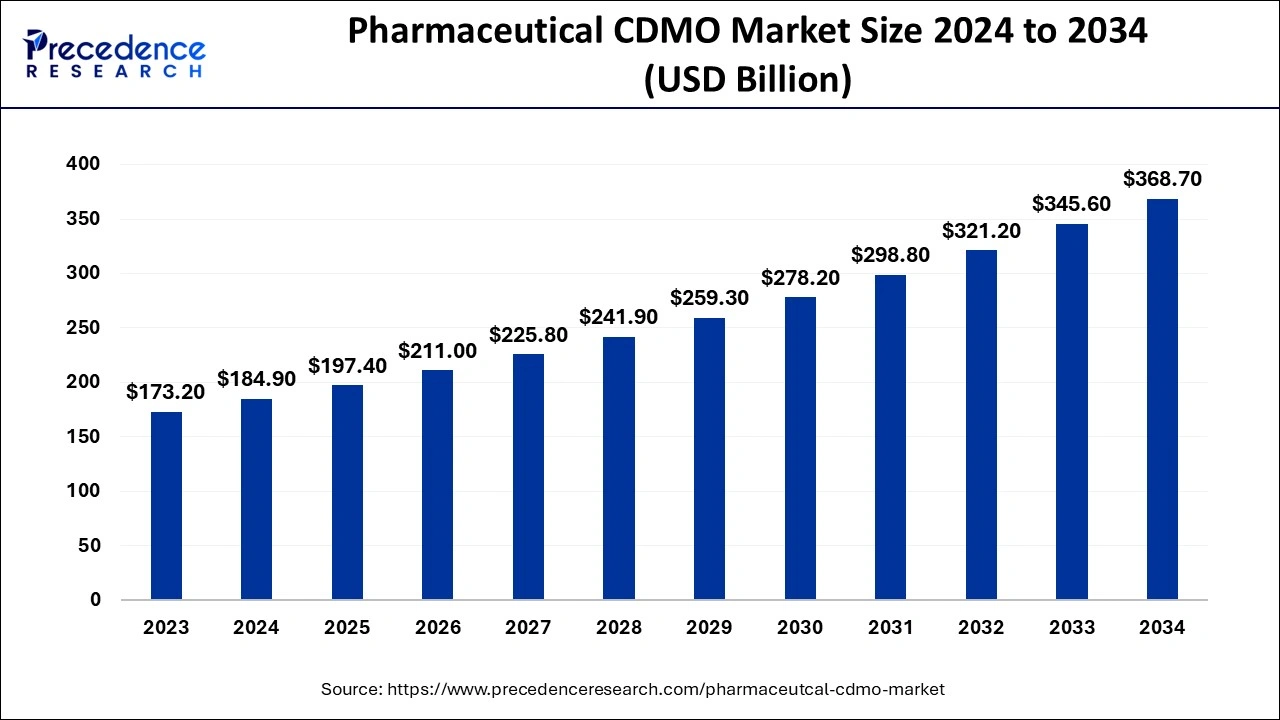

Pharmaceutical CDMO Market Size Projected to Reach USD 368.70 Bn by 2034

The pharmaceutical CDMO market is estimated to grow from USD 197.40 billion in 2025 to approximately USD 368.70 billion by 2034, According to Precedence Research.

Ottawa, Nov. 28, 2024 (GLOBE NEWSWIRE) -- The global pharmaceutical CDMO market size was evaluated at USD 184.90 billion in 2024 and is projected to reach USD 197.40 billion in 2025, with growth expected to reach USD 368.70 billion by 2034, exhibiting a CAGR of 7.2% during the forecast period from 2024 to 2034.

