Tarrant County Commercial Property Values are Up as Commercial Sales Lag

Tarrant County commercial values are up 39% for 2023.

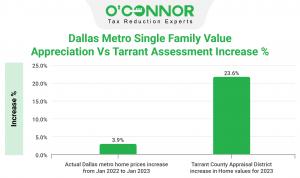

DALLAS, TEXAS, UNITED STATES, May 9, 2023/EINPresswire.com/ -- Tarrant Appraisal District has proposed commercial assessed value increases that average over 39% for apartments, office, warehouse, retail, and hotel properties. This is above the average increase when comparing Tarrant County to Brazoria, Bexar, Collin, Dallas, Denton, Fort Bend, Hidalgo, Lubbock, Nueces, and Harris counties. O’Connor is currently evaluating data from additional counties and will release more findings as they become available.Tarrant County is higher than eight of the other counties evaluated with an average commercial assessment increase of 39.09%. When compared to other counties within the Dallas metropolitan area, Tarrant County is behind Denton County, where commercial assessed value is up an average of 49.22%. However, Tarrant County has higher average increases in commercial value assessments than Collin County and Dallas County who are up 31.70% and 27.79%, respectively. Hotel property owners in Tarrant County are likely the most appalled at the 2023 assessments. Tarrant County hotel properties are up in assessed value by over 80%!

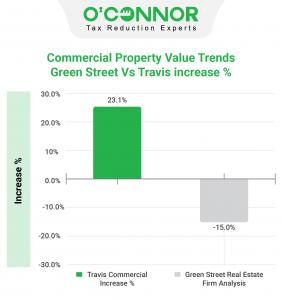

There is a gap of almost 50% between the estimated commercial values reported in the Green Street Commercial Price Index (April 6, 2023) and Tarrant County commercial assessment increases for 2023. Green Street shows values down while TAD shows values up 39%.

While the Tarrant Appraisal District assessment increases for commercial properties are enormous, they are inconsistent with the trends for commercial property values both in Tarrant County, Texas, and the U.S. Commercial real estate values plummeted in 2022 due primarily to large increases is capitalization rates. (Capitalization or cap rate move inversely with value. The higher the cap rate, the lower the value. The rates for 10-year treasuries rose from 1.76% to 3.55%. Cap rates increase when 10-year-treasuries increase.)

There is gulf between the top price commercial property buyers are willing to pay and the amount the sellers can accept, and this is creating a slump in the commercial real estate market. Sales are off between 70 to 80%. Commercial owners are only selling when forced, with most choosing to wait out the market for more favorable conditions.

Inflation, higher insurance costs which have hit coastal areas the most, and higher property taxes are the primary factors influencing this sluggish commercial real estate market. Given these trends, it is hard to see how Tarrant County can rationalize the substantial increases in commercial property tax assessments.

There is no reprieve for Tarrant County commercial owners with property of any age range, however value assessments are up the most for property constructed in 2001 and later. These values are up a whopping 35.7%. Owners with property built between 1961 and 1980 are similarly grieved with values increasing by 35.4%.

Tarrant County commercial property owners with property in the range of $1M to $5M may think they are stinging from seeing their assessments go up by over 20%, but owners with property valued at $5M and higher are seeing sky-high assessed values of 37.4%.

With an average increase of 39.7% for assessment on Tarrant County apartments, it shouldn’t be a shock that there are property owners receiving even higher increases for 2023, but that is little comfort to those who own property built between 1961 and 1980. Assessed values for this age range are up over 40%.

Tarrant County commercial office property owners are seeing increases below average for commercial property at around 10% increase in assessed values. When reviewing office property by age range, it is again property constructed in the era of 1961 to 1980 where values have gone up the most.

Breaking from the trend, it is the properties built prior to 1960 where retail commercial properties in Tarrant County are seeing the largest bumps in value assessments. Owners of these retail properties face increases of over 35%.

Tarrant County warehouse assessments are up an average of 21.1% for 2023. Property owners with the most substantial growth to their assessed values are those with warehouses built before 1960 (up 28%) and those with newer warehouses built in 2001 and since (up 24.7%).

O’Connor has analyzed office property value increases by property subtype and while this group of commercial properties is not seeing the radical hikes seen by other commercial properties, medical offices are clearly hardest hit among office property owners. Tarrant County medical office properties are up 15.4% for 2023.

At an average increase of over 40%, Tarrant County apartment property owners are likely to be more than just a little annoyed. This doesn’t begin to describe the feeling of property owners with senior living apartments, where assessed values in 2023 have skyrocketed almost 53%!

When breaking down the Tarrant County increase in values by retail property subtypes, neighborhood shopping centers are being clobbered with assessed value increases of 25.3%.

The average rise in assessed value for Tarrant County commercial warehouse property is around 19%, but when comparing self-storage warehouses and standard warehouses, there is a distinct difference in the level of increase, with increases of 11.9% and 20% respectively.

The protest deadline is May 15, 2023. Whether you are a residential or commercial property owner, protest now to be certain you don’t miss the deadline. There are three steps to the appeal process: informal, formal or appraisal review board, and judicial. O’Connor expects record reduction in Tarrant County tax assessments for 2023.

Remember, you do not have to accept the new appraisal value, it is a property owner’s right to appeal. Don’t pay more than your fair share. Record levels of property tax protest are expected to follow.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Join the Property Tax Protection Program™ and O’Connor will do if for you for half the savings. Call / or enroll on line; relax; and save. We helped owner save over $170 million in property taxes in just 2022.

Patrick O'Connor, President

O'Connor

713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube