IMF Survey: Subdued Growth in Latin America for 2014

Ceramic factory in Canelones, Uruguay. Growth in Latin America is expected to stay in low gear in 2014 (photo: Nicolas Celaya/Newscom)

Regional Economic Outlook

Subdued Growth in Latin America for 2014

IMF Survey

April 24, 2014

- Latin America expected to grow by 2½ percent in 2014 and 3 percent in 2015

- Risks to growth include lower commodity prices, rising external funding costs

- Region should strengthen public finances, step up structural reforms

Economic activity in Latin America and the Caribbean is expected to stay in low gear in 2014, according to the IMF’s latest forecast for the region.

The recovery in the United States and other advanced economies is expected to bolster export growth, but lower world commodity prices and rising global funding costs are likely to weigh on activity across the region.

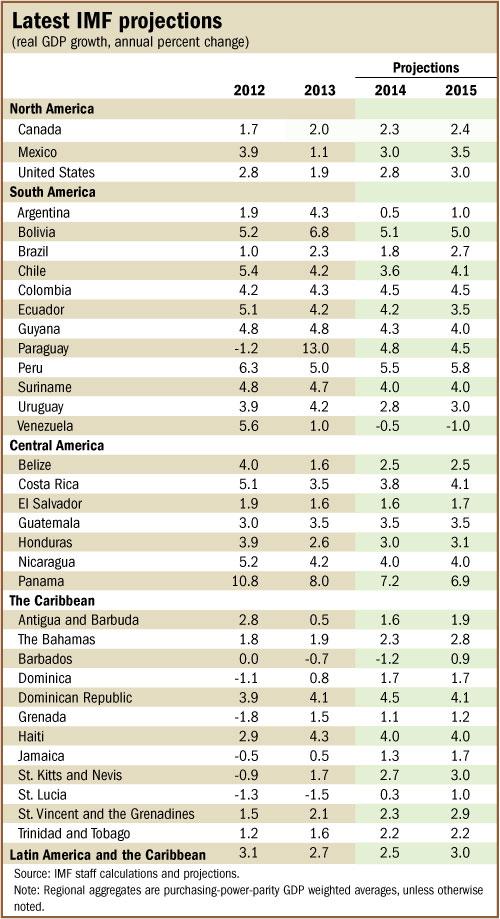

The IMF’s Regional Economic Outlook for the Western Hemisphere, released on April 24 in Lima, Peru, projects regional growth of 2½ percent in 2014, down from 2¾ percent in 2013. Weak investment and subdued demand for the region’s exports held back activity in 2013, as did increasingly binding supply bottlenecks in a number of economies. For 2015, the IMF projects a modest pickup, to 3 percent.

According to the report, Latin America still faces a number of downside risks. The key risk is a sharper decline in commodity prices caused by weaker demand from some of the major commodity-importing economies, especially China. Although the effects from a gradual and orderly normalization of U.S. monetary policy should be contained for most of the region, increased capital flow volatility also remains a risk.

Divergent growth dynamics

Growth in the financially integrated economies—Brazil, Chile, Colombia, Mexico, Peru, and Uruguay—in 2014 is expected to remain the same as in 2013, at 3½ percent. However, the average growth number masks considerable divergence across countries (see table).

Mexico’s economy is expected to rebound to 3 percent this year owing to a stronger U.S. recovery and normalization of domestic factors. In Brazil, activity is expected to fall below 2 percent in 2014, as weak business confidence continues to weigh on private investment.

The IMF said the key policy priorities for the financially integrated countries include a careful calibration of macroeconomic policies, a clear focus on reducing financial vulnerabilities, and stepped-up structural reforms to remove obstacles to growth.

Growth in the other commodity exporters—Argentina, Bolivia, Ecuador, Paraguay, and Venezuela—is projected to fall sharply in 2014, to about 2¾ percent from nearly 6 percent in 2013. The IMF said that fundamental policy adjustments are needed in Venezuela to avert the risk of disorderly dynamics.

Control public spending

Further policy adjustments are also needed to restore macroeconomic stability in Argentina, especially in the context of less favorable prospects for global commodity prices. The other economies in this group will also need to control levels of public spending, which have increased sharply over the past decade owing to strong commodity revenue.

Economic activity in Central America is projected at about 3½ percent in 2014, similar to last year’s level. Looking ahead, the IMF pointed out that a consolidation of public finances is necessary to reduce fiscal and external imbalances, and to ensure debt sustainability. Consolidation efforts would have to include both expenditure restraint and higher tax revenues.

Growth remains tepid in most of the Caribbean. The tourism-dependent economies are expected to grow on average by 1.4 percent in 2014 and the commodity exporters by 3.2 percent. Reducing high public debt levels remains a key challenge in much of the Caribbean along with further efforts to address long-standing competitiveness problems, notably in the tourism-dependent economies.

Background studies

The Regional Economic Outlook also contains three background studies. The first analyzes the impact of U.S. monetary policy normalization on Latin America and the Caribbean. The second study looks at the impact of lower commodity prices on economic growth in the region. The third background study looks at the changes in the cyclicality of fiscal policy across Latin America.

Stay Connected

Write to us

The IMF Survey welcomes comments, suggestions, and brief readers' letters, a selection of which are posted under What readers say. Letters may be edited. Please address Internet correspondence to imfsurvey@imf.org.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.