Increasing Insurance Agency Access to Hard-to-Place Workers' Comp Solutions

Legacy Employer Concepts offers insurance agencies PEO solutions for hard-to-place workers' comp, avoiding state fund delays and enhancing client efficiency.

ST. PETERSBURG, FLORIDA, UNITED STATES, August 28, 2024 /EINPresswire.com/ -- In high-risk industries, securing workers' compensation coverage can be a daunting challenge for insurance agencies across the United States. As these agencies exhaust their standard markets, they are often left with limited options: either lose the business or resort to state workers' compensation fund placements. Legacy Employer Concepts, a leader in providing alternative workers' compensation solutions, is stepping up to offer a game-changing approach for insurance agencies facing this dilemma.State workers' compensation funds, while a fallback option, come with a host of challenges that can impact both the insurance agencies and the businesses they serve. These state funds often entail longer processing times, reduced commission structures for the agencies, and quarterly audits for the businesses involved. These factors not only strain the relationship between the agency and its clients but also add administrative burdens that can hinder the growth and efficiency of the business.

However, a growing number of insurance agencies are finding a powerful ally in an unexpected place: Professional Employer Organizations (PEOs). Traditionally viewed as competitors, PEOs are now being recognized for their potential to provide innovative solutions that help insurance agencies avoid the pitfalls of state work comp fund placements.

The PEO Advantage

PEOs offer a comprehensive suite of services that go beyond just providing workers' compensation coverage. By partnering with a PEO, businesses gain access to a wide range of HR services, including payroll administration, employee benefits, risk management, and compliance assistance. This comprehensive approach not only provides coverage solutions but also enhances the efficiency of the business by minimizing or eliminating back-office burdens.

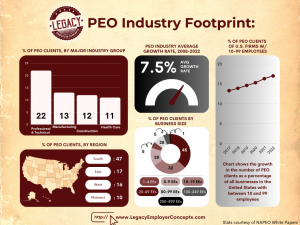

For insurance agencies, this means the ability to offer their clients a more attractive and efficient alternative to state work comp funds. The PEO product is designed to streamline business operations, allowing companies to focus on growth rather than getting bogged down by administrative tasks. According to the National Association of Professional Employer Organizations (NAPEO), a recent study by noted economists Dr. Laurie Bassi and Dan McMurrer revealed that businesses using PEOs grow 7 to 9 percent faster, experience 10 to 14 percent lower employee turnover, and are 50 percent less likely to go out of business. This study underscores the significant impact PEOs can have on a business's long-term success. Read the full NAPEO study here.

A Quick Turnaround Solution

One of the most compelling advantages of utilizing PEOs is the speed of the quote-to-placement process. Legacy Employer Concepts prides itself on delivering quick and efficient solutions, understanding that time is of the essence for both the agency and the client. By working with a PEO broker like Legacy Employer Concepts, insurance agents can streamline the quoting process, saving valuable time and resources.

Instead of securing appointments with multiple PEOs and submitting quote information to each one individually, agents can rely on Legacy Employer Concepts to handle the heavy lifting. With access to a broad network of PEO markets, the broker can quickly assess the needs of the business and match them with the most suitable PEO partner. This not only speeds up the process but also ensures that the client receives a tailored solution that meets their specific needs.

A Resource for Insurance Agencies

The evolving landscape of workers' compensation coverage is pushing insurance agencies to think creatively and embrace new resources. PEOs, once seen as a threat, are now emerging as valuable partners that can enhance the agency's service offerings and strengthen client relationships. By leveraging the expertise and network of a PEO broker, insurance agencies can expand their market access and provide their clients with the best viable solutions, all while avoiding the challenges associated with state work comp funds.

Legacy Employer Concepts is at the forefront of this shift, offering insurance agencies across the country the tools and support they need to succeed in today's competitive market. With a commitment to providing fast, efficient, and customized solutions, Legacy Employer Concepts is helping agencies turn a once-daunting challenge into a strategic opportunity.

For more information about Legacy Employer Concepts and how they can assist your agency with hard-to-place workers' comp solutions, please visit www.legacyemployerconcepts.com.

________________________________________

About Legacy Employer Concepts

Legacy Employer Concepts is a leading provider of alternative workers' compensation solutions, specializing in helping insurance agencies secure coverage for high-risk industries. With a focus on efficiency, speed, and customer satisfaction, Legacy Employer Concepts offers a range of services designed to support the growth and success of both insurance agencies and the businesses they serve.

Brett Arthur

Legacy Employer Concepts LLC

+1 813-460-9166

brett@legacyemployerconcepts.com

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.