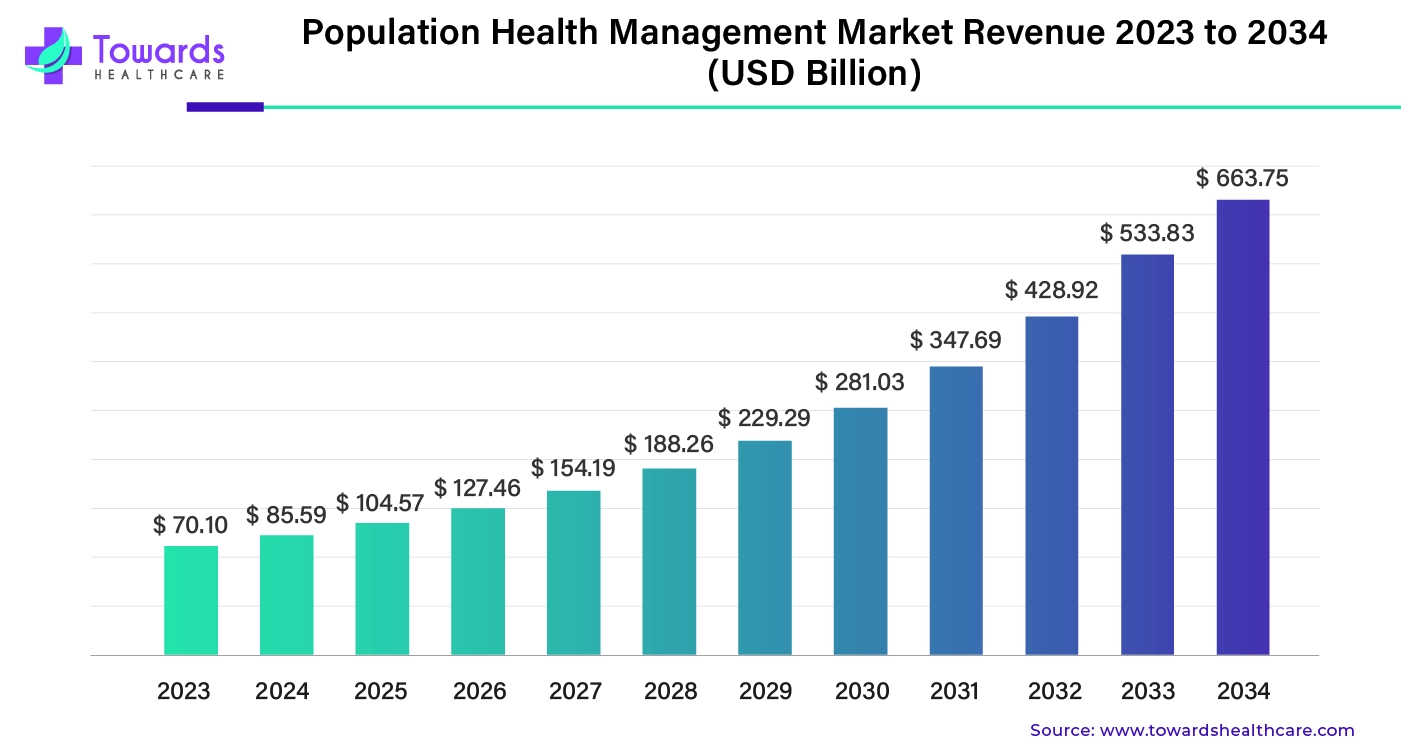

Population Health Management Market to Attain $663.75 Bn by 2034

The global population health management market size is calculated at USD 104.57 billion in 2025 and is expected to reach around USD 663.75 billion by 2034, growing at a CAGR of 22.05% for the forecasted period.

Ottawa, Nov. 27, 2024 (GLOBE NEWSWIRE) -- The global population health management market size was valued at USD 85.59 billion in 2024 and is predicted to hit around USD 533.83 billion by 2033, a study published by Towards Healthcare a sister firm of Precedence Statistics.

