What do recent surveys reveal about euro area business investment in 2024?

Prepared by Valerie Jarvis and Barbara Schirato

Published as part of the ECB Economic Bulletin, Issue 5/2024.

This box assesses the outlook for euro area business investment in 2024 according to recent surveys conducted by the European Commission and the European Investment Bank. Euro area business investment decelerated considerably in 2023 in the wake of the pandemic, the 2022-23 energy crisis and the subsequent tightening of financing conditions in succession. After contracting sharply in the final quarter of 2023, investment ticked up modestly in the first quarter of 2024. The June 2024 Eurosystem staff macroeconomic projections for the euro area point to subdued annual investment growth in 2024, which is broadly in line with the results of the surveys.

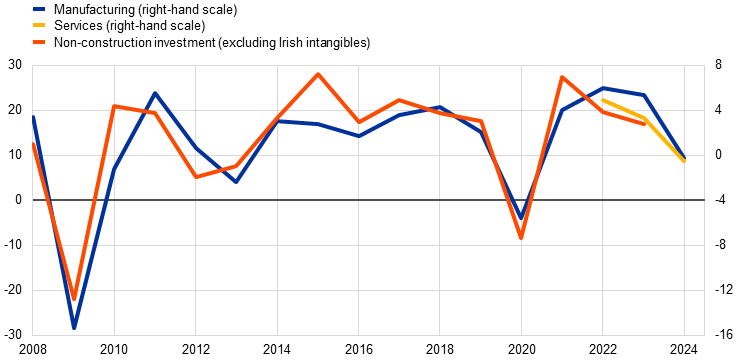

The latest Investment Survey from the European Commission suggests muted business investment growth for 2024. The biannual Investment Survey carried out by the European Commission asks firms qualitatively about investment plans for the year and typically tracks annual business investment growth reasonably well. The March/April 2024 reading suggests that, by historical standards (crisis periods aside), investment intentions for 2024 are particularly low in manufacturing, with the balance indicators corresponding to levels normally associated with a stagnation in euro area business investment (Chart A).[1] This sombre outlook was also suggested by S&P’s March 2024 Business Outlook Survey, while the Commission’s late-2023 survey had previously revealed a marked rise in the share of investment allocated to replacement and rationalisation in recent years.[2],[3] At the same time, the share of business investment dedicated to expanding capacity fell to just 20% in manufacturing in 2023 – a historical low and a decline of around 10 percentage points compared with pre-pandemic averages – with a further slight decline expected for 2024 (Chart B). Shares are similar in services, but no historical comparison is possible, as the services sector survey was only launched in 2021.

Chart A

Business investment intentions and non-construction investment

(left-hand scale: balance indicators; right-hand scale: annual percentages changes)

Sources: European Commission, Eurostat and ECB staff calculations.

Notes: Investment intentions using observations from the spring of each year. Non-construction investment excludes Irish intangibles. The latest observations reflect March/April 2024 investment intentions for 2024 and non-construction investment to 2023.

Chart B

Purpose of investment by sector

(percentages of respondents)

Sources: European Commission and ECB staff calculations.

Notes: Averages are available only for manufacturing (services survey only launched in 2021). The latest observations are for 2023 (taken from the Commission’s October/November 2023 Investment Survey).