The global China pharmaceutical CDMO, which is expected to be valued at USD 31.2 billion in 2024, is anticipated to undergo substantial expansion, reaching an estimated USD 59.60 billion by 2034, supported by a robust CAGR of 6.7% from 2024 to 2034.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/checkout/2936

The pharmaceutical CDMO plays a major role in the pharmaceutical and biotechnology industries. The pharmaceutical CDMO market deals with contract development and manufacturing organizations (CDMOs) that provide comprehensive support to biopharmaceutical companies worldwide. The major industrial players are Pfizer Inc., Biocon Biologics, Lupin Limited, GlaxoSmithKline Plc, Thermo Fisher Scientific Inc., Novartis AG, AstraZeneca AG, and Johnson & Johnson. The services offered by CDMOs refer to antibody production, protein purification, DNA technology, cell culturing, fermentation, vaccines, etc.

The CDMOs offer end-to-end services and solutions related to clinical or pharmaceutical development and manufacturing, good clinical practice (GLP), good manufacturing practice (GMP), quality control and quality assurance, etc. These organizations are also involved in providing promising support for commercial production, supply chain management, regulatory affairs, and many other industrial areas. They ensure that pharmaceutical companies work in compliance with current good manufacturing practices (cGMP) and regulatory standards that are regulated by the U.S. Food and Drug Administration (USFDA), the European Medicines Agency (EMA), and internationally.

Pharmaceutical CDMO Market Highlights:

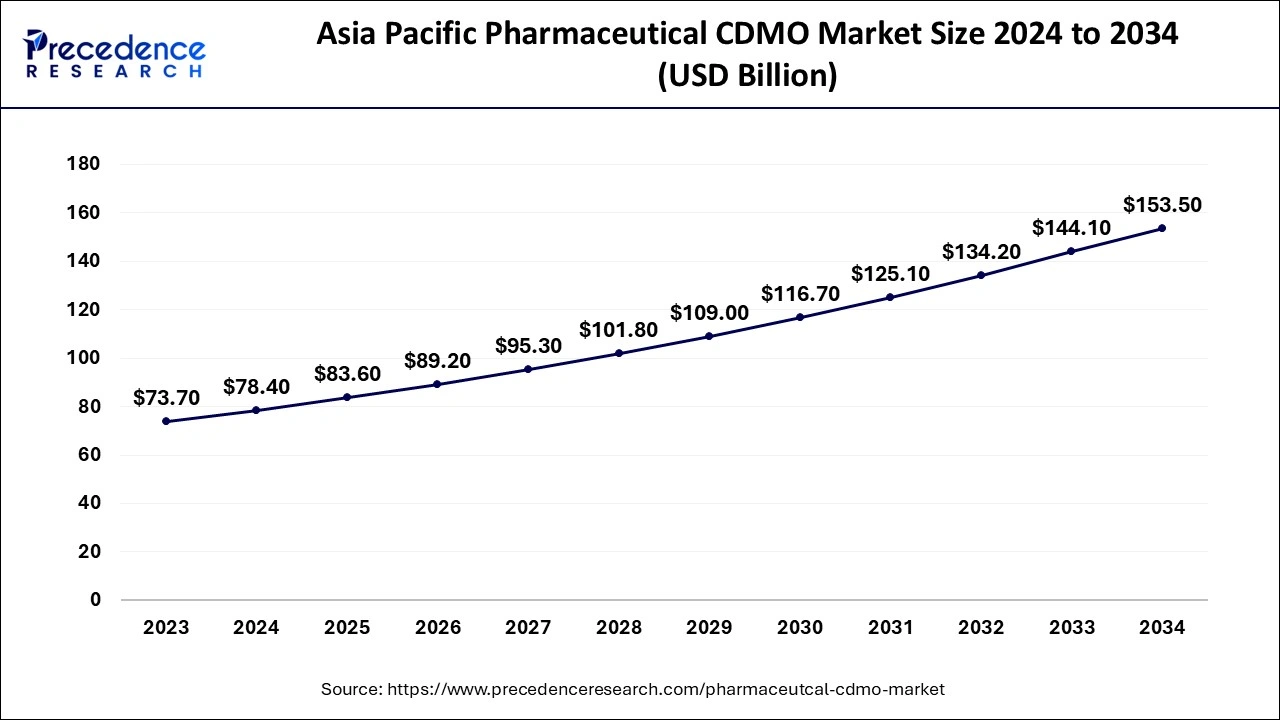

- Asia Pacific accounted for the maximum market share of 42.4% in 2023.