Download statistics of this report @ https://www.towardshealthcare.com/download-statistics/5230

Population Health Management Market: Transforming Global Healthcare Sector Through Advanced Data Integration

Population health management (PHM) refers to software and services that focus on achieving better care and financial savings. PHM solutions improve patient outcomes and reduce overall healthcare expenditures. Thus, governments and healthcare organizations around the world are using PHM solutions as a tool to treat various communicable and noncommunicable diseases and prevent their occurrence. According to the World Health Organization (WHO), noncommunicable diseases kill about 41 million people each year, equivalent to 74% of all deaths worldwide.

The population health management market is experiencing rapid growth due to the rising utilization of digital technologies in the healthcare sector. According to the NIH, as of 2023, more than 80% of healthcare providers worldwide have adopted digital elements to improve patient satisfaction and healthcare delivery. This trend is a result of growing government funding for digital healthcare solutions. The U.S. Department of Health and Human Services (HHS) stated that it invested USD 400 million in 2022 to support the adoption of healthcare IT systems.

PHM solutions are beneficial as they help with workflow automation and coordination and provide better clinical results. As explained in a World Bank report of 2022 on integrated PHM platforms, this approach supported limiting the load on hospitals during the COVID-19 outbreak by monitoring patients online and managing available resources. Various health organizations, such as the European Public Health Association (EUPHA), also acknowledge the role of PHM in eliminating inequalities in the healthcare provisions. The EUPHA indicated that nations adopting the PHM strategies observed a 15% overall change in the outcome of rural health care, demonstrating its effectiveness in underserved areas.

Get the latest insights on healthcare industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Population Health Management Market Trends

- Increasing Cases of Chronic Diseases: Chronic diseases are considered the primary reason for adopting PHM, as the burden on many nations has increased. According to the CDC report, about 6 out of 10 adults in the U.S. have at least one chronic illness. PHM systems assist in the management of patient data, which makes it easier to prevent diseases as well as take care of the patient.

- Increasing Healthcare Costs: Healthcare institutes around the globe are adopting advanced health management technologies to reduce healthcare costs. Population health management (PHM) enhances population health through data-driven planning and the delivery of proactive care to optimize health outcomes. The American Hospital Association (AHA) pointed out that with PHM platforms, value-based care programs reduced healthcare costs among the involved healthcare systems by 20% in 2022.

-

Increasing Usage of Telehealth: The use of telehealth with PHM platforms has grown quickly, as these platforms offer a unified analytics solution to enhance insights for patients, care managers, and care providers. According to a report published by the World Bank, the utilization of telehealth improves health systems and public health and increases reach for underserved populations.

Regional Insights

High Adoption of Digital Healthcare Solutions Supported North America’s Dominance

North America held the largest share of the market in 2023. Higher implementation of advanced healthcare technologies and evolving regulatory frameworks have put North America at the forefront of the population health management market. As reported by the CDC, in 2023, more than half of the healthcare organizations in the U.S. implemented EHRs that easily incorporate PHM systems. Furthermore, the American Medical Association (AMA) said that the usage of value-based care models in healthcare systems in the U.S. has increased in the past few years, which is a significant factor in boosting the adoption of PHM solutions. Moreover, rising government investments in healthcare contributed to the region's dominance. In February 2023, the Canadian government announced it would increase health funding to provinces and territories by US$ 196.1 billion over 10 years, including US$ 46.2 billion in new funding.

Asia Pacific: The Fastest Growing Region

Asia Pacific is expected to witness rapid growth in the market during the forecast period due to the increasing government initiatives to advance healthcare infrastructure. According to a report published in 2022, the World Bank approved a US$ 1 billion loan toward India's Pradhan Mantri-Ayushman Bharat Health Infrastructure Mission. In addition, the increasing population and the growing focus on digitization of the healthcare system fuel the regional market growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Segmentation Insights

- By product, the services segment dominated the population health management market with the largest share. This is mainly due to the increasing prevalence of chronic conditions and the need for better care. PHM services provide healthcare organization with better solutions. Healthcare providers often collaborated with third-party organizations for effective PHM solutions.

- By delivery mode, the cloud-based segment led the market in 2023. This is mainly due to the heightened adoption of cloud-based healthcare technologies, owing to their enhanced security. Moreover, the increasing need for efficient data transfer and management, especially with the rise of telehealth services, bolstered the segment.

- By end-use, the healthcare providers segment led the market in 2023 due to the increasing emphasis on improving care quality and enhancing patient experiences while managing costs. However, PHM solutions allow healthcare providers to analyze disease patterns and data, thereby enhancing patient care.

