Summary of Shareholder Voting on Rule 14a-8 Proposals

This summary is focused on 14a-8 proposals that were voted on by shareholders during the 2023-2024 season.[1]

We refer to the accompanying charts which have the supporting detail for what follows. As you’ll see, we divide proposals into five categories consistent with our team’s tracking of this data for several proxy seasons.

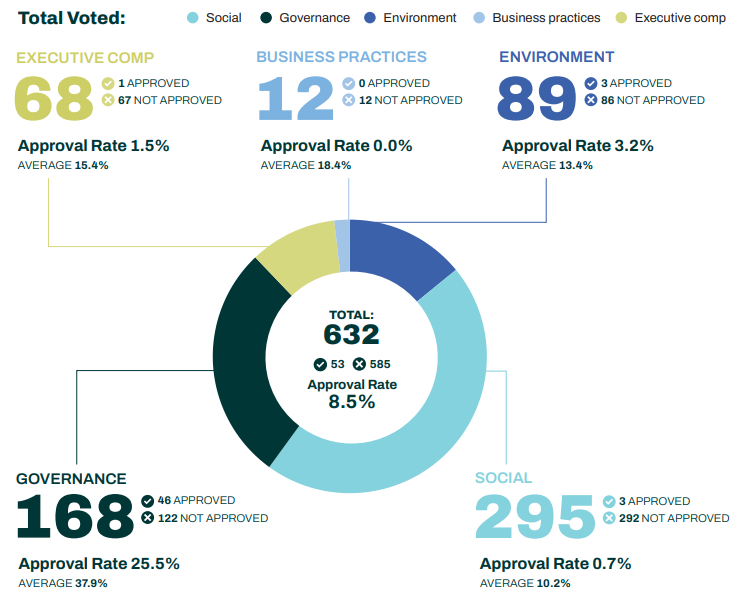

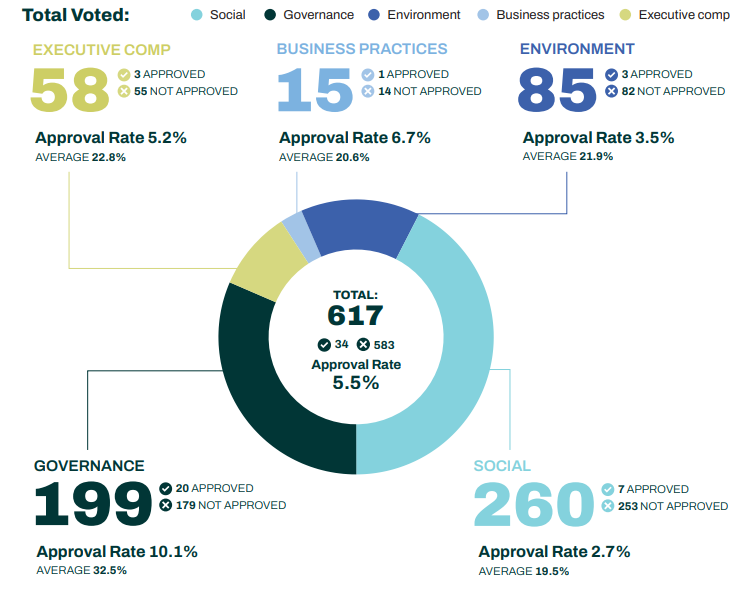

632 proposals were voted on in the 2023-2024 season compared with 617 in 2022-2023, an increase of 2.4%. 2

SOCIAL

- The number of Social proposals increased from 260 to 295 season over season (13.5%), and were 46.7% of all proposals that were voted on this season.

- Only three of the 295 proposals were approved by shareholders (1.0%). In the prior 2022-2023 season seven were approved (2.7%).

