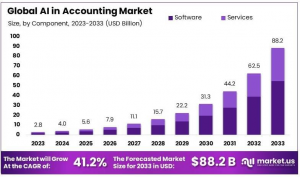

AI in Accounting Market to Hit Nearly USD 88.2 Billion by 2033, North America dominates with 32% Share

The Global AI in Accounting Market is projected to reach USD 88.2 Billion by 2033, growing at a CAGR of 41.2% during the forecast period from 2024 to 2033.

Software dominates the component segment with 62% due to its essential role in automating accounting tasks and improving accuracy.

”

NEW YORK, NY, UNITED STATES, January 28, 2025 /EINPresswire.com/ -- According to the research conducted by Market.us, The Global AI in Accounting Market1 is poised for remarkable growth, projected to reach USD 88.2 billion by 2033, up from USD 2.8 billion in 2023, reflecting a staggering compound annual growth rate (CAGR) of 41.2% from 2024 to 2033. North America, capturing 32% of the market share with a valuation of USD 0.896 billion, stands out due to its robust technological infrastructure and the high concentration of tech companies specializing in artificial intelligence.— Tajammul Pangarkar

The integration of Artificial Intelligence (AI) in accounting is revolutionizing the way financial data is managed and processed. By automating complex and time-consuming tasks, AI technologies are enhancing accuracy and efficiency, allowing accountants to focus on more strategic elements of their roles. This shift is driven by the increasing demand for real-time data processing and the need for more sophisticated financial analysis.

Several factors are accelerating AI adoption in accounting. The growing complexity of financial regulations requires more accurate and efficient compliance, which AI can streamline. Additionally, the competitive business landscape drives firms to seek efficiencies and cost savings, areas where AI excels. Moreover, advancements in machine learning and natural language processing have enhanced AI's accessibility and effectiveness for accounting functions.

👉 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/purchase-report/?report_id=125529

Market demand for AI in accounting is on the rise as businesses of all sizes seek to enhance decision-making and improve financial reporting. Small and medium enterprises (SMEs) are particularly keen on adopting AI solutions to gain a competitive edge and manage their finances more effectively. Moreover, as cloud-based AI solutions become more prevalent, the barriers to entry are lowering, making these technologies accessible to a broader range of companies.

Investors and key stakeholders in the AI accounting market include tech giants who are developing AI solutions, venture capitalists who fund innovative startups, and accounting firms eager to integrate these new technologies into their services. Additionally, software developers specializing in financial applications are also significant players, as they create tailored AI tools that meet the specific needs of accountants and financial analysts.

Key Takeaways

➤The AI in Accounting market, valued at USD 2.8 billion in 2023, is projected to reach USD 88.2 billion by 2033, growing at a CAGR of 41.2%.

➤Software leads the component segment with 62%, driven by its key role in automating tasks and enhancing accuracy in accounting.

➤Cloud deployment holds 65.3% of the market, fueled by demand for secure, scalable, and easily accessible solutions.

➤Invoice Processing leads the application segment with 25%, as businesses seek to automate invoice management and reduce errors.

➤SMEs represent 58% of the market in terms of organization size, showing a surge in AI adoption to optimize accounting processes.

➤North America dominates with 32% share, supported by a strong presence of AI tech providers and early adoption in accounting.

👉 𝐂𝐥𝐢𝐜𝐤 𝐭𝐨 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐧𝐝 𝐃𝐫𝐢𝐯𝐞 𝐈𝐦𝐩𝐚𝐜𝐭𝐟𝐮𝐥 𝐃𝐞𝐜𝐢𝐬𝐢𝐨𝐧𝐬: https://market.us/report/ai-in-accounting-market/free-sample/

Analyst's Viewpoint

Market Opportunities and Risks

Artificial Intelligence (AI) in accounting is reshaping financial processes with significant improvements in accuracy, speed, and analytical capabilities. Key applications such as financial forecasting and cash flow management are leveraged by AI to enhance decision-making and optimize resource allocation. AI models use historical data and market conditions to predict financial outcomes, thereby allowing businesses to make proactive adjustments.

