ACG Research: Positive 2Q for Worldwide Router and Switching Market

Although a successful 2Q for vendors, market forces are driving SPs to focus on architectural transitions to distributed cloud, 5G & next-gen service delivery

SPs are focusing on architectural transitions related to distributed cloud, 5G & next-generation service delivery, & ACG anticipates an uptick in spend in 2H as providers continue to address issues.”

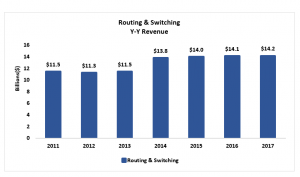

GILBERT, ARIZONA, US, August 27, 2018 /EINPresswire.com/ -- ACG Research has released its 2Q 2018 worldwide Routing and Switching market share report. The worldwide Routing and Switching market increased 12.3% quarter over quarter but decreased 8.9% year over year. increased in q-q revenue for a total of $803.6 million. The edge/switching segment grew, posting revenue of $2.55 billion. Regionally, APAC increased revenue 20.7% q-q but down 6.4 y-y. The EMEA region was up slightly 1.5% q-q but decreased 5.1% y-y. The Americas increased 11.8% q-q but decreased 8.9% y-y.— Ray Mota

Market forces are driving service providers to move to digital transformation. To succeed they will need to enable their technology/infrastructure so that their network services are flexible, scalable and on demand, have rapid provisioning of new applications and services as well as provide support for new business models. Several key technologies, virtualization, automation and orchestration, 5G, analytics and machine learning, edge computing, and migration to an all IP infrastructure are now mature enough for network introductions that will underpin service providers’ digital transformation.

Vendors are facing price pressure for standalone hardware, resulting in low/declining revenue for products and compressing gross margins for the product segment. This trend is being driven by not only monetary pressure related to hardware, but also by a shift away from standalone hardware products.

“Providers are focusing on architectural transitions specifically related to distributed cloud, 5G and next-generation service delivery, and ACG anticipates an uptick in spend in the second half as providers continue to address the issues,” says Ray Mota, CEO. “We anticipate webscale companies spending almost 13% on capex and CSP approximately 1.5%.”

TREND and DRIVER HIGHLIGHTS

• Expectation is for long-term U.S. service provider capex growth in the flat to low single-digit range, approximately in line with SP revenue growth.

• U.S. cloud providers expected to spend $61 billion in 2018.

• Webscalers will spend approximately 75% of their capex on servers and storage and 25% on networking equipment. SPs will spend about 70% on networking equipment and 30% on other infrastructure.

• Factors influencing the purchase of SD-WAN: cost, need for agility, simplification of software and a centralized infrastructure, and cloud optimization.

• Telcos are focusing on architectural transitions specifically related to distributed cloud, 5G and next-generation service delivery, and ACG anticipates an uptick in spend in the second half of the year.

• Businesses are looking for more options on security, cloud UC, networking services or network as a service and customer experience applications.

For more information about ACG’s routing and switching services contact sales@acgcc.com.

sales@acgcc.com

ACG Research

408-200-0967

email us here

About ACG Research

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.