Does Mandatory Risk Disclosure Harm Corporate Innovation?

There is a debate over whether mandating more risk disclosure will positively or negatively affect corporate innovation. On one hand, information is the lifeblood of capital markets and disclosing more should reduce information asymmetry, which in turn reduces firms’ cost of capital. A lower cost of capital will allow firms to raise more capital for investment in innovation activities.

On the other hand, mandating more risk disclosure may harm investment in R&D as firms are forced to disclose the risks of innovation, but have difficulty disclosing the benefits of innovation. For example, in the current race for Artificial Intelligence (AI), the risks are already largely known (e.g. if the system fails the money invested in AI would be wasted) while the benefits are hard to quantify (e.g. the extent of potential improvement in productivity of office workers). An additional issue is that more disclosure may make less risky projects, such as exploratory patents or capital expenditures, more attractive. For example, why should we invest in firm A’s early-stage cure for cancer when firm B’s weight loss drug has a proven market for billions?

We find evidence consistent with the latter argument that mandating more risk disclosure has harmful effects on corporate innovation. To test this, we examine 5,202 U.S firms from 1994 to 2010, totaling approximately 40,000 firm-years. To make sure these firms actually invest in innovation, we only include firms that either report > $0 in R&D expenses or >= 1 patent over the sample period.

To test the effect of mandating risk disclosure, we exploit a regulatory change announced in 2005. That year the Securities and Exchange Commission (SEC) mandated publicly listed firms to disclose risk (Item 503(c) of Regulation S-K) in the Item 1a Risk Factors section. After this change we find that corporate R&D, patent filings, citations per patent, and market value per patent declined. Our results show that after the mandatory risk disclosure regulation was imposed, the average firm

- Spent $1.294 million less on R&D

- Issued 0.371 fewer patents

- Received 0.654 fewer citations per patent

- Experienced a reduction in average patent value by $1.929 million

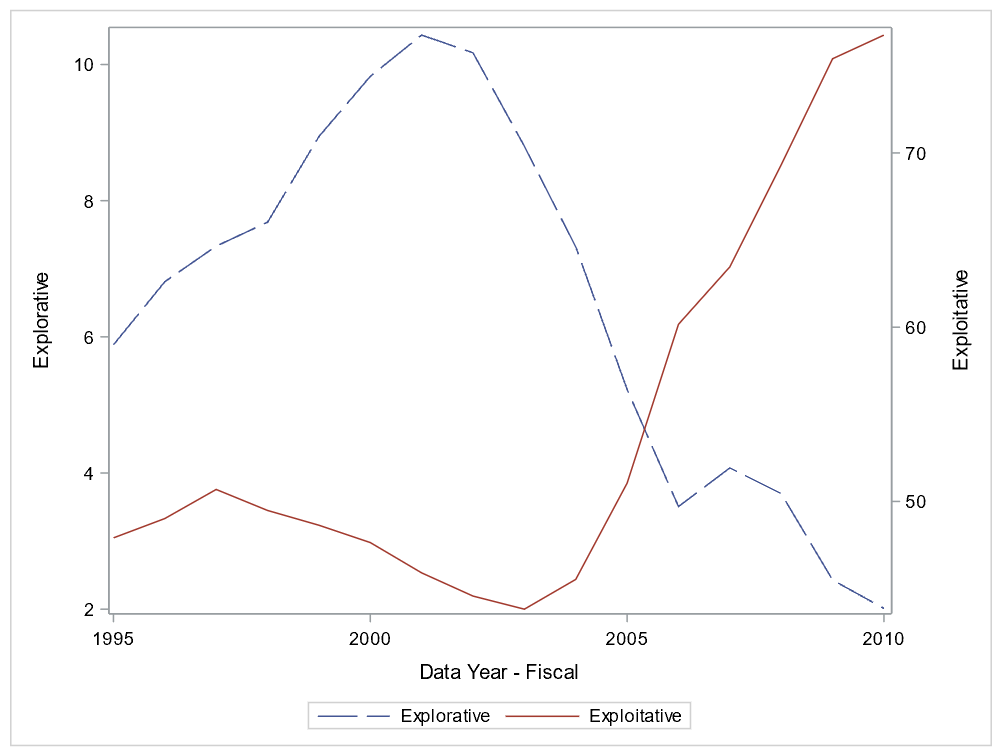

Furthermore, after the 2005 mandate, firms began shifting away from risky innovation towards less risky projects. Corporate patents began to shift towards exploitative patents, patents that leverage existing technology, and away from exploratory patents, which are more novel technologies (see Figure 1). Moreover, the mandate also caused a directional increase in capital expenditures, a less risky form of investment than R&D. An average firm sees an increase of $0.495 million in capital expenditures after the mandate.

Figure 1. Percentage of Explorative versus Exploitative Patents Over Time

To address endogeneity issues, such as reverse causality (e.g. innovation causes more risk disclosure) or unobserved variables (e.g. innovation and risk disclosure are both common in emerging firms), we take advantage of an SEC rule in 2008 that exempts smaller reporting companies from having to disclose risks. Firms with revenues under $50 million were exempted from the risk disclosure rules while those above $50 million in revenues still had to disclose risks.

We used a regression discontinuity design analysis that compares firms slightly above the exemption threshold (between $50 million and $100 million) and slightly below the threshold (<$50 million). These firms should be similar to one another except for that one group is arbitrarily required to disclose risks and the other is not. We find that the exemption allowed smaller reporting companies to increase corporate R&D by 1.644%, patent filings by 0.137%, citations per patent by 0.185%, and market value per patent by 0.249% compared to slightly larger firms.

Further analysis indicates that the negative impact of mandatory risk disclosure is caused by firms unable to secure additional financing for their projects. Our evidence shows that

- Firms that lack internal cash produce much less innovation post mandate

- During recessions (which reduce the availability of external capital), firms produce much less innovation post mandate

- Firms are more likely to raise funds through equity issuances, which are more expensive capital than debt issuances.

Thus, the mandate for risk disclosure either enacted barriers to raising more capital or increased the cost of capital for innovative firms, which in turn constrained R&D and innovation.

These results have important implications for executives and regulators. For executives, this reinforces the notion that “disclosing less is more” when it comes to innovation. Other research shows that market scrutiny such as going public or having more analyst coverage can lead to reduced innovation. This research further supports that disclosing more risks may spook investors away from innovative firms.

For regulators, the results indicate that mandating disclosure may lead to unintended consequences, such as reduced innovation. The costs associated with mandatory disclosure could be more substantial than previously anticipated. So a corollary of this research is that regulators should consider both direct costs (including filing, legal fees, company time, and other expenses) and indirect costs (such as competitors gaining access to crucial information or the impact of regulation on firm investment) when formulating new disclosure regulations.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.