However, the integration of AI also introduces certain risks. There is the potential for "hallucinations" or inaccurate outputs not based on the actual data, alongside challenges in managing the privacy and security of vast data pools accessed by AI systems. The sophistication of AI can also enable fraudulent activities like phishing and forgery on a larger scale, necessitating robust oversight and preventive measures.

Key Applications

AI's adoption in accounting spans several critical areas. Automated bookkeeping, invoice classification, and enhanced reporting are pivotal, simplifying traditional accounting tasks and reducing the workload on human accountants. These technologies allow firms to focus more on strategic planning and less on mundane tasks.

Consumer Awareness and Regulatory Environment

Consumer awareness about the benefits and implications of AI in accounting is growing, prompting more businesses to adopt these technologies. However, this shift requires a careful balancing act with regulatory compliance, such as adhering to standards like GDPR and SOXA, to ensure that AI tools in accounting maintain high ethical standards and transparency.

Regulatory Environment

The regulatory landscape is also evolving with the technology. As AI tools become more integral to accounting practices, regulations are being updated to ensure that these technologies are used responsibly. Ensuring that AI applications comply with current regulations and ethical guidelines is crucial for maintaining trust and integrity in financial reporting and auditing.

👉 𝐃𝐫𝐢𝐯𝐞 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐆𝐫𝐨𝐰𝐭𝐡 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲: 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐟𝐨𝐫 𝐊𝐞𝐲 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 @ https://market.us/purchase-report/?report_id=125529

Impact Of AI

Automation and Efficiency: AI is transforming traditional accounting tasks, such as data entry, account reconciliations, and financial reporting, by automating these processes. This not only speeds up operations but also reduces the incidence of human error, leading to more accurate financial statements. As a result, accountants can allocate more time to strategic decision-making and consulting roles.

Predictive Analytics and Decision Making: AI enhances financial forecasting by analyzing historical data to identify patterns that can predict future financial performance. This capability allows businesses to make informed decisions faster, allocate resources more efficiently, and mitigate potential risks before they become problematic.

Blockchain Integration: The combination of AI with blockchain technology promises greater transparency and security in financial transactions. Blockchain provides an immutable ledger, which when paired with AI's analytical prowess, ensures accurate, tamper-proof records and facilitates quicker audits.

Client Services and Personalization: AI-driven tools are enhancing the way accounting firms interact with their clients. By using AI for tasks like customer inquiries and report generation, firms can provide personalized service more efficiently. This technology enables faster response times and more customized advice, improving overall client satisfaction.

Regional Analysis

North America is a prominent leader in the AI in Accounting market, holding a substantial 32% share, valued at USD 0.896 billion. This significant market presence can be attributed to the region's advanced technological infrastructure and the dense concentration of tech companies that specialize in artificial intelligence.

The region's established tech ecosystem fuels AI innovation, particularly in accounting. Key hubs like Silicon Valley, Boston, and Toronto attract top talent and investment, driving the development and adoption of AI tools that improve efficiency and accuracy in accounting practices.

North America's regulatory framework supports AI integration in accounting by providing guidelines for ethical use. These standards help businesses implement AI while ensuring compliance and transparency, encouraging more companies to adopt AI solutions and fueling market growth.

👉 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐟𝐨𝐫 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐌𝐞𝐭𝐡𝐨𝐝𝐨𝐥𝐨𝐠𝐲 𝐭𝐨 𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝 𝐎𝐮𝐫 𝐃𝐚𝐭𝐚-𝐬𝐨𝐮𝐫𝐜𝐢𝐧𝐠 𝐏𝐫𝐨𝐜𝐞𝐬𝐬 𝐢𝐧 𝐃𝐞𝐭𝐚𝐢𝐥: https://market.us/report/ai-in-accounting-market/request-sample/

Market Segmentation

Component Analysis

Software plays a crucial role in automating various accounting tasks, such as bookkeeping, reconciliation, and reporting. By reducing manual intervention, it enhances accuracy, reduces human errors, and speeds up processes. These benefits are driving the high demand for AI-powered accounting software, contributing to its market dominance with 62% of the total share in the component segment.

