US CPI's Return to the '2.0 Era' Triggers Global Market Volatility: What Ordinary Investors Should Know

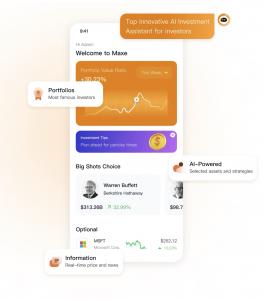

MAXE: The Revolutionary AI Financial Management App

NEW YORK, NEW YORK, U.S. , August 15, 2024 /EINPresswire.com/ -- On Tuesday, the U.S. Department of Labor reported that the unadjusted CPI for July rose 2.9% year-on-year, slightly below the expected 3% and up from 3%. The seasonally adjusted CPI increased by 0.2% month-on-month, meeting expectations after a previous decline of 0.1%. The unadjusted core CPI rose 3.2% year-on-year, as expected, down from 3.3%. The seasonally adjusted core CPI also rose 0.2% month-on-month, in line with expectations, up from a previous increase of 0.1%.

Global financial markets have been closely monitoring the recent Consumer Price Index (CPI) data for July, released by the U.S. Department of Labor. The data revealed a significant development: the U.S. The inflation rate has declined for the fourth consecutive month, returning to the Federal Reserve's 2% target range for the first time since March 2021. This announcement led to a strong market response, with widespread expectations that the Federal Reserve will initiate a rate cut cycle at its September policy meeting, thereby injecting new liquidity into the global economy.

After the data was released, overseas financial markets experienced significant fluctuations. According to Wind data, the dollar index initially rose sharply but then quickly fell back. London spot gold saw a brief drop before rebounding. US S&P 500 and Nasdaq 100 index futures both increased.

Analysts indicate that Wall Street elites have been actively discussing potential interest rate cuts by the Federal Reserve in September, frequently adjusting their investment portfolios in response to the latest industry news.

Wall Street elites can maximize their investment returns through timely industry news and effective collaboration within their elite circles. In contrast, ordinary investors often lack these advantages. Typically, they rely on media reports and their own experience to adjust their asset portfolios. However, investment opportunities can be fleeting, and some information may become outdated by the time it reaches the media. Consequently, ordinary investors should seek better methods to support their investment decision-making.

In response to the points raised above, a leading investment tracking app, MAXE, offers a solution to help investors make better investment decisions

About the challenge of ordinary investors missing valuable investment opportunities due to limited information and delays, MAXE has introduced an innovative AI financial assistant. This assistant harnesses big data and its proprietary core algorithm to gather the latest financial insights from various channels. It seamlessly combines this information with each user's unique risk profile and portfolio performance to provide personalized investment advice tailored to individual needs. Furthermore, MAXE's dedicated development team has continuously enhanced and optimized this feature over the years, ensuring that its AI financial assistant remains at the forefront of the industry.

Additionally, MAXE empowers users by allowing them to observe the precise asset allocations and investment decisions of renowned, successful investors in real-time through the app. This feature transcends traditional methods that typically rely on broad market analysis or second-hand reviews, users gain direct insight into the actual investment strategies and risk management practices utilized by the industry's top authorities.

This unique level of visibility offers a remarkable advantage to MAXE users. By studying the decisions of these successful investors, users can adopt and adapt proven techniques and allocation models to enhance their investment strategies. This approach not only fosters a deeper understanding of effective investment practices but also encourages informed decision-making, ultimately helping ordinary investors navigate the complexities of the market with greater confidence and clarity.

MAXE serves users around the globe. As of now, the cumulative number of users who have downloaded the MAXE app has exceeded 300,000. This milestone indicates that an ever-growing number of individuals recognize the value of MAXE and are utilizing the APP to optimize their investment and financial management strategies.

Now, MAXE is available on Google Play and App Store . Say goodbye to traditional financial management methods and embrace the future of finance with MAXE. For more information, visit our website at www.maxeai.com and follow us on social media for updates and tips on financial management.

Ying Wang

MAXE AI

+65 6991 2300

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.