- Europe is expected to grow at a solid CAGR of 7.7% during the forecast period.

- By service type, the active pharmaceutical ingredient (API) manufacturing segment held a major market share of 63.6% in 2023.

- By service type, the finished dosage formulation (FDF) development and manufacturing segment is registering a notable CAGR of 7.9% during the forecast period.

- By research phase, the phase III segment recorded the highest market share of 31.8% in 2023.

- By research phase, the phase II segment is growing at a notable CAGR of 7.5% during the forecast period.

Global Pharmaceutical CDMO Market Revenue, By Service Type 2021-2023 (USD Billion)

| Service Type | 2021 | 2022 | 2023 |

| Active Pharmaceutical Ingredient (API) Manufacturing | 97.5 | 103.7 | 110.4 |

| Finished Dosage Formulation (FDF) Development and Manufacturing | 36.8 | 39.4 | 42.3 |

| Liquid Dose Formulatioz | 12.9 | 13.9 | 14.9 |

| Injectable Dose Formulation | 6.7 | 7.4 | 8.2 |

| Secondary Packaging | 152.6 | 162.5 | 173.2 |

Global Pharmaceutical CDMO Market Revenue, By Research Phase 2021-2023 (USD Billion)

| Research Phase | 2021 | 2022 | 2023 |

| Pre-clinical | 18.4 | 19.6 | 20.9 |

| Phase I | 22.9 | 24.4 | 26 |

| Phase II | 34 | 36.3 | 38.8 |

| Phase III | 48.6 | 51.7 | 55.1 |

| Phase III | 28.7 | 30.5 | 32.4 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2936

Major Trends in the Pharmaceutical CDMO Market

-

Promising Research and Development Services: The pharmaceutical CDMOs offer a wide range of services related to advanced technologies in biotechnology and pharmaceutical fields. Researchers, clinicians, industrialists, and other potential end users have widely adopted recent advancements like next-generation sequencing (NGS), computer-aided drug design (CAD), computer-aided drug manufacturing (CAM), chromatography techniques for protein purification, etc. These R&D services are provided by CDMOs like Enzene Biosciences Ltd, Thermo Fisher Scientific Inc., Samsung Biologics, Catalent, and many other organizations with precision and standardized protocols. These services are also provided with regulatory guidelines for risk assessment, troubleshooting, and standard reaction procedures.

-

Strategic Collaborations and Regulatory Compliance: Several biopharmaceutical companies ranging from small start-ups like LLP to large-scale plants rely on resources from specific industrial players or organizations. These resources are related to industrial performance to enhance quality and precision in workflows. Qiagen, Thermo Fisher Scientific Inc., Merck, etc. contribute to providing promising industrial services and solutions. All of the operations are performed in compliance with regulatory standards provided by the U.S. FDA or EMA by implementing GMP, CGMP, and GLP guidelines. The robust scientific innovations rise from the interdependency between several companies, organizations, and government authorities.

-

Implementation of GMP, GLP, and cGMP in Medical Practice: Every industrial process from project planning up to the product launch is conducted in accordance with good manufacturing practices (GMP), good clinical practices (GLP), and current good manufacturing practices (cGMP). The biopharmaceutical products like vaccines, drugs, drug formulations, APIs, tablets, capsules, and other products like antibodies, proteins, enzymes, chemical reagents, etc. go through cGMP and GLP processes to ensure their quality, safety, and risk assessment. The CDMOs are responsible for delivering such improved products and authenticated services to companies and consumers to ensure patient safety through product reliability.