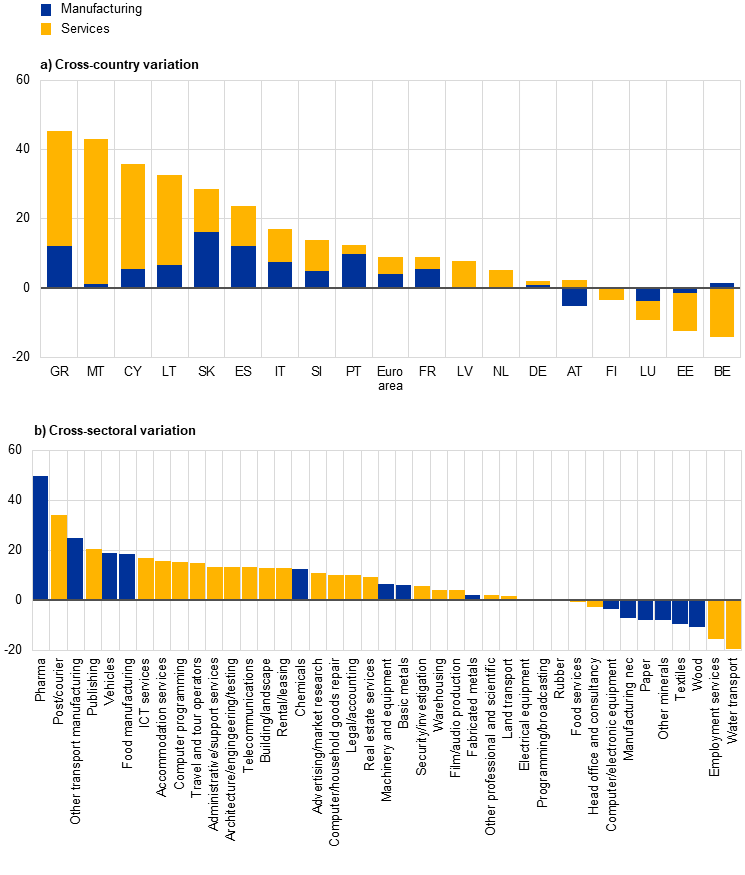

The euro area aggregate masks considerable cross-country and cross-sector variation. The Commission’s euro area averages obscure considerable variation across countries, with investment intentions typically more positive ‒ and revised up since late 2023 ‒ in southern euro area economies, as well as in some newer member countries of the euro area. While recent adverse economic shocks had a less negative impact in countries with a larger services sector, newly disbursed Next Generation EU funds may also already be playing a stronger role in investment in southern euro area economies (Chart C, panel a).[4] Cross-sector variation is also considerable across both manufacturing and services, albeit with manufacturing sectors typically exhibiting downward revisions in investment intentions for 2024 since the late-2023 survey, while the pattern remains more mixed in services (Chart C, panel b).

Chart C

Cross-country and cross-sector variation in investment intentions

(balance indicators)

Sources: European Commission, Eurostat and ECB staff calculations.

Notes: Panel a): Countries ranked from highest to lowest by 2024 business investment intentions, aggregated by weighting investment intentions in manufacturing and private sector services by their respective country shares in country-level non-construction investment. Ireland and Hungary not shown due to data limitations. Panel b): Sectors ranked from highest to lowest 2024 investment intentions. The latest observations reflect the outcomes from the Commission’s March/April 2024 Investment Survey.

Investment intentions for 2024 are higher in sectors with stronger output expectations and lower in more energy-intensive sectors. Investment intentions tend to be higher in sectors with stronger output expectations (as reflected in the strength of new orders, higher rates of capacity utilisation and higher space and equipment needs at the individual sectoral level). In this context, services typically face markedly brighter prospects than manufacturing, with the exception of the pharmaceutical sector (Chart D, panel a). In the aftermath of the 2022-23 energy crisis, energy intensity is likely to continue to influence investment decisions for some time. This is also suggested by the European Investment Bank’s latest Investment Report (EIBIS 2023), where energy costs topped the list of European long-term barriers to investment.[5] Chart D, panel b) shows a negative correlation between sectoral investment intentions and energy intensity – a co-movement that has become notably stronger since the onset of the energy crisis in 2022. While the recent crisis is likely to continue to require additional investment to reduce energy dependence in many sectors, it seems that longer-term viability considerations are increasingly holding back investment in those sectors where energy costs exceed around 10% of total costs.

Chart D

Investment intentions by output expectations and energy intensity

a) By output expectations |

b) By energy intensity |

|---|---|

(z-scores; balance indicators) |

(percentage share of energy in total costs; balance indicators) |

| |

Sources: European Commission, OECD and ECB staff calculations.

Notes: Panel a): Euro area investment intentions for 2024 relative to 2023; output expectations as four-quarter average of new orders in manufacturing and expected demand in next three months in services, all relative to their pre-pandemic averages and standard deviations. Regression lines in both charts relate to all sectors. Panel b): Energy intensity computed using OECD (TiVa) input-output matrices (see the box entitled “Natural gas dependence and risks to euro area activity”, Economic Bulletin, Issue 1, ECB, 2022). The latest observations are taken from the Commission’s March/April 2024 Investment Survey, for the second quarter of 2024 for output expectations and from 2021 data for energy intensities.

In the face of the series of shocks seen since the start of the decade, some business investment is increasingly being directed towards transitioning to a greener, more energy-efficient economy, although further investment will be needed to meet EU targets ahead. EIBIS 2023 reports a notable increase in the share of European firms investing in energy efficiency in recent years and a strong rise in the use of digital technologies across Europe since the pandemic (albeit still with notable deficits with the United States in the shares of firms using AI and Big Data and in patenting activity related to advanced technologies).[6] Meanwhile, the Commission’s latest stock-take suggests much higher rates of investment will be required – amounting to at least an additional 1.5% of EU GDP to be invested annually compared with the decade from 2011 to 2020 – to meet the EU’s longer-term carbon neutrality targets.[7] Ongoing needs in these areas provide further scope for increased business investment ahead.