Rong360 Jianpu Technology Inc. (NYSE:JT) Big Data Institute: Mortgage Rate of 23 Cities Rose in September

Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Institute: LPR Plus Basis Points Determined across Many Cities, Mortgage Rate of 23 Cities Rose in September

Jianpu Technology (NYSE:JT)

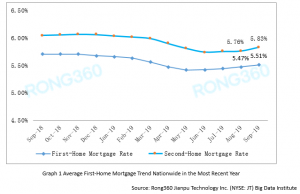

BEIJING, CHINA, October 15, 2019 /EINPresswire.com/ -- 1.The mortgage rate nationwide increased for four consecutive months, the average interest rate on first-home mortgage was 5.51%.The monitoring data released by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute shows that the mortgage rate nationwide increased for four consecutive months. In September 2019, the average mortgage rate for first-time homebuyers nationwide was 5.51%, posting an increase of 4 basis points (BP) on a month-on-month (MoM) basis. Specifically, 66 BP have been added above the corresponding LPR. Additionally, the average mortgage rate for second-time homebuyers was 5.83%, posting an increase of 5 BP’s on a MoM basis. Specifically, 98 BP have been added above the corresponding LPR level.

2.Mortgage rates rose among 23 cities in September, less than one-tenth of banks piloted new housing mortgage policy before October.

On the whole, mortgage interest rates upward trend showed up across more cities. According to the data released by Rong360 Big Data Research Institute for September 2019, the mortgage rates for first-time homebuyers of 23 cities rose in that month, and 9 cities maintained prior month’s levels, but the mortgage rates for first-time homebuyers of 3 cities including Suzhou, Nanjing and Taiyuan were lower.

Before the National Day (October 1st 2019), the monitoring data of Rong360 Big Data Research Institute showed that among 533 bank branches (sub-branches) in 35 cities, less than one-tenth of the bank branches piloted the new benchmark LPR in advance. Among them, China Merchants Bank (CMB) has implemented new housing mortgage policy across the most cities, while China Minsheng Banking Corp., Ltd. (CMBC) is still implementing in accordance with the old policy. Some state-owned banks, including the Postal Savings Bank of China (PSBC), Industrial and Commercial Bank of China (ICBC), and Agricultural Bank of China (ABC) have also tried the new LPR pilot quotation method in second-tier cities in advance, but these banks were more cautious for first-tier cities and there was no pilot in advance.

However, the monitoring data released by the Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute shows that even without advance pilot initiatives, the number of banks whose mortgage interest rates are lower than the floor of the new LPR among the 533 banks still decreased. At the end of September, the number of banks whose first-home mortgage interest rates were less than 4.85% reduced to 14, and the number of banks with second-home mortgage interest rates less than 5.45% reduced to 81.

3. Key cities are increasing efforts to deploy the new policy of LPR. Mortgage rate may continue to show upward trends.

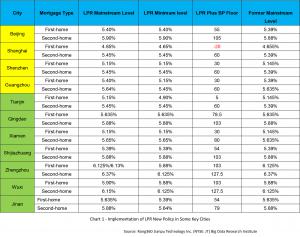

After October 8th, among first-tier cities: almost all the banks in Beijing, Shanghai and Shenzhen have implemented the new policy, except for a very few banks. While less than half of banks in Guangzhou have started to deploy the new policy. Among second-tier cities, most banks in Tianjin, Qingdao, Wuxi, Xiamen, Shijiazhuang and Zhengzhou are using the new LPR quotation mechanism while the standard of quotation and the way Basis Points are added may need further improvement.

Although there is a transition period of more than one month in the early stages, a few first-tier cities have not been deployed yet. While for the second and third-tier cities, they may need a longer transition time to adjust the interest rate and confirm the quotation method.

Taken together, the mainstream level remained the same level or increased slightly after adopting the LPR for quoting mortgage loans. Comparing the growth ranges of first home mortgage rate within 2BP, the growth range of second-home mortgage rate increased more, and the highest level reached 6 BP.

In the future, mortgage rate may continue to show upward trends under the stringent credit quote and housing market control. Furthermore, as the spread of LPR new policy, banks that haven’t adopted LPR for the reason of facing upward pressure, may take actions in the short term, which will further push up the home mortgage rate in its city. However, there isn’t much interference from quotation and frequency of LPR for mortgage rates. The effect of new policies will gradually weaken so as to ensure the stability of the real estate market.

Statement

Disclaimer: The data in this report are obtained through public channels. Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Institute strives to be accurate and reliable, but does not guarantee the accuracy and completeness of these data, and does not assume legal responsibility arising from data problems. Any user who cites, reprints and distributes the report to third parties agrees that the risks and consequences of the data issue are entirely at their own risk.

Di wang

Jianpu Technology

+86 138 0146 7518

email us here

Visit us on social media:

Twitter

LinkedIn

Facebook

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.