Stickney Township Residential Values On Average Unchanged, Commercial Values climbed by 4%

O'Connor found that Stickney Township residential values remained unchanged on average, while commercial values increased by 4%.

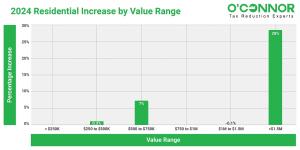

CHICAGO, ILLINOIS, August 30, 2024 /EINPresswire.com/ -- Residential Assessment SurgesProperty owners in Cook County typically anticipate an annual increase in property values. In 2024, the combined residential property value in Stickney Township, Cook County, Illinois was just over $3 billion. A 7% increase was observed among residential property owners with residences valued between $500k and $750k, but otherwise property in lower value ranges remained fairly unchanged in value. Stickney Township households valued in excess of $1.5 million experienced the highest increase in valuation at 28%.

Commercial Values Gain Even More Pronounced

Commercial property experienced a significant increase in value accounts in Stickney Township, in contrast to residential property. Residential property values experienced a modest increase in 2024, while commercial values saw marginally higher increases with an average of 4%. In 2024, the average value of commercial property over $1.5 million in Stickney Township was $1.4 million, which represents a 5% increase from the previous year. A 2% increase was found among owners of commercial properties valued between $1 million and $1.5 million.

What Can Property Owners Do?

The figures indicate that Stickney Township in Cook County, Illinois has experienced a modest increase in its assessment. Stickney Township appeals process may be perplexing to property owners; however, O’Connor is available to provide assistance. O’Connor collaborates with professional property tax specialists to provide the most compelling evidence for claims of unequal appraisal reduction and sales. O’Connor collaborates with property tax attorneys to mitigate our clients’ property taxes in every feasible manner. In order to achieve the most favorable result, property owners should confirm their exemptions prior to appealing the assessment value.

About O’Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 900 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

Facebook

X

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.