Dividend Announcement: Shelton Equity Income Fund (EQTIX)

The Fund seeks to invest in dividend paying stocks and seeks to create additional income by writing covered calls on its holdings.

Currently, the Fund’s 12-month Trailing Yield (7.68%) is in the top 1% of its Morningstar Large Value category as of (6/30/21).”

DENVER, CO, UNITED STATES, July 19, 2021 /EINPresswire.com/ -- The Shelton Equity Income Fund (EQTIX) declared a dividend of $ 0.4652 per share payable to shareholders of record as of June 30, 2021.— Shelton Capital Management

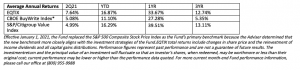

EQTIX has paid dividends since 1996. Currently, the Fund’s 12-month Trailing Yield (7.68%) is in the top 1% of its Morningstar Large Value category as of (6/30/21). It also received an Overall Morningstar RatingTM of 4 stars among 1,141 Large Value funds, based on risk-adjusted returns, as of 6/30/2021.

The Fund seeks to invest in dividend paying stocks and seeks to create additional income by writing covered calls on its holdings.

For more information on the Shelton Equity Income Fund (EQTIX), click here.

About Shelton Capital Management

Shelton Capital Management is a multi-strategy asset manager delivering sophisticated investment solutions and acts as a co-fiduciary on employer-sponsored retirement plans as a 3(38) advisor. Founded in 1985, Shelton Capital Management has maintained consistent investment principles and a steadfast focus on authentic customer service. Shelton Capital Management manages over $3.8 billion of assets as of June 30, 2021. For additional information, please call (800) 955-9988.

Important Information

Investors should consider a fund’s investment objectives, risks, charges, and expenses carefully before investing. The prospectus contains this and other information about the fund. To obtain a prospectus, visit www.sheltoncap.com or call (800) 955-9988. A prospectus should be read carefully before investing.

It is possible to lose money by investing in a fund. Past performance does not guarantee future results. Any projections or other forward-looking statements regarding future events or performance of markets, companies, or otherwise are not necessarily indicative or differ from, actual events or results.

2021 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Investments in derivatives may be risker than other types of investments. They may be more sensitive to changes in economic or market conditions than other types of investments. Many derivatives create leverage, which could lead to greater volatility and losses that significantly exceed the original investment. Positions in equity options can reduce equity market risk, but can limit the opportunity to profit from an increase in the market value of stocks in exchange for upfront cash as the time of selling the call option. Unusual market conditions or the lack of a ready market for any particular option at a specific time may reduce the effectiveness of option strategies and could result in losses.

Distributed by RFS Partners, a member of FINRA and affiliate of Shelton Capital Management.

INVESTMENTS ARE NOT FDIC INSURED OR BANK GUARANTEED AND MAY LOSE VALUE.

Morrison Shafroth

Momentum

+1 720470-3653

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.