Deployment Mode Analysis

Cloud-based accounting solutions have become highly preferred due to their scalability, accessibility, and security. With cloud deployment, businesses can access their financial data from anywhere and anytime, which is a significant advantage for organizations operating in different regions. Additionally, cloud platforms offer robust security features to protect sensitive financial information.

Application Analysis

Invoice processing is one of the most vital applications of AI in accounting. AI-driven tools automate the extraction and categorization of invoice data, streamlining the invoicing process, and minimizing errors. This automation is essential for improving efficiency and reducing manual workload in handling large volumes of invoices. The high demand for such solutions has helped invoice processing capture 25% of the overall application segment.

Organization Size Analysis

Small and medium-sized enterprises (SMEs) are increasingly adopting AI-powered accounting solutions to streamline their financial management processes. With AI, SMEs can automate repetitive tasks, ensure compliance, and generate insights, which contributes to their market dominance in the organization size segment, making up 58% of the market share.

End-user Industry Analysis

The banking, financial services, and insurance (BFSI) sector has the highest share in the AI accounting market, accounting for 34.7%. This is largely due to the sector's critical need for accuracy, compliance, and regulatory reporting. AI helps BFSI firms automate complex accounting processes, manage large volumes of transactions, and ensure compliance with ever-changing financial regulations.

Emerging Trends

Providing Predictive Insights: AI offers predictive analytics, helping accountants anticipate future financial trends and make informed decisions.

Assisting in Research: Accountants are leveraging AI tools to conduct research more efficiently, accessing relevant information swiftly.

Facilitating Task Automation: AI is being used to automate various workflows within accounting, enhancing overall efficiency.

Attracting Investments: The potential of AI to automate clerical tasks and increase profitability is drawing significant investment into accounting firms.

Reducing Workload: AI tools are helping consultants save time by automating tasks like email drafting and data formatting, allowing them to focus on higher-value activities.

Top Use Cases

Automating Routine Tasks: AI handles repetitive jobs like entering data, processing invoices, and matching accounts. This frees up accountants to focus on more important work.

Improving Audits: AI can quickly review large amounts of data to spot unusual patterns or mistakes, making audits more thorough and efficient.

Summarizing Documents: AI helps by quickly summarizing key points from contracts, invoices, and receipts, making it easier to find important information.

Enhancing Business Communication: AI assists in planning meetings, creating agendas, and drafting emails and reports, helping accounting teams communicate more effectively.

Detecting Fraud: AI monitors transactions in real-time to identify unusual activities, helping to catch fraudulent actions quickly.

Major Challenges

Job Security Concerns: Many accountants worry that AI could make their roles redundant, leading to resistance against adopting new technologies. However, AI is more likely to serve as a helpful tool rather than a replacement.

Data Privacy Issues: Handling sensitive financial information with AI systems raises concerns about data breaches and unauthorized access. It's crucial to have strong security measures to protect this data.

Overdependence on Technology: Relying too much on AI can lead to complacency, where professionals might trust AI outputs without sufficient human oversight. It's important to balance automation with human judgment.

High Implementation Costs: Setting up AI infrastructure can be expensive, which might discourage some firms from adopting these technologies.

Keeping Up with Rapid Technological Changes: The fast pace of AI advancements makes it challenging for accounting professionals to stay updated and maintain the necessary skills.

Market Opportunities for Key Players

Automation of Repetitive Tasks: AI can automate time-consuming tasks like data entry, reconciliation, and invoicing, reducing human error and freeing up accountants for higher-value work. This enhances efficiency and lowers operational costs. Automation tools powered by AI help firms scale operations while maintaining accuracy, making it easier to serve more clients with fewer resources.

Advanced Data Analytics and Insights: AI-powered analytics can process large datasets to identify trends, anomalies, and financial risks that would be difficult for humans to spot. Accountants can use these insights to provide clients with more strategic advice, from tax planning to risk management. The ability to predict cash flow and analyze market patterns offers a competitive edge for accounting firms.

