UAE Experiential Learning Market Outlook to 2025 - E-Learning Segment Paving Ways for International Players to Expand

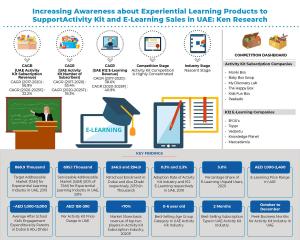

UAE K12 E-Learning Market and Kid’s Activity Kit Subscription Market to be valued AED 250 Million and AED 5.4 Million respectively by 2025 - Ken Research

UNITED ARAB EMIRATES ( UAE ), December 14, 2020 /EINPresswire.com/ -- • Changing lifestyle with increasing number of dual working parents and kids spending majority of time with house-helps has led to increasing need of self-engaging, fun and educational solution such as activity kits.• Activity kit demand expected to thrive with increasing foreign competition and introduction of educational curriculum and skill development based activity boxes.

• UAE E-Learning industry is gaining traction due to increasing marketing efforts by Indian companies and with entry of offline institutes in online coaching.

Increasing Foreign Competition and Re-Engineering Activity Box Themes: Due to presence of large number of expats in UAE, Indian companies such as Flinto and Magic Crate are already supplying activity kits in UAE. Unlike local companies in UAE these companies have a strong sale and marketing strategy and can therefore expand easily in the country. Xplorabox also have plans to expand in GCC. Majority of the existing activity kits are based on art & craft theme and are therefore used just as a fun activity. Increasing awareness about “Learning by Doing” methodology in schools will lead to increase in traction towards curriculum aligned boxes which can help in delivering education in a fun way. Demand from older age groups will also increase with inclusion of interesting themes such as math, science, robotics, coding, etc and by making the activities difficult and interesting.

Increasing Sales of Activity Kit through B2B2C Partnerships:

Majority of companies have small teams and therefore rely on social media and word-of-mouth for marketing. However schools can be the best platform to market their product as the adoption rate of educational products suggested by school or teachers is always high. Companies can enter into commission partnership with schools and pre-schools to increase their sales. For instance, My Discovery Lab provides 10% commission to its school partners for every lead and in exchange it provides free assemblies, prizes for STEAM excellence, parent workshops, and support with partner school’s STEAM curriculum.

Introduction of Coding and Arabic Courses by E-Learning Companies: Irrespective of the curriculum, Arabic is a compulsory subject in all government as well as private schools in UAE. Expats students usually have to join a additional Arabic coaching classes as their parents are also not able to help them with the subject. E-Learning Players can takeover or partner with an existing Arabic Coaching institute such as Appy kids, Keefak, Inlingua and others to introduce Arabic coaching. Increasing awareness of vocational courses for kids have lead to increase in demand of coding courses. There are various offline coding & computers training centers such as Shinning Star, Sylvan Learning, Witty Learning and online players such as Coding Circle, Penrose, Code Monkey, etc in UAE. BYJU’s Toppr and Vedantu are expected to launch their coding courses WhitHatJr, Toppr Codr and Vedantu Superkids in UAE.

Analysts at Ken Research in their latest publication " UAE Experiential Learning Market Outlook to 2025- Concentrated Activity Box and E-Learning Segment Paving Ways for International Players to Expand" observed that existing experiential learning industry in UAE has multiple gaps which can filled by introduction of an integrated solution that enables curriculum based learning along with skill based learning with the help of multiple methods including activity boxes, educational videos, stories, books, games, quizzes and one-o-one classes. The activity kit industry and K12 E-Learning industry is expected to grow at CAGR (2020-2025) 22.2% and 40.9% respectively.

For More Information on the research report, refer to below link: -

https://www.kenresearch.com/education-and-recruitment/education/uae-experiential-learning-market-outlook-to-2025/392125-99.html

Key Segments Covered: -

K8 Activity Kit Industry Revenue By Age Group

0-3 years

4-6 years

7-9 years

10-14 years

K8 Activity Kit Industry Revenue By Subscription Type

1 Month

2 Month

3 Months

6 Months

12 Months

Others (4 Month, 8 Month & 9 Month)

K8 Activity Kit Industry Revenue By Emirate

Dubai

Abu Dhabi

Sharjah

Others (Ajman, Umm Al Quwain, Ras Al Khaimah and Al Fujairah)

K12 E-Learning Industry Revenue By Grade

UKG- Grade 3

Grade 4-5

Grade 6-8

Grade 9-12

Key Target Audience

E-Learning Companies

Activity Kit Companies

Toy Companies

Schools

Pre-Schools

Government Authority

Time Period Captured in the Report:

Historical Period: 2017-2020

Forecast Period: 2020-2025

Companies Mentioned:

UAE Activity Kit Subscription Competitive Ecosystem

Monki Box

Baby Box Swop

My Discovery Lab

The Happy Box

Kids Fun Box

Peekado

UAE K12 E-Learning Competitive Ecosystem

BYJU’s

Toppr

Vedantu

Knowledge Planet

Meccademia

Key Topics Covered in the Report: -

Target Addressable Audience, Serviceable Addressable Market and Share of Market for Experiential Learning

Snapshot of Dubai Education Industry

Snapshot of Abu Dhabi Education Industry

Existing Gaps in Experiential Learning Industry

Supply Ecosystem

Business Model Analysis in Activity Kit Industry

Revenue Streams in Activity Kit Industry

Organizational Structure of Activity Kit Company

Case Studies of Offline Players Providing Experiential Learning in UAE such as Sylvan Learning Dubai and Metamindz

Porter Five Force Analysis for Activity Kit Industry and E-Learning Industry

BCG Matrix for Activity Kit Industry

Impact of COVID

Demand Side Survey Analysis

Analyst Recommendation

GTM Strategy for a New Entrant (Market Potential, Target Audience Bracketing, Product Positioning, Product Pricing Strategy, Marketing and Customer Acquisition Strategy and Potential Risks)

Related Reports by Ken Research: -

https://www.kenresearch.com/education-and-recruitment/education/india-experiential-learning-market-outlook-to-2025/373312-99.html

https://www.kenresearch.com/education-and-recruitment/education/saudi-arabia-e-learning-market-outlook-to-2025/348335-99.html

https://www.kenresearch.com/education-and-recruitment/education/covid-impact-on-ed-tech-india/348336-99.html

Contact Us: -

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ankur Gupta

Ken Research Private limited

+91 9015378249

ankur@kenresearch.com

Visit us on social media:

Facebook

Twitter

LinkedIn