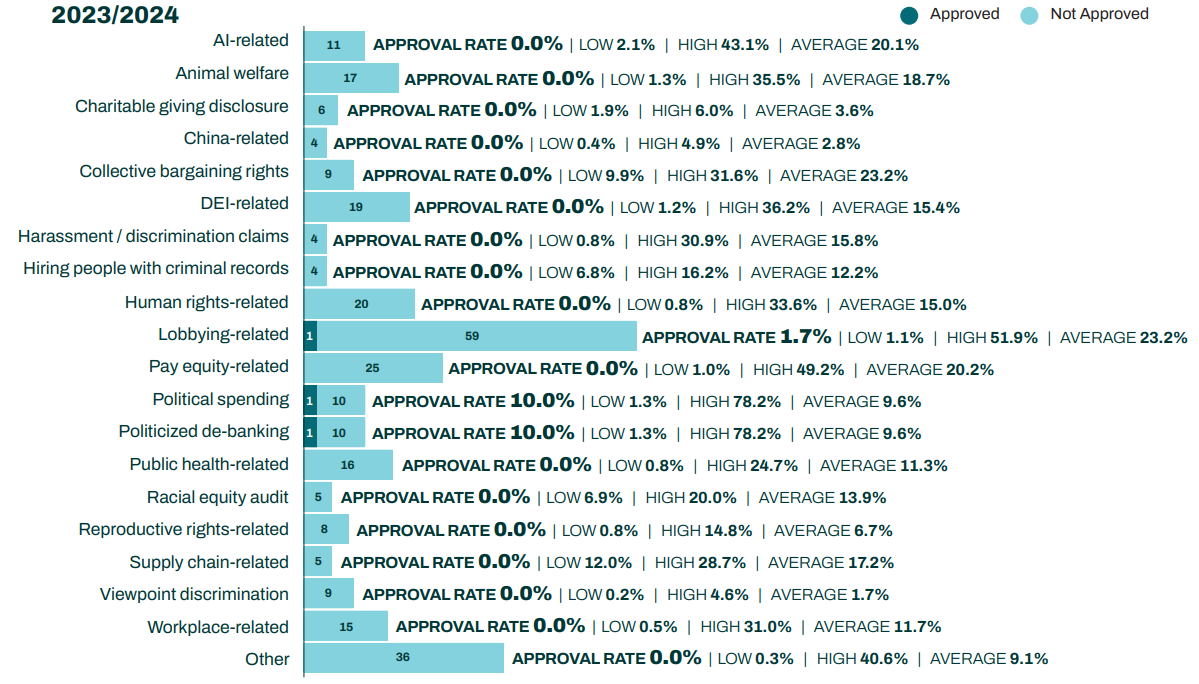

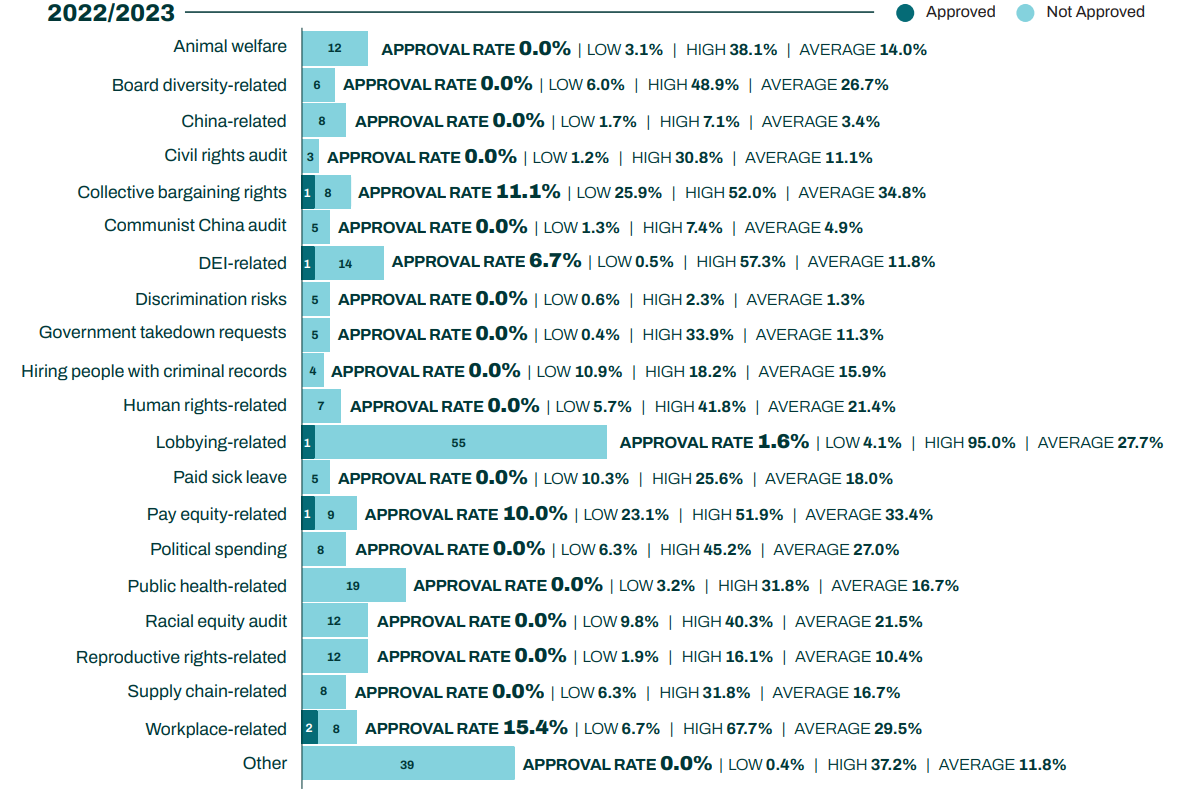

- Average shareholder support for Social proposals fell from 19.5% to 10.2% season-over-season. For our defined segments, support ranged from 1.7% (Viewpoint discrimination) to 23.2% (Collective bargaining rights).

- We saw proposals for four new Social segments: AI-related (20.1% support), Harassment / discrimination claims (15.8% support), Politicized de-banking (9.6% support) and Viewpoint discrimination (1.7% support). One proposal for Politicized de-banking was approved.

- There were 60 Lobbying-related proposals, one of which was approved (1.7%). Two of 56 were approved in 2022-2023 (3.6%).

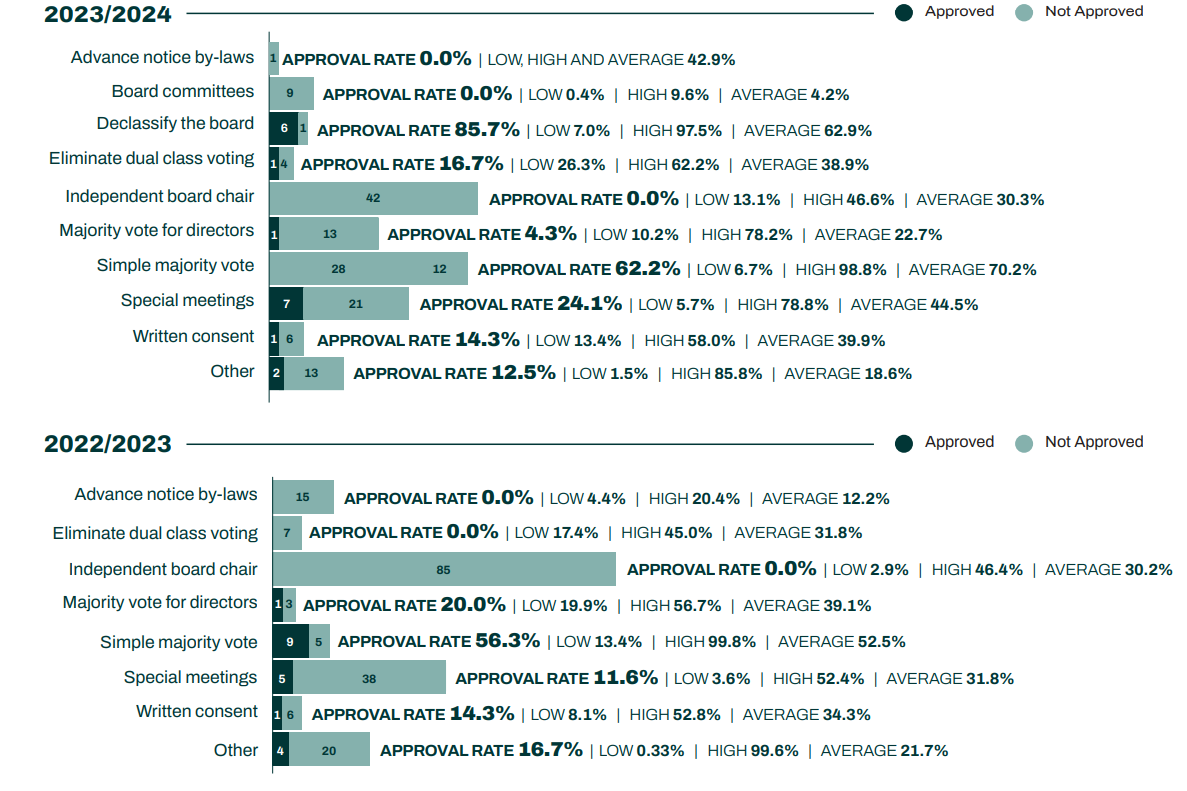

GOVERNANCE

- The number of Governance proposals declined from 199 to 168 season-over-season, a 15.6% drop.

- However, average voting support increased from 32.5% to 37.9% season-over-season.

- 46 of the 168 Governance proposals this season were approved (25.0%), compared with 20 out of 199 in the 2022-2023 season (10.1%). The 46 that were approved were 79.3% of all proposals approved by shareholders this season, despite Governance proposals only being 26.6% of all the proposals voted on this season.

- Simple majority vote stands out among all segments. 41 were voted on this season and 28 were approved (62.2%), compared with 14 and 9 the prior season (64.3%), as average voting support increased to 70.2% from 52.5%. The 28 that were approved were 52.8% of all proposals approved by shareholders this season.

- Declassify the board also stood out. Six out of seven were approved this season (85.7%).

- But not all Governance proposals did well. E.g., There were 42 Independent board chair proposals this season and 85 the season before; none of which were approved.

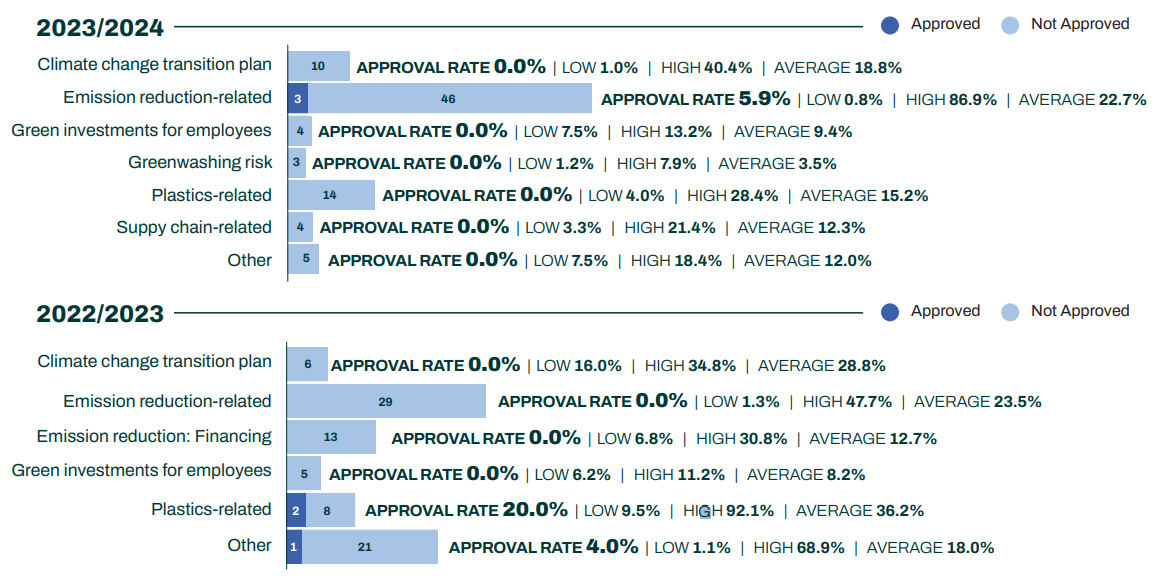

ENVIRONMENT

- There were 89 proposals voted on this season compared with 85 in the prior season.

- 49 of the 89 proposals (55.0%) were Emission reduction-related of which three were approved by shareholders (5.9% of the 89). On average, Emission reduction-related proposals received 22.7% support from shareholders this season. There were 42 such proposals in 2022-2023, none of which were approved.

- No other Environment proposals were approved by shareholders this season, as average shareholder support declined from 21.9% to 13.4% season-over-season.

