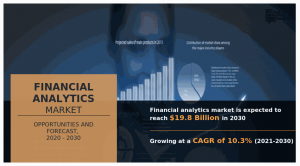

Why Invest in This Industry | The Financial Analytics Market Share Reach USD 19.8 Billion by 2030 at 10.3% CAGR

Increase in adoption of pervasive computing devices, rise in advanced storage capabilities & growth in innovation of new analytic tools boost the market growth

PORTLAND, PORTLAND, OR, UNITED STATE, August 2, 2024 /EINPresswire.com/ -- Allied Market Research published a new report, titled, " Why Invest in This Industry | The Financial Analytics Market Share Reach USD 19.8 Billion by 2030 at 10.3% CAGR." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segment, Porter’s Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain thorough understanding of the industry and determine steps to be taken to gain competitive advantage.

The global financial analytics market was valued at USD 7.6 billion in 2020, and is projected to reach USD 19.8 billion by 2030, growing at a CAGR of 10.3% from 2021 to 2030.

Request Sample Report (Get Full Insights in PDF – 190 Pages) at: https://www.alliedmarketresearch.com/request-sample/3633

Rise in adoption of advanced computing devices, increase in storage capabilities, and innovation in analytics tools drive the growth of the global financial analytics market. North America accounted for the highest share in 2020, and is projected to continue its leadership status by 2030. The demand for financial analytics services and solutions increased during the Covid-19 pandemic, due to rise in need to take better financial decisions during economic uncertainty.

The financial analytics market is segmented on the basis of component, deployment mode, organization size, industry vertical, and region. Depending on the component, it is segmented into solution and service. The solution segment is further sub segmented into database management system (DBMS), data integration tools, query, reporting and analysis, analytics solutions, and others. According to deployment mode, it is segmented into on-premise and cloud. As per organization size, it is segmented into large enterprises and small-medium enterprises. By industry vertical, it is segmented into BFSI, IT and telecom, manufacturing, retail and E-commerce, government, healthcare, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

If you have any questions, Please feel free to contact our analyst at: https://www.alliedmarketresearch.com/connect-to-analyst/3633

Based on component, the solution segment contributed to the highest share in 2020, accounting for more than two-thirds of the total market share, and is estimated to maintain its dominant share by 2030. However, the services segment is projected to manifest the highest CAGR of 12.6% from 2021 to 2030.

Based on industry vertical, the BFSI segment held the largest share in 2020, accounting for more than one-fourth of the global financial analytics industry, and is projected to continue its lead position during the forecast period. However, the retail and e-commerce is segment is estimated to witness the fastest CAGR of 14.5% during the forecast period.

Enquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/3633

Based on region, North America accounted for the highest share in 2020, contributing to more than one-third of the total market share, and is projected to continue its leadership status by 2030. However, Asia-Pacific is projected to portray the fastest CAGR of 13.4% during the forecast period.

Leading players of the global financial analytics market analyzed in the research include Deloitte LLP, International Business Machine Corporation, Hitachi Vantara Corporation, Oracle, Microsoft Corporation, SAP SE, Rosslyn Data Technologies, Teradata Corporation, Symphony Teleca Services, Inc., and TIBCO Software, Inc.

Buy Now & Get Exclusive Discount on this Report (190 Pages PDF with Insights, Charts, Tables, and Figures) at: https://www.alliedmarketresearch.com/financial-analytics-market/purchase-options

Covid-19 Scenario:

● The demand for financial analytics services and solutions increased during the Covid-19 pandemic, due to rise in need to take better financial decisions during the times of economic uncertainty.

● Moreover, increase in volume of data generated by different industries and the need to manage this huge amount of data also increased the demand for financial analytics.

Thanks for reading this article, you can also get an individual chapter-wise section or region-wise report versions like North America, Europe, or Asia.

If you have any special requirements, please let us know and we will offer you the report as per your requirements.

Lastly, this report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market.

About Us:

Allied Market Research (AMR) is a market research and business-consulting firm of Allied Analytics LLP, based in Portland, Oregon. AMR offers market research reports, business solutions, consulting services, and insights on markets across 11 industry verticals. Adopting extensive research methodologies, AMR is instrumental in helping its clients to make strategic business decisions and achieve sustainable growth in their market domains. We are equipped with skilled analysts and experts and have a wide experience of working with many Fortune 500 companies and small & medium enterprises.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies. This helps us dig out market data that helps us generate accurate research data tables and confirm utmost accuracy in our market forecasting. Every data company in the domain is concerned. Our secondary data procurement methodology includes deep presented in the reports published by us is extracted through primary interviews with top officials from leading online and offline research and discussion with knowledgeable professionals and analysts in the industry.

David Correa

Allied Market Research

+1 800-792-5285

email us here

Visit us on social media:

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.