on the basis of GMV)

For more information on the research report, refer to below link:

https://www.kenresearch.com/healthcare/pharmaceuticals/india-e-pharmacy-competition-benchmarking/345912-91.html

Related Reports

https://www.kenresearch.com/healthcare/pharmaceuticals/pharmeasy-91-street-media-technologies-private-limited-business-overview/345916-91.html

https://www.kenresearch.com/healthcare/pharmaceuticals/netmeds-marketplace-limited-business-overview/345915-91.html

https://www.kenresearch.com/healthcare/pharmaceuticals/medlife-wellness-retail-private-limited-business-overview/345914-91.html

https://www.kenresearch.com/healthcare/pharmaceuticals/1-mg-technologies-private-limited-business-overview/345913-91.html

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ankur Gupta

Ken Research Private limited

+91 90153 78249

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.