How Companies React to Say on Pay Failures

Say on Pay continues to exert significant influence on corporate governance, compelling companies to reassess and adjust their executive compensation practices in response to shareholder feedback. Analyzing 77 companies within the Russell 3000 facing failed Say on Pay votes, this Equilar study aims to dissect the myriad of changes implemented by these companies post-failure and discern emerging trends in executive compensation governance. The study examines 2023 proxies following a failed Say on Pay vote, and analyzes common changes these companies made and the results in the next fiscal year following changes. A key finding is that implementing changes as post-failure mitigation can, in most cases, lead to positive effects on shareholder voting in the following year, but there are still circumstances where changes might not be effective.

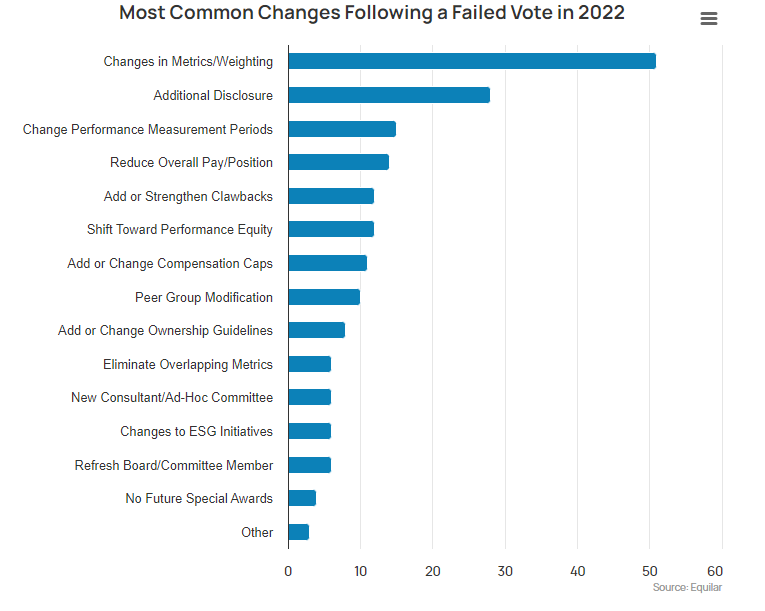

In response to shareholder dissent in 2022, companies embarked on a series of strategic adjustments to their executive compensation practices. Among the most prominent changes enacted by these companies were modifications in metrics or weightings, observed in 51 instances. Pebblebrook Hotel Trust, for example, decided to “increase the target level performance goal from the 50th percentile to the 55th percentile’” to ensure it outperformed the majority of its peers. Similarly, Norwegian Cruise Line Holdings introduced a relatively adjusted EPS metric in 2023 requiring outperformance versus the S&P 500 Index. As disclosed, the update of the metric was out of the purpose to “motivate [its] management team to continue to conserve cash during the resumption of cruises while balancing the need to efficiently generate revenue and continue to work towards historical Load Factors.” These adjustments reflect a deliberate effort to refine performance evaluation frameworks, aligning executive compensation more closely with long-term shareholder value creation. By recalibrating the metrics used to determine executive pay, companies aim to ensure that compensation packages incentivize behaviors and outcomes that contribute meaningfully to corporate performance and shareholder returns.

Meanwhile, a substantial number of companies—28 in total—opted to bolster transparency through additional disclosure in their proxies. Many investors might feel excluded when Say on Pay is being determined due to a lack of transparency and potential delays in information sharing. This doesn’t necessarily mean that the investors are opposing a payment plan, but merely suggests that more information is needed for them to evaluate the rationality of a particular payment plan. In response to shareholders’ desire to see additional transparency around equity grants, Riot Platforms incorporated an increased level of detail in its proxy statement to provide additional information about the variety of its equity awards granted to executives. In an era marked by heightened stakeholder scrutiny and demands for greater corporate accountability, this proactive stance towards effective communication signifies a recognition of the pivotal role transparency plays in building and sustaining investor trust. By providing shareholders with comprehensive and accessible information regarding executive compensation practices through more disclosure, companies aim to foster a culture of openness and accountability, thereby strengthening the bond of trust between management and shareholders.

A comparative analysis of the changes made by companies in response to Say on Pay failures in 2023 and 2019 reveals shifts in governance strategies. In 2023, metrics or weightings adjustments were the most prevalent with 66% of the failing companies adopting this strategy. However, only 45% of the companies underwent different metrics or weightings in 2019. This suggests a heightened focus on refining performance evaluation frameworks and aligning executive compensation with company performance metrics in the recent year. Additionally, shareholders tend to express more concerns regarding transparency in disclosure, where 36% of the companies made corresponding changes in 2023 but only 29% in 2019. Conversely, there was a notable decrease in the percentage of companies shifting towards performance equity in 2023 compared to 2019. Only 18% of companies made such changes recently compared to a sizeable 47% in 2019. This suggests that many companies already shifted towards a greater prevalence of performance equity in the past and are now fine-tuning the metrics being used. Overall, the data underscores the dynamic nature of corporate responses to Say on Pay challenges, reflecting evolving governance priorities and shareholder expectations over time.

