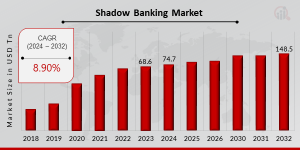

Shadow Banking Market Size Worth USD 148.5 Billion By 2032 | Growth Rate (CAGR) of 8.90%

Shadow Banking Market Research Report By, Type, Asset Class, Regulation, Leverage, Regional

UT, UNITED STATES, January 29, 2025 /EINPresswire.com/ -- The global Shadow Banking Market1 has experienced remarkable growth and is expected to continue expanding at a significant rate over the next decade. In 2023, the market size was estimated at USD 68.6 trillion, and it is projected to grow from USD 74.7 trillion in 2024 to USD 148.5 trillion by 2032, reflecting a strong compound annual growth rate (CAGR) of 8.90% during the forecast period (2024–2032). This growth is primarily driven by increasing demand for alternative financial services, financial market innovation, and evolving regulatory frameworks.Key Drivers of Market Growth

Increasing Demand for Alternative Financial Solutions

With traditional banking institutions facing stricter regulations, shadow banking has emerged as a popular alternative for individuals and corporations seeking financing options. The ability to provide loans and financial products outside of traditional banks has been a key driver for the sector, especially in regions where banks’ lending capacity is limited.

Expansion of Non-Banking Financial Institutions

Non-bank financial intermediaries, including asset managers, pension funds, and insurance companies, are playing an increasingly important role in the shadow banking system. These institutions offer more flexible terms, tailored financial products, and enhanced efficiency compared to traditional banks, thereby boosting the growth of the market.

Regulatory Arbitrage and Innovation

The global financial crisis of 2008 led to an increase in regulatory measures, causing financial institutions to seek alternatives that provide more flexibility. Shadow banking allows institutions to bypass stringent regulations, fostering market growth. Moreover, ongoing innovations in financial products, such as securitization, asset-backed securities, and money market funds, continue to drive the market.

Globalization of Financial Markets

The increasing interconnection of global financial markets has allowed shadow banking to expand across borders. With investors looking for new opportunities in diverse regions, shadow banking has become an attractive avenue for capital flow, particularly in emerging economies where financial markets are less regulated.

Technological Advancements

The integration of technology, such as blockchain and artificial intelligence, is transforming the shadow banking landscape. These technologies are improving transaction speed, transparency, and security, making shadow banking services more appealing to a wider audience.

Download Sample Pages https://www.marketresearchfuture.com/sample_request/23999

Key Companies in the Shadow Banking Market

• ING Group

• Citigroup

• HSBC

• Barclays

• Wells Fargo

• Deutsche Bank

• JPMorgan Chase

• UBS

• Nomura

• Morgan Stanley

• Credit Suisse

• Royal Bank of Canada

• Goldman Sachs

• Bank of America

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/shadow-banking-market-23999

Market Segmentation

To provide a detailed analysis, the shadow banking market is segmented by type, region, and services offered:

1. By Type

Asset Management: Investment funds, pension funds, and hedge funds managing private capital.

Structured Finance: Securitization, collateralized debt obligations (CDOs), and mortgage-backed securities.

Money Market Funds: Short-term, low-risk investments often used for liquidity management.

Peer-to-Peer Lending: Platforms facilitating loans directly between borrowers and lenders.

2. By Region

North America: Leading market due to the presence of major financial institutions and increasing adoption of alternative financing solutions.

Europe: Strong market growth is driven by financial market innovations, evolving regulations, and expanding non-bank financial intermediaries.

Asia-Pacific: Rapid growth in shadow banking due to increasing urbanization, rising disposable incomes, and an expanding middle class.

Rest of the World (RoW): Steady growth is expected in Latin America, the Middle East, and Africa due to rising demand for financial services in developing economies.

3. By Services Offered

Lending Services: Including corporate loans, personal loans, and peer-to-peer lending.

Investment Services: Covering hedge funds, mutual funds, and private equity.

Trading and Securitization: Including the sale and purchase of securities, derivatives, and collateralized debt products.

Asset Management: Encompassing fund management and portfolio services.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23999

The global shadow banking market is poised for substantial growth, driven by increasing demand for alternative financial services, ongoing technological advancements, and the expansion of non-bank financial institutions. As regulatory pressures on traditional banks intensify and financial markets continue to evolve, the shadow banking sector will play a crucial role in shaping the future of global finance. With opportunities spanning various regions and sectors, the shadow banking market will remain a pivotal part of the global financial landscape.

Related Report:

Marine Cargo Insurance Market

https://www.marketresearchfuture.com/reports/marine-cargo-insurance-market-24797

Fintech Cloud Market

https://www.marketresearchfuture.com/reports/fintech-cloud-market-23345

Cloud Security in Banking Industry Market

https://www.marketresearchfuture.com/reports/cloud-security-in-banking-market-31516

BFSI A2P SMS Market

https://www.marketresearchfuture.com/reports/bfsi-a2p-sms-market-38653

Internet of Things (IoT) in BFSI Market

https://www.marketresearchfuture.com/reports/internet-of-things-in-bfsi-market-39115

About Market Research Future

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

1 https://www.marketresearchfuture.com/reports/shadow-banking-market-23999