Enhanced Fraud Detection and Risk Management: AI algorithms can analyze transaction patterns to detect signs of fraud or unusual behavior. With machine learning, these systems can become more accurate over time, helping accounting firms offer proactive risk management services to clients. This feature is increasingly valuable as businesses look to protect themselves from financial crimes.

Client Personalization and Service Improvement: AI enables accounting firms to offer highly personalized services to clients. Using AI chatbots and virtual assistants, firms can provide round-the-clock support, answer client queries, and offer tailored advice based on individual client needs. This improves client satisfaction and strengthens relationships.

𝐆𝐫𝐚𝐛 𝐚𝐧 𝐞𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐬𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭 𝐡𝐞𝐫𝐞 - https://market.us/report/ai-in-accounting-market/free-sample/

Market Companies

- IBM Corporation

- Amazon Web Services Inc.

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Intuit Inc.

- Xero Limited

- Sage Group Plc

- UiPath

- Kore Inc.

- AppZen Inc.

- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers (PwC)

- KPMG International Cooperative

- EY (Ernst & Young)

- Other Key Players

Recent Developments

February 2024: Xero introduced an AI-powered assistant named Just Ask Xero (JAX), which allows users to perform accounting tasks through voice commands. JAX is currently in beta testing and aims to streamline various accounting processes for small businesses by integrating conversational interfaces across multiple platforms.

November 2024: Sage reported a significant revenue increase attributed to its investment in generative AI through the Sage Copilot assistant. This tool automates various accounting tasks and has attracted over 8,000 new customers since its launch. Sage's cloud-native solutions have seen strong growth, highlighting the effectiveness of their AI strategy.

Conclusion

In summary, the integration of AI in accounting is revolutionizing the industry by automating routine tasks, improving accuracy, and increasing efficiency. AI tools such as machine learning and data analytics help accountants process large volumes of data quickly, identify errors, and provide actionable insights. This allows professionals to focus on more strategic decision-making and advisory roles, enhancing the value they bring to businesses.

However, while AI offers numerous benefits, it also presents challenges, including the need for upskilling the workforce and addressing concerns about data privacy and security. Firms must balance AI adoption with human expertise to ensure ethical and effective use. As the technology continues to evolve, its role in accounting will undoubtedly expand, reshaping the future of the profession.

𝑨𝒓𝒆 𝒚𝒐𝒖 𝒄𝒖𝒓𝒊𝒐𝒖𝒔 𝒂𝒃𝒐𝒖𝒕 𝒈𝒆𝒏𝒆𝒓𝒂𝒕𝒊𝒗𝒆 𝑨𝑰 𝒊𝒏 𝒎𝒂𝒓𝒌𝒆𝒕 𝒕𝒓𝒆𝒏𝒅 𝒓𝒆𝒑𝒐𝒓𝒕𝒔? 𝑪𝒉𝒆𝒄𝒌 𝒐𝒖𝒕 𝒕𝒉𝒊𝒔 𝒏𝒆𝒘 𝒓𝒆𝒑𝒐𝒓𝒕 𝒐𝒏 𝒊𝒕𝒔 𝒊𝒎𝒑𝒂𝒄𝒕 𝒐𝒏 𝒕𝒉𝒆 𝒊𝒏𝒅𝒖𝒔𝒕𝒓𝒚.

Generative AI in FMCG Market - https://marketresearch.biz/report/generative-ai-in-fmcg-market/

Generative AI in Learning and Development Market - https://marketresearch.biz/report/generative-ai-in-learning-and-development-market/

Generative AI in Retail Market - https://marketresearch.biz/report/generative-ai-in-retail-market/

Generative AI in CPG Market - https://marketresearch.biz/report/generative-ai-in-cpg-market/

Generative AI in Retail Stores Market - https://marketresearch.biz/report/generative-ai-in-retail-stores-market/

Generative AI in Computer Vision Market - https://marketresearch.biz/report/generative-ai-in-computer-vision-market/

Generative AI In Content Creation Market - https://marketresearch.biz/report/generative-ai-in-content-creation-market/

Generative AI in Energy Market - https://marketresearch.biz/report/generative-ai-in-energy-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

1 https://market.us/report/ai-in-accounting-market/