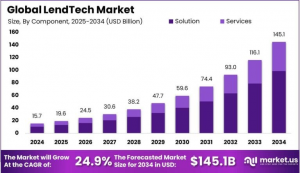

LendTech Market Projected to Grow USD 145.1 billion by 2034, at a robust CAGR of 24.9%, Read Why...

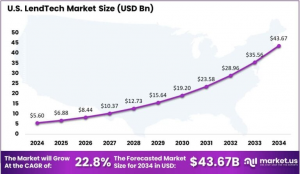

In 2024, North America accounted for over 38% of the total LendTech market share, equating to a revenue of approximately USD 5.9 billion...

These technologies enhance credit assessments and risk management, leading to more efficient and customer-focused lending services. In 2024, North America captured over 38% of the total market share, attributed to advanced technology infrastructures and high fintech adoption rates.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=140324

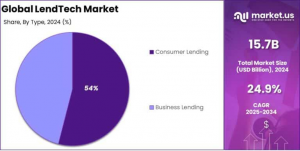

Key market components are divided into solutions and services, with the solution segment dominating over 68% of the market in 2024 due to the reliance on automated tools that streamline the lending process. Consumer lending, including personal loans and mortgages, play significant roles in this growth, driven by the shift towards online platforms providing faster approvals and competitive rates.

The market's growth is also supported by trends towards digital financial services2 reshaping traditional lending models. As regulatory environments evolve, they encourage innovation and technology integration, fostering a landscape where LendTech companies drive financial inclusion and access to credit for underserved populations.

Experts Review

Industry experts highlight the transformative impact of technological innovations on the LendTech market, which enhances efficiency and expands access to financial services. The integration of AI and machine learning has improved the accuracy and speed of credit risk assessments, enabling more precise loan approvals. This shift is empowering fintech companies and traditional lenders to offer personalized and flexible lending solutions, addressing consumer demands for faster and more convenient services.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=140324

Despite its growth potential, the LendTech industry faces significant regulatory challenges. As digital lending platforms often fall into regulatory gray areas, compliance across multiple jurisdictions becomes complex and costly. This complexity may deter new market entrants and slow the growth of existing players.

Opportunities within LendTech arise from its ability to significantly extend financial inclusion to underserved groups by utilizing alternative data sources for credit scoring. This opens up new lending opportunities, particularly in emerging markets where conventional banking infrastructures are underdeveloped.

The market also faces cybersecurity risks due to its reliance on digital platforms, making robust security measures critical to maintaining consumer trust and protecting sensitive financial data. Companies must continuously adapt to evolving threats to secure their platforms, ensuring data integrity and customer satisfaction.

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://market.us/purchase-report/?report_id=140324

Report Segmentation

The LendTech Market segmentation includes component, type, enterprise size, and end-user categories, which collectively illustrate the market's comprehensive outlook. The component breakdown comprises solutions and services, where solutions such as loan origination systems and automated underwriting hold a significant share due to their efficiency and cost-reduction benefits.

Types of lending include consumer (e.g., personal loans, mortgages) and business lending (e.g., commercial loans, trade finance), each addressing different market needs. Consumer lending is driven by the increasing demand for convenient, online borrowing options, simplifying the traditional loan process.

Enterprise size segmentation examines SMEs and large enterprises. In 2024, SMEs held over 51% of the market share. Their growth is fueled by the LendTech platforms offering flexible lending solutions not typically available through traditional banks, facilitating quick funding and competitive interest rates.

End-users in the market include banks, credit unions, and non-banking financial companies. As these institutions integrate LendTech to enhance user experiences, they drive further adoption and innovation across the sector, highlighting the importance of digital transformation in financial services.

These segments demonstrate LendTech’s adaptability and strategic potential for addressing diverse consumer and business needs within the digital lending landscape.

🔴 𝐓𝐨 𝐆𝐚𝐢𝐧 𝐠𝐫𝐞𝐚𝐭𝐞𝐫 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/lendtech-market/free-sample/

Drivers, Restraints, Challenges, and Opportunities

Key drivers of the LendTech market include the rapid adoption of digital lending platforms, fueled by the increasing shift to online and mobile financial services. The demand for personalized, efficient lending experiences is pushing companies to invest in AI and data analytics to streamline credit processes.

Despite the market’s positive trajectory, regulatory challenges remain a significant restraint. As LendTech models evolve, they often face inconsistent regulatory policies across different regions. The lack of standardization can lead to complexities in compliance, increasing operational costs and potentially hindering market expansion.

