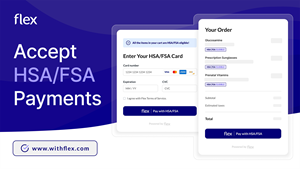

Fintech Startup Flex Raises Seed Round to Help DTC Consumer Health and Wellness Brands Accept HSA and FSA Payments Online

Flex operates like Stripe for the HSA/FSA payments ecosystem, enabling brands to take advantage of $150B in potential annual HSA/FSA spending

SAN FRANCISCO, Sept. 04, 2024 (GLOBE NEWSWIRE) -- Flex, which offers the easiest way for direct-to-consumer health and wellness brands to begin accepting HSA and FSA payments online, announced today that it has raised a $3.2M seed round from Y Combinator, SV Angel, Precursor, Liquid 2 Ventures and others. Flex will use the funding to accelerate product development and sales & marketing, and to capitalize on strong interest from brands in capturing more of the $150B in potential annual HSA/FSA spending.

“We were impressed by the strength and experience of the Flex team, whose deep fintech expertise and proven execution capabilities gave us great confidence in their ability to deliver on their ambitious vision to transform the landscape of health-related spending,” said Beth Turner, Managing Partner at SV Angel.

Charles Hudson, Managing Partner and Founder, Precursor Ventures, said, “Flex is closing an important and large gap in the payments ecosystem - one that will help brands and consumers leverage HSA and FSA dollars more efficiently.”

Flex customers include fast-growing brands like KindredBravely, BedJet and Lumen.

To date, online acceptance of HSA/FSA payments has been complex, primarily due to the need to substantiate each item’s eligibility on the fly. This means that only very large merchants with extensive IT resources – companies like Walmart and Amazon – have been able to build their own systems to process HSA/FSA payments online. Smaller merchants have been unable to leverage consumers’ desire to spend their HSA/FSA dollars online. Consumers instead must pay out of pocket and submit itemized receipts to their FSA provider seeking reimbursement. The difficulty of that process means consumers often purchase their products elsewhere, from merchants who make the process easier.

Flex can get merchants started with HSA/FSA acceptance in as little as 30 minutes, and is currently working with more than 100 brands. The company offers two main solutions.

- Flex’s Product Verification provides a fast and straightforward way for merchants to identify and process payment for items that are eligible for everyone - such as OTC medications, menstrual products, and first aid supplies - during checkout.

- Flex's Health Check is for merchants selling dual-use items - meaning, they can be HSA/FSA eligible for consumers whose doctors say they are medically necessary to treat a condition. Health Check leverages telehealth to enable a healthcare provider to ascertain whether a customer qualifies to designate a purchase as a medical expense.

Flex operates like Stripe for the HSA/FSA ecosystem. At the heart of the Flex platform is a sophisticated API that enables the company to swiftly check item eligibility and then process payment for those eligible items. Specifically, Flex interfaces with the SIGIS Eligible Products List. SIGIS is a non-profit affiliate of the IRS responsible for determining which items are eligible for HSA/FSA spending.

Sam O’Keefe and Miguel Toledo founded Flex in June 2023. The two had worked together in the anti-fraud group of fintech startup Unit 21 and had an interest in the intersection of health and fintech. Specifically, O'Keefe – an athlete with a deep interest in fitness – wanted to explore ways to get health insurance companies to cover exercise programs. After researching the market and speaking with many merchants, the two co-founders decided to focus on helping D2C consumer health and wellness companies leverage HSA and FSA spending programs.

“Flex differentiates itself through a comprehensive approach by offering product verification during checkout, the ability to confirm the eligibility of dual-use items, issuing Letters of Medical Necessity, and handling split tenders—orders that include both eligible and non-eligible items," said O'Keefe. “Flex offers the most comprehensive solution available for helping brands accept HSA and FSA payments online.”

Flex sets itself apart from competitors in several other ways:

- The team’s deep knowledge of and background in the payments ecosystem

- Ability to meet the customer where they're at with multiple options for implementation, from a robust API, to Shopify payment app, to a no-code solution to get up and running quickly

- Ability to provide guidance on the regulatory landscape, including submitting products for consideration for the SIGIS Eligible Products List.

- Moving and onboarding quickly, in as little as 30 minutes, and typically within 48 hours.

About Flex

Flex offers the easiest way for direct-to-consumer health and wellness brands to begin accepting HSA and FSA payments online. Flex enables merchants to take advantage of $150B in potential annual HSA/FSA spending - driving new revenue, increasing cart sizes and improving customer retention. It also helps consumers expand the scope of their eligible HSA/FSA spending and ensure they don’t lose their FSA funds at the end of the year. Flex is known for its deep knowledge of HSA/FSA eligibility and for offering the most comprehensive merchant solutions. Merchants can get started at www.withflex.com.

Media contact:

Michelle Faulkner

Big Swing

617-510-6998

michelle@big-swing.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3592dd99-933e-44a4-8c26-95b453b913a6