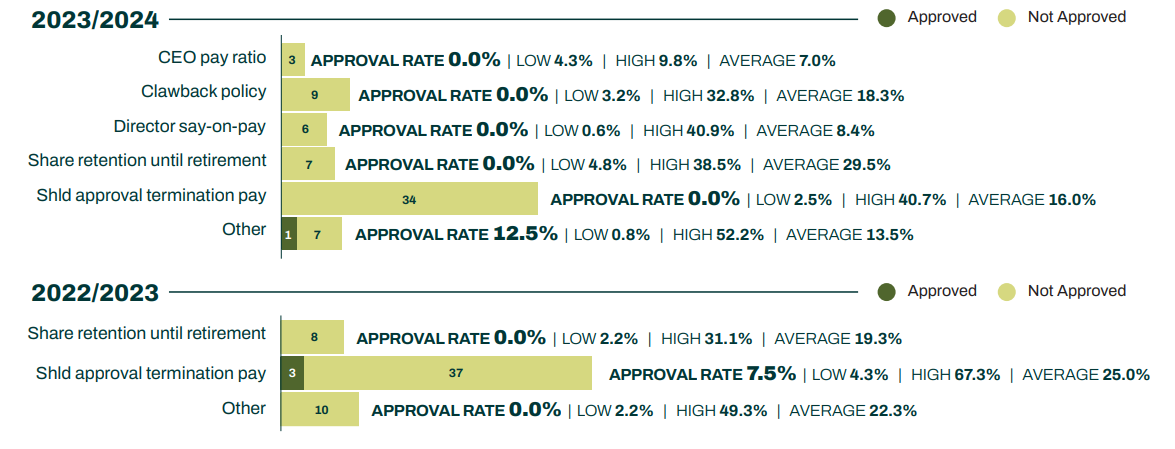

EXECUTIVE COMPENSATION

- Only one of 68 was approved this season (1.5%), compared with three of 58 in 2022-2023 (5.2%).

- Average shareholder support declined from 22.8% to 15.4% season-over-season.

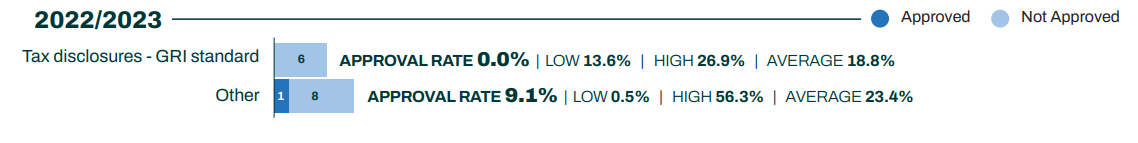

BUSINESS PRACTICES

- For reasons explained below, most Business practices proposals are now either Sell the company or Tax disclosures – GRI standard, neither of which received shareholder approval this season. One was approved in 2022-2023.

- Our team has been tracking 14a-8 proposals for several seasons including coverage of shareholder voting results and challenges to inclusion brought by companies making no-action letter requests to the SEC. In doing so we used Business practices as a category to identify those likely to draw (i)(7) challenges (ordinary business).

- Given recent changes in SEC policy – which have made it more difficult to succeed with an (i)(7) challenge — the number of proposals that we’ve put into this category has declined significantly since 2021 but we thought it useful to maintain it as a separate category.

- But for the change in SEC policy, we would have put more proposals in our Business practices category instead of our Social category. As noted in our 14a-8 Challenges coverage, it appears that the SEC has partly backed away from this policy this season as the SEC invoked (i)(7) thirteen times when it wasn’t the challenger’s first choice for grounds for exclusion and, in one case, not at all.

An expensive soapbox?

Until the 2021 change in SEC policy, Governance was the focus of most 14a-8 shareholder proposals. This has shifted to Social proposals, and to some extent with Environment proposals, led by activist umbrella groups such as As You Sow (asyousow.org), which this season has sponsored 89 14a-8 proposals as shown on its website here. As You Sow was the named proponent for 48 that went to a vote this season, only one of which was approved (2.0%).

Our data suggests that institutional investors are tiring of proposals that are extraneous to company business which would explain the drop-off in support for Social proposals (19.5% to 10.2%) and Environment proposals (21.9% to 13.4%). This season only three of 295 Social proposals (1.0%) and three of 89 Environment proposals were approved (3.3%).

NCPPR v SEC

A broad-sweeping challenge to the SEC’s 14a-8 shareholder proposal rule is pending in the Fifth Circuit, and it includes Constitutional claims. Oral argument was heard on March 5, 2024.

1We define the 2023-2024 season as annual shareholder meetings held between July 1, 2023 and June 30, 2024, and the 2022-2023 season as annual shareholder meetings held between July 1, 2022 and June 30, 2023.(go back)