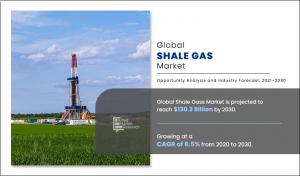

Shale Gas Market to Witness Robust Expansion throughout the Forecast Period 2021 – 2030

Shale Gas Market Expected to Reach $130.3 Billion by 2030

PORTLAND, OREGON, UNITED STATES, March 15, 2023 /EINPresswire.com/ -- The global shale gas market size was valued at $57.2 billion in 2020 and is projected to reach $130.3 billion by 2030, growing at a CAGR of 8.5% from 2021 to 2030. Shale gas refers to natural gas that is trapped within shale formations. Shales are fine-grained sedimentary rocks that can be rich sources of petroleum and natural gas. The combination of two production techniques includes horizontal drilling and hydraulic fracturing which has allowed access to large volumes of shale gas, which were previously uneconomical to produce. The production of natural gas from shale formations has rejuvenated the natural gas industry in the U.S. Shale gas is trapped within the pores of this sedimentary rock. Gas is normally stored in three ways in gas shale, which include free gas, adsorbed gas, and dissolved gas. The gas stored within the rock pores and natural fractures is known as free gas and the gas that is adsorbed on organic materials and clay is known as adsorbed gas. Moreover, the gas dissolved in organic materials is known as a dissolved gas. Gas shale is the name given to a shale gas reservoir (play). Shale gas reservoirs are spread over large areas up to 500 m. They are characterized by low production rates. Shale gas reservoirs are fine-grained and rich in organic carbon content which signifies large gas reserves. There are disparities in lithology in gas shales which point toward the fact that natural gas is stored in the reservoir in a broad array of lithology & textures such as non-fissile shale, siltstone, and fine-grained sandstone (not only shale). Often, shale laminations or beds are interbedded in siltstone- or sandstone-dominant basins.

Get a PDF brochure for Industrial Insights and Business Intelligence @ https://www.alliedmarketresearch.com/request-sample/457

The shale gas market trends are segmented on the basis of technology, End-user, and region. Depending on the technology, the market is categorized into Vertical fracking, Horizontal fracking, and Rotary fracking. On the basis of End-user, it is classified into residential, commercial, industrial, power generation, and transportation. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global Shale gas market growth analysis covers in-depth information about the major industry participants. The key players operating and profiled in the report include Southwestern Energy Company, EQT Corporation, Equinor ASA, Repsol SA, SINOPEC/Shs, Chesapeake Energy Corporation, Royal Dutch Shell PLC, Exxon Mobil Corporation, Chevron Corporation, and PETROCHINA/Shs.

The global shale gas market forecast is analyzed and estimated in accordance with the impacts of the drivers, restraints, and opportunities. The period studied in this report is 2020–2030. The report includes a study of the market with respect to the growth prospects and restraints based on the regional analysis. The study includes Porter’s five forces analysis of the industry to determine the impact of suppliers, competitors, new entrants, substitutes, and buyers on the market growth.

Enquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/457

Impact Of Covid-19 On The Shale Gas Market

- US shale oil & gas demand plummeted, prices collapsed, and bankruptcies were announced at exceptional rates due to the uncertainties in crude oil & natural gas prices, Break-Even (BE) prices for fracking operations, financial & technical constraints within the industry, global hydrocarbon demand development, political & regulatory factors in the US, and environmental & societal sustainability.

- US shale industry registered net negative free cash flows of $300 billion, impaired more than $450 billion of invested capital, and saw more than 190 bankruptcies since 2010. However, there is a negative impact on the global shale gas market.

- The emergence of COVID-19 has coincided with a core oil market management dispute. That dispute mainly involves the market shares commanded by Saudi Arabia (the largest sovereign producer among the OPEC membership) and Russia which, along with Mexico and occasionally Norway, has cooperated with OPEC as “OPEC+”. Oil market management disputes inevitably result in lower prices, and so the global oil industry finds itself reeling from the combined effects of OPEC+ disarray and ultra-low global demand caused by the pandemic.

- The world began locking down its economies, which brought historic low oil & gas prices as demand crashed. This meant that investment in LNG production & export facilities became less attractive. With demand in freefall, U.S. producers began questioning their investment timescales for new LNG export projects. Final investment decisions have been delayed on seven U.S. LNG projects, representing around 14 billion cubic feet per day of potential capacity.

- Natural gas consumption was negatively impacted in early 2020 by an exceptionally mild winter in the northern hemisphere. This was soon followed by the imposition of partial to complete lockdown measures in response to COVID-19 and an economic downturn in almost all countries and territories worldwide. As of early June, all major gas markets have experienced a fall in demand or sluggish growth at best as is the case of the People’s Republic of China (hereafter, “China”). Europe is the hardest-hit market, with a 7% year-on-year decline so far in 2020. The global oversupply is pushing major natural gas spot indices to historic lows, while the oil and gas industry is cutting its spending or postponing or canceling some investment decisions to make up for the severe shortfall in revenue.

- The decline was widespread, with record declines in both OECD (-4.8%) and non-OECD (-3.9%) countries. The US (the world’s 2nd-largest energy producer), saw a decline of 5.3%, the largest decline in the world last year, and the largest domestic decline on record. Production of all fossil fuels, nuclear power, and biofuels declined.

Procure Complete Report @ https://www.alliedmarketresearch.com/checkout-final/b0c39aea5df14329fbcd1b1e8a350df4?utm_source=AMR&utm_medium=research&utm_campaign=P21776

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality “Market Research Reports2” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains.

David Correa

Allied Analytics LLP

+1 800-792-5285

email us here

1 https://www.alliedmarketresearch.com/shale-gas-market

2 https://www.alliedmarketresearch.com/