Role of Artificial Intelligence in the Pharmaceutical CDMO: Increasing Performance Accuracy

The incorporation of artificial intelligence in the pharmaceutical CDMO market refers to a major support of telemedicine, data analytics, the Internet of Things (IoT), industrial automation, and many other advancements. Several industrial operations like production, manufacturing, supply chain, data collection, data validation, etc. can run smoothly with the insertion of AI by reducing processing time and increasing performance accuracy. The novel innovations through research and development can reach up to every applicable area such as developing and developed countries, and urban or rural areas with the help of AI.

Precision medicines, personalized treatment plans, remote patient monitoring, remote access to medications and consultations, etc. are possible due to the versatility of AI in telemedicine and other sectors. National as well as international businesses in pharmacy, biotechnology, and clinical research can work in coordination through virtual networking platforms, online conference meetings, and annual campaigns or programs. It is possible to track and store the online details about business reports, and business outcomes by keeping confidentiality and privacy.

Pharmaceutical CDMO Market Regional Outlook

The Asia Pacific pharmaceutical CDMO market surpassed USD 78.4 billion in 2024 and is projected to exceed around USD 153.5 billion by 2034. The market is expanding at a CAGR of 7% from 2024 to 2034.

Asia Pacific dominated the pharmaceutical CDMO market in 2023 due to favorable Indian government schemes and the dominating position of India or Japan in the import-export of chemical compounds for API manufacturing.

The Japan pharmaceutical CDMO market size was estimated at 18.30 billion in 2024 and is projected to reach around USD 39.74 billion by 2034, representing at a healthy CAGR of 7.4% from 2024 to 2034. The CDMOs present in this region and all across the globe include Enzene BioSciences Ltd, Thermo Fisher Scientific Inc., etc. which provide comprehensive healthcare solutions and services to the biopharmaceutical companies.

There are several successful industrial players like Biocon Biologics, GlaxoSmithKline Plc, Lupin Limited, and many other industries that are delivering impactful experiences to their customers. The presence of strong technical professionals and an analytically skilled workforce are putting great effort into healthcare domains and CROs, CMOs, or CDMOs.

- In June 2024, Lupin Limited announced that it had received the Establishment Inspection Report (EIR) from the U.S. Food and Drug Administration (USFDA) for its API manufacturing facility situated in Somerset, New Jersey.

- In November 2024, Lupin Limited announced its plan to expand its therapeutic impact in mostly prevalent diseased areas through Lupin Manufacturing Solutions (LMS) as pharma CDMO players in India.

What is the Europe pharmaceutical CDMO market size?

The Europe pharmaceutical CDMO market size is predicted to hit USD 88.8 billion by 2034 increasing from USD 42.6 billion in 2024, with a CAGR of 7.7% from 2024 to 2034.

Europe is anticipated to be the fastest-growing in the pharmaceutical CDMO market during the forecast period due to the presence of strong manufacturing facilities and CDMOs, CROs, or CMOs all across Europe. The United Kingdom also has the presence of well-organized healthcare system and infrastructure that aims to improve patient health and wellness.

The United Kingdom pharmaceutical CDMO market size was valued at USD 8 billion in 2024 and is estimated to touch USD 17.6 billion by 2034, supported by a robust CAGR of 8.3% from 2024 to 2034. There are several CDMOs and industries in Europe like Fujifilm Corporation which hold a diverse range of bioreactors, and other instruments required to conduct research and development.

The stringent rules, regulations, and guidelines in the United Kingdom along with healthcare acts and laws are strictly implemented by industries and professionals in Europe. The healthcare system provides innovative therapies, treatments, and medications against several diseases which creates ample growth opportunities for the pharmaceutical CDMO market.

- In November 2024, Fujifilm Diosynth Biotechnologies announced the launch of the first phase of its CDMO facility expansion that will deliver vaccines, biologics, oncolytic viruses, and advanced therapies to the pharmaceutical and biotechnology companies.