In addition, cybersecurity risks pose significant challenges. The digital nature of LendTech solutions makes them attractive targets for cyberattacks, endangering consumer trust and company credibility. Implementing robust cybersecurity measures is essential to mitigate these risks and ensure consumer protection.

Despite these challenges, the market offers substantial opportunities, particularly in expanding financial inclusion. By leveraging alternative data sources for credit assessment, LendTech platforms can reach underserved populations, providing access to financial services previously unavailable through traditional banking channels. This ability to broaden market reach and include unbanked individuals underscores the transformative potential of LendTech in reshaping financial services globally.

These dynamics reflect the complex landscape in which LendTech firms operate, balancing innovation with regulatory compliance and security needs.

Key Player Analysis

Key players in the LendTech market include Nelito Systems Ltd., Tavantas, and Visa, Inc., each contributing significantly to the industry’s growth through innovation and strategic advancements.

Nelito Systems is a prominent player, offering comprehensive software solutions that enhance the efficiency of financial institutions. Their suite includes loan origination systems and core banking solutions, crucial for improving loan processing accuracy and speed.

Tavantas specializes in digital lending solutions catering to both traditional and emerging fintech companies, providing flexible and innovative tools that adapt to changing market demands.

Visa, Inc., while primarily known for payment processing, has ventured into the digital lending space, offering solutions that streamline credit processes and enhance consumer lending experiences. Their entry into LendTech highlights the convergence of payment networks and lending technologies, fostering greater flexibility and integration.

These companies are driving market dynamics by leveraging technology to improve financial services, maintaining leadership through continuous innovation and by addressing the evolving needs of consumers and businesses.

Recent Developments

Recent developments in the LendTech market illustrate strategic enhancements and technological adoptions. In November 2024, Moody's Corporation acquired Numerated Growth Technologies, seeking to enhance its LendTech solutions with robust data analytics capabilities across various asset classes. This acquisition underscores the trend of integrating advanced analytics in lending platforms to enhance risk assessment and decision-making processes.

In February 2025, Massachusetts’ Enterprise Bank implemented Newgen Software’s commercial lending solution, designed to streamline lending processes using a low-code platform. This implementation marks a significant step in enhancing operational efficiency and customer service within traditional banking frameworks.

These advancements highlight the strategic focus within the industry on leveraging technology to innovate and improve lending processes. They reflect ongoing efforts to enhance customer experiences and operational efficiencies in a rapidly evolving market landscape, emphasizing the role of technology in driving the future of financial services.

Conclusion

The LendTech market is poised for significant growth, driven by technological advancements in digital lending platforms and the broader shift towards online financial services. While regulatory complexities and cybersecurity threats present challenges, the opportunities to enhance financial inclusivity and streamline banking processes are vast.

Key players like Nelito Systems, Tavantas, and Visa, Inc., are at the forefront, implementing innovative solutions that reshape lending landscapes. As demand for efficient, customer-centric financial services continues to rise, LendTech is well-positioned to lead the digital transformation within the global finance sector, promising a dynamic future.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

Predictive Dialer Software Market - https://market.us/report/predictive-dialer-software-market/

Agentic AI in HR & Recruitment Market - https://market.us/report/agentic-ai-in-hr-recruitment-market/

Voice Commerce Market - https://market.us/report/voice-commerce-market/

Digital Signage in Banking & Finance Market - https://market.us/report/digital-signage-in-banking-finance-market/

AI in Robotic Platforms Market - https://market.us/report/ai-in-robotic-platforms-market/

Edge AI in Retail Market - https://market.us/report/edge-ai-in-retail-market/

AI Microcontroller Market - https://market.us/report/ai-microcontroller-market/

Network Forensics Market - https://market.us/report/network-forensics-market/

Semiconductor Radiation Detector Market - https://market.us/report/semiconductor-radiation-detector-market/

AI Accelerator Market - https://market.us/report/ai-accelerator-market/

Europe Creator Economy Market - https://market.us/report/europe-creator-economy-market/

AI Vulnerability Scanning market - https://market.us/report/ai-vulnerability-scanning-market/

Green Outsourcing in BPO Market - https://market.us/report/green-outsourcing-in-bpo-market/

Digital Cross-Border Remittance Market - https://market.us/report/digital-cross-border-remittance-market/

Aerospace Semiconductor Market - https://market.us/report/aerospace-semiconductor-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

1 https://market.us/report/lendtech-market/

2 https://market.us/reports/banking-financial-services/

3 https://market.us/report/digital-lending-platform-market/