Ultipa Named "Tech of the Future – AI & Data" Finalist in the 2024 Banking Tech Awards USA

Ultipa is recently named "Tech of the Future – AI & Data" finalist in the 2024 Banking Tech Awards USA

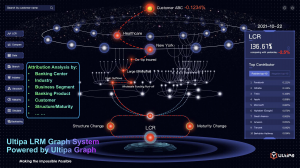

PLEASANTON, CA, USA, March 21, 2024 /EINPresswire.com/ -- Ultipa, a pioneering leader in cutting-edge technology solutions, is thrilled to announce that it has been named a finalist in the Tech of the Future – AI and Data Category of 2024 Banking Tech Awards USA. This recognition is a testament to Ultipa's category-defining capabilities - Graph XAI for Real-time Liquidity and Asset & Liability Management and Attribution Analysis

Ultipa's co-founder and COO, Monica Liu, expressed her excitement about this achievement, stating, "Being recognized as a finalist in the Tech of the Future – AI and Data Category at the Banking Tech Awards is a remarkable milestone for Ultipa. It underscores our commitment to innovation and excellence in delivering solutions that empower the financial industry."

Monica Liu, added, "Our Real-time Liquidity Risk Management, powered by Ultipa Graph, the fastest graph database in the market, is a game-changer for banks. Unlike other solutions that take hours or even days to compute critical indicators like the Liquidity Coverage Ratio, Ultipa provides such information in real-time. Additionally, our solution offers attribution analysis and multi-day comparison capabilities, allowing financial institutions to invest their excess liquidity while ensuring compliance with international regulations like Basel III. The remarkable ROI of Ultipa Liquidity Risk Management, which has reached an astonishing 100x for one of our customers, speaks volumes about the value we bring to the industry. And the Smart ALM2 solution goes beyond liquidity risk management to cover thousands of financial indicators, and allow the users to analyze all these data, plus supply-chain data and more, in a connected fashion, so that risks, opportunities, KPIs, and attribution analysis can be conducted in a holistic and instant fashion"

Monica added that, “Ultipa boldly positions itself as a pioneering XAI company, wielding a magical power akin to defying the second law of thermodynamics (entropy) within the realm of artificial intelligence.” -- The key take-away here is that while most AI and Big-data frameworks are ever-increasing the entropy of their systems, the results would be making the system overwhelmingly expensive to build, deploy and operate, while Ultipa's Graph XAI is taking an entropy-decreasing approach -- using less hardware (cluster size-wise smaller) but with better efficiency and parallelization, so that TCO can be significantly lower, and so is the carbon footprint smaller and greener (from ESG perspective).

Kate Stevenson from FinTech Futures (the host of 2024 Banking Tech Awards USA) commented that, "There are impressive number of nominations and participants for this year's Banking Tech Awards, and we are deeply impressed with Ultipa's unprecedented XAI capabilities being innovatively deployed in the bank's back office sectors where were traditionally dominated by larger conglomerates like Oracle... what makes most sense here is that graph's exceptional capabilities to traverse deeply (and instantly) amongst large amount of data without having to wait endlessly as in SQL's stored procedures."

Ultipa's Liquidity Risk Management and ALM solutions are revolutionizing how financial institutions manage their liquidity, and asset-n-liability, enabling them to make informed decisions in real-time and optimize their operations efficiently. This recognition as a finalist in the Tech of the Future – AI and Data Category at the 2024 Banking Tech Awards USA further cements Ultipa's position as an industry leader and innovator.

For more information about Ultipa and its innovative solutions, please visit:

Intra-Day LRM: https://www.ultipa.com/solutions/liquidity-risk-management

Smart ALM: https://www.ultipa.com/solutions/asset-and-liability-management

Steve M.

Deep Tech Business

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

1 https://www.ultipa.com/solutions/liquidity-risk-management

2 https://www.ultipa.com/solutions/asset-and-liability-management