- In October 2024, Porton Pharma Solutions announced that its exciting innovations are delivering positive and impactful outcomes to its global customers in supply chains, and CDMO services. Porton Pharma is the first R&D and production base in Europe.

For questions or customization requests, please reach out to us @ sales@precedenceresearch.com | +1 804 441 9344

Pharmaceutical CDMO Market Coverage

| Report Attribute | Key Statistics | |

| Market Size in 2024 | USD 184.90 Billion | |

| Market Size in 2025 | USD 197.40 Billion | |

| Market Size by 2034 | USD 368.70 Billion | |

| Growth Rate from 2024 to 2034 | 7.2 | % |

| Dominating Region | Asia Pacific | |

| Leading Country | China | |

| Fastest Growing Region | Europe | |

| Base Year | 2023 | |

| Forecast Period | 2024 to 2034 | |

| Segments Covered | Service Type, Research Phase, and Region | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

| Companies Covered | Bushu Pharmaceuticals Ltd., Nipro Corporation, Thermo Fisher Scientific Inc., Samsung Biologics, Laboratory Corporation of America Holdings, Siegfried Holding Ag, Catalent, Inc, Lonza Group AG, Recipharm Ab, Piramal Pharma Solutions, Cordenpharma International, Cambrex Corporation, Wuxi Apptec | |

Pharmaceutical CDMO Market Segmentation Outlook

Service Type Outlook

The active pharmaceutical ingredient (API) manufacturing segment led the market in 2023 due to robust API manufacturing facilities in India, China, and the U.S. The potential of India to produce its own API drugs that will aid in saving the lives of people in pandemics and epidemic crises is the crucial driving force for the growth of this segment. The wide adoption of advanced tools and techniques by biopharmaceutical companies for drug design and development is another major driving force boosting the progress of this segment in the market.

The finished dosage formulation (FDF) development and manufacturing segment is anticipated to be the fastest-growing in during the forecast period. This segmental growth is attributed to the increased shift towards scientific innovation, research and development, new product approvals, and product launches in the market. The pharmaceutical drugs, drug formulations, vaccines, tablets, proteins, enzymes, etc. are widely produced and delivered in the market by ensuring their safety, quality, and efficacy. The potential end users like hospitals, pharmacies, research institutes, research laboratories, etc. also drive the growth of this segment by adopting FDF products increasingly.

Research Phase Outlook

The phase III segment dominated the pharmaceutical CDMO market in 2023 due to the rising need to ensure the safety and effectiveness of novel biopharmaceutical products. The outstanding efforts of scientists in clinical research, biotechnology, and pharmaceuticals are creating favorable opportunities for the phase III clinical trial segment. A large-scale production of healthcare products requires the phase III clinical trial assessment which avoids any life-threatening impacts on people’s lives.

By the research phase, the phase II segment is expected to be the fastest-growing in the pharmaceutical CDMO market during the forecast period due to the importance of phase II clinical trials in clinical research, pharmaceutical processes, etc. Randomized clinical trials by taking a small group of patient participants can be performed to assess drug safety and efficacy. These phase II clinical trials avoid any life dangers and negative impacts of healthcare products on patients’ lives.

Browse More Insights:

-

Active Pharmaceutical Ingredients Market: The global active pharmaceutical ingredients market size accounted for USD 214.72 billion in 2023 and it is expected to surpass around USD 384.51 billion by 2033 and is expanding at a CAGR of 6.08% over the forecast period 2024 to 2033.

-

Pharmaceutical Analytical Testing Market: The global pharmaceutical analytical testing market size surpassed USD 8.37 billion in 2023 and is estimated to increase from USD 9.10 billion in 2024 to approximately USD 21 billion by 2034.

-

Pharmaceutical Packaging Market: The global pharmaceutical packaging Market size was USD 134.07 billion in 2023, estimated at USD 146.14 billion in 2024 and is anticipated to reach around USD 342.16billion by 2034, expanding at a CAGR of 8.88% from 2024 to 2034.