The number of changes adopted by each company when addressing previous Say on Pay failures varies, as suggested by the graph above. The overall number of changes each company made remains comparable to that in 2019, averaging approximately 2.5 changes per company. Among the 77 affected companies in 2023, 14.3% of them opted not to make any changes, while another 14.3% implemented just one adjustment, indicating a passive or conservative response. The most common scenario is two changes, representing 26% of the companies evaluated in this study. Notably, a smaller subset, approximately 13% of companies implemented five or more changes. As an exemplification, Norwegian Cruise Line Holdings made a total of seven changes, the highest among all companies, and saw a significant increase in its approval percentage, from 15.3% in 2022 to a steady 69% in 2023. Overall, these responses reflect a spectrum of strategies aimed at rebuilding investor trust and aligning executive compensation with shareholder interests. It is difficult to argue if there is a correlation between the number of changes made and the passing rate of Say on Pay, but the mere action of implementing any changes could show investors that board members are valuing shareholders’ opinions.

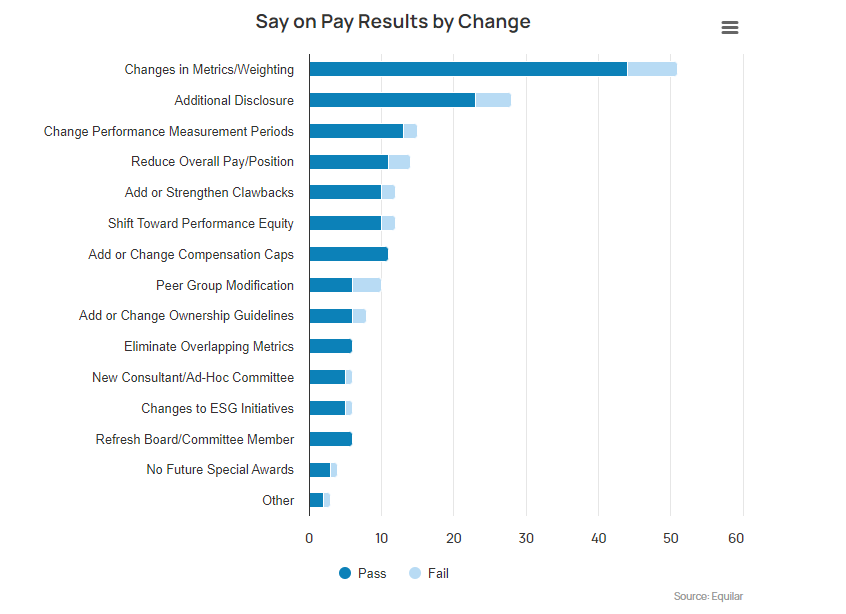

In the subsequent year following the Say on Pay failures in 2022, outcomes varied among the affected companies. Notably, 80.5% of companies successfully passed their Say on Pay votes, addressing shareholder concerns and regaining investor confidence. However, 16.9% of companies still failed to secure majority approval, which indicates that modifications in their strategies must be implemented to mitigate the challenges that remain between management and shareholders.

The effectiveness of the broad range of changes made by companies in response to failed Say on Pay votes becomes evident when considering the outcomes of subsequent votes. The graph above expands on the previous one, showing the distribution of companies that passed versus failed in each category of change. On average, 85% of the companies involved in the three most common changes passed the next year’s vote, which showed a decent level of effectiveness to the voting result.

Although the data shows that most companies that implemented changes passed Say on Pay in the following year, there are still cases where the changes did not garner a tangible positive result. AMC Entertainment, for example, failed in two consecutive years (2022 and 2023) with approval percentages of 35.9% and 48.2 %, respectively. Following its failure in 2022, the Company concluded, in a follow-up conversation with its investors, that while investors certainly had disagreements on executive compensation, they were much more concerned with corporate governance improvements. However, these strategies proved to have little effect in regaining the board’s confidence, as voting results remained disappointing in 2023. Comparing the actions taken in the previous year, the Company took different and more financial-performance-related actions in response to the 85% stock price drop during the year due to, as it stated, “studio release schedule changes which were outside the Company’s control.” The Company highlighted actions including cutting the target pay of CEO Adam Aron by 25% in 2024 and adopting a one-year target for performance-based equity awards during the volatility.

Given the fact that implementing changes, even those favored by investors, can’t always ensure a successful Say on Pay in the following year, we can conclude that there isn’t a golden rule that can affect shareholders’ votes to ensure a passing vote. However, the data does show that changes, in most circumstances, can lead to positive effects.

Methodology:

- Failed Say on Pay votes are defined as those that achieved less than 50% shareholder approval.

- The calculation used for Say on Pay voting is:

![]()