Competitive Landscape

Key players operating in the population health management market include Oracle, Tuesday Health, Conifer Health Solutions, LLC, Veradigm LLC, UKRI, Optum, Inc., Athenahealth, Inc., McKesson Corporation, Welltok (Virgin Pulse), Medecision, Enli Health Intelligence (Cedar Gate Technologies), eClinicalWorks, and Koninklijke Philips N.V. These companies are making efforts to gain a competitive edge and stay ahead of the competition.

Conifer Health Solutions, LLC. continue to innovate through its strategic partnerships with Welldoc Enter to Launch Conifer Connect, a personalized digital health app, which enable collaborative care and better health.

Latest Developments

- In October 2024, Henry Ford Health launched Populance, a non-profit subsidiary to support value-based care services, focusing on improving outcomes for patients with chronic conditions while reducing overall healthcare costs.

- In August 2024, Panda Health introduced PHM software, which is designed to manage and analyze patient data from various sources, aiming to improve health outcomes through features like risk stratification and care coordination.

- In February 2024, Persistent Systems launched a Generative AI-powered Population Health Management (PHM) Solution in collaboration with Microsoft, focusing on Social Determinants of Health (SDoH) to enhance patient care and optimize costs.

- In January 2024, Arcadia announced the launch of Enhanced Benchmarks and Arcadia Vista Push, aimed at improving value-based care performance and delivering insights, alongside a roadmap for future innovations.

Browse More Insights of Towards Healthcare:

- The U.S. 503A compounding pharmacies market size is estimated to grow from USD 3.99 billion in 2022 at a 6.11% CAGR (2023-2032) to reach an estimated USD 7.18 billion by 2032.

- The home healthcare market reached a size of USD 192.4 billion in 2023 and is projected to grow to USD 427.69 billion by 2033, driven by a strong 8.6% CAGR.

- The mHealth market reached USD 60.65 billion in 2023 and is projected to grow to USD 176.54 billion by 2033, expanding at a robust 7.5% CAGR during this period.

- The U.S. child care market was valued at USD 59.87 billion in 2023 and is expected to reach USD 88.22 billion by 2033, growing at a 4.3% CAGR from 2024 to 2033.

- The health insurance market size is calculated at USD 1.78 trillion in 2024 and is expected to be worth USD 3.63 trillion by 2034, expanding at a CAGR of 7.4% from 2024 to 2034.

- The clinical trials market size is calculated at USD 54.39 billion in 2024 and is expected to be worth USD 94.68 billion by 2034, expanding at a CAGR of 5.7% from 2024 to 2034.

- The cord blood banking services market was estimated at USD 33.9 billion in 2023 and is projected to grow to USD 65.36 billion by 2034, rising at a CAGR of 6.15% from 2024 to 2034.

- The drug screening market size was estimated at USD 6.15 billion in 2023 and is projected to grow to USD 10.34 billion by 2034, rising at a CAGR of 4.84% from 2024 to 2034.

- The pharmaceutical CDMO market size was estimated at USD 146.05 billion in 2023 and is projected to grow to USD 315.08 billion by 2034, rising at a CAGR of 7.24% from 2024 to 2034.

- The comparator drug sourcing market size was estimated at USD 1.16 billion in 2023 and is projected to grow to USD 2.24 billion by 2034, rising at a CAGR of 6.15% from 2024 to 2034.

Segments Covered in the Report

By Product

- Software

- Services

By Delivery Mode

- On-premise

- Cloud-based

By End-use

- Providers

- Payers

- Employer Groups

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa (MEA)

Discover our detailed Table of Contents (TOC) for the Industry, providing a thorough examination of market segments, material, emerging technologies and key trends. Our TOC offers a structured analysis of market dynamics, emerging innovations, and regional dynamics to guide your strategic decisions in this rapidly evolving healthcare field - https://www.towardshealthcare.com/table-of-content/population-health-management-market-sizing

Acquire our comprehensive analysis today @ https://www.towardshealthcare.com/price/5230

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations. We are a global strategy consulting firm that assists business leaders in gaining a competitive edge and accelerating growth. We are a provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardsautomotive.com

https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare

Get Our Freshly Printed Chronicle: https://www.healthcarewebwire.com