- Pharmaceutical Temperature Controlled Packaging Solutions Market: The global pharmaceutical temperature controlled packaging solutions market size reached USD 5.53 billion in 2023 and is expected to hit around USD 10.8 billion by 2033, poised to grow at a CAGR of 6.9% from 2024 to 2033.

-

Pharmaceutical Water Market: The global pharmaceutical water market size was valued at USD 38.69 billion in 2023 and is predicted to hit USD 95.14 billion by 2033 with a CAGR of 9.2% from 2024 to 2033.

-

Pharmaceutical Contract Packaging Market: The global pharmaceutical contract packaging market size was USD 12.99 billion in 2023, estimated at USD 14.16 billion in 2024 and is anticipated to reach around USD 29.76 billion by 2034, expanding at a CAGR of 7.71% from 2024 to 2034.

-

Pharmaceutical Chemicals Market: The global pharmaceutical chemicals market size was USD 115.45 billion in 2023, calculated at USD 123.42 billion in 2024 and is projected to surpass around USD 240.52 billion by 2034, expanding at a CAGR of 6.9% from 2024 to 2034.

-

Pharmaceutical Manufacturing Market: The global pharmaceutical manufacturing market size was USD 511.66 billion in 2023, calculated at USD 576.64 billion in 2024 and is projected to surpass around USD 1,906.09 billion by 2034, expanding at a CAGR of 12.7% from 2024 to 2034.

-

Sustainable Pharmaceutical Packaging Market: The global sustainable pharmaceutical packaging market size surpassed USD 87.29 billion in 2023 and is estimated to increase from USD 99.70 billion in 2024 to approximately USD 376.82 billion by 2034. It is projected to grow at a CAGR of 14.22% from 2024 to 2034.

- Pharmaceutical Intermediates Market: The global pharmaceutical intermediates market was valued at USD 33.60 billion in 2023 and is expected to hit over USD 54.73 billion by 2033, poised to grow at a noteworthy CAGR of 5% from 2024 to 2033.

Pharmaceutical CDMO Market Leading Manufacturers

- Bushu Pharmaceuticals Ltd.

- Nipro Corporation

- Thermo Fisher Scientific Inc.

- Samsung Biologics

- Laboratory Corporation of America Holdings

- Siegfried Holding Ag

- Catalent, Inc

- Lonza Group AG

- Recipharm Ab

- Piramal Pharma Solutions

- Cordenpharma International

- Cambrex Corporation

- Wuxi Apptec

These companies leverage their vast resources and expertise to provide clinically proven medications and healthcare services to expand their pharmaceutical drug manufacturing capabilities, research and development efforts in biotechnology and offer promising services through their contract development and manufacturing (CDMO) facilities.

* Interested in Company Profiles? Click to Download Detailed Profiles

What is Going Around the Globe?

- In October 2024, Teijin Limited and Hilleman Laboratories situated in Singapore announced a strategic international business partnership to expand CDMO business in cell and gene therapy.

- In January 2024, AGC Biologics announced its plan to establish a new manufacturing facility at its Yokohama Technical Center in Japan. This new facility is seen to promote the associated services in pharmaceutical industry.

Segments Covered in the Report:

By Service Type

- Active Pharmaceutical Ingredient (API) Manufacturing

- Small Molecule

- Large Molecule

- High Potency (HPAPI)

- Finished Dosage Formulation (FDF) Development and Manufacturing

- Solid Dose Formulation

- Tablets

- Others (Capsules, Powders, etc.)

- Solid Dose Formulation

- Liquid Dose Formulation

- Injectable Dose Formulation

- Secondary Packaging

By Research Phase

- Pre-clinical

- Phase I

- Phase II

- Phase III

- Phase IV

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2936

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsevsolutions.com

For Latest Update Follow Us: