Michigan Firm Offers Zero Fees Planning and Investment Management for Clients Amid COVID-19 Crisis

Dewey Steffen, CEO & Chief Investment Officer, Great Lakes Wealth

Great Lakes Wealth offering “No Fee” Planning and Investment Management to Help Ease the Financial Impact of Public Health Crisis

The best way we can give back right now is by making it easier for people to invest in their future by saving them money on professional management fees over the next 12 months.”

DETROIT, MICHIGAN, USA, May 19, 2020 /EINPresswire.com/ -- Northville, Michigan based Great Lakes Wealth is offering to waive fees for up to one year in response to the financial impact of the COVID-19 pandemic being felt by so many Americans.— Dewey Steffen, Great Lakes Wealth CEO and Chief Investment Officer

The firm, who has been offering pro bono financial tips and charitable support for small businesses and frontline workers since the pandemic began, is offering to waive fees on financial planning and investment management for up to one year for new and existing clients now through June 30, 2020.

“This pandemic has exemplified, among other things, the importance of having a plan and a financial safety net,” said Dewey Steffen CEO and Chief Investment Officer of Great Lakes Wealth. “The best way we can give back right now is by making it easier for people to invest in their future by saving them money on professional management fees over the next 12 months.”

The No Fee offer includes investment management and a free goals-based financial plan, targeted for college planning, insurance planning, estate planning and retirement planning, an area that has been hit especially hard by COVID-19.

The US Stock market has taken a beating and millions have lost jobs due to the pandemic, which has put a strain on retirement accounts and people’s ability to save for retirement.

“Many people have found themselves out of a job during this current crisis but some, luckily, have assets in a retirement plan,” said Steffen. “And now, with the passage of the CARES Act, individuals affected by COVID-19 can withdraw up to $100,000 from their employee-sponsored retirement accounts like 401(k)s without penalty, creating a fantastic opportunity to get economic relief. This is a big deal! Typically, the penalty for withdrawing from a 401(k) before the age of 59 ½ is 10% of the distribution. However, a coronavirus-related distribution (CRD), when done appropriately, will waive the penalty and the taxes due. For a limited time, these individuals can now not only rebuild their retirement accounts without penalties or taxes but, with our offer, have access to our investment management and professional planning without fees, too.”

Steffen said having a plan helps people feel more in control, especially in times of crisis. He said Great Lakes Wealth advisors have been working overtime to both council fears and help their clients adapt plans to the constantly changing pandemic environment.

“This pandemic has changed everything in life, including the way we think about personal finances,” said Steffen. “Waiving fees is fairly unprecedented, but these are unprecedented times and we hope to help investors thrive, instead of just survive, the financial impacts of this pandemic.”

For Zoom/Skype interviews and media inquiries please contact Sherrie Handrinos at Sherrie@boostonemarketing.com or call 734-341-6859.

About Great Lakes Wealth

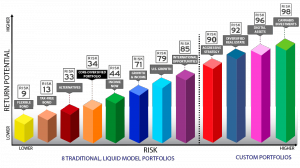

Great Lakes Wealth proudly combines Wall Street solutions with Main Street values to bring common-sense investing to clients around the globe. The Metro Detroit based wealth management firm offers goals-based financial planning, superior asset and wealth management solutions, and concierge-style client service to create customized portfolios that meet the unique financial needs of clients of all sizes in an ever-changing world. Great Lakes Wealth is an award-winning firm that prides itself on community leadership, social responsibility and client-centric service. For more information visit https://www.greatlakeswealth.us or call (248) 378-1200.

Great Lakes Wealth, LLC is a Registered Investment Advisor. The information provided is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Great Lakes Wealth and its representatives are properly licensed or exempt from licensure. No advice may be rendered without a service agreement in place. Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC Headquartered at 18 Corporate Woods Blvd., Albany, NY 12211. Purshe Kaplan Sterling Investments and Great Lakes Wealth are not affiliated companies.

Sherrie Handrinos

Boost 1 Marketing, LTD

+1 